Summary

The Stochastic Volatility (SV) model and its variants are widely used in the financial sector while recurrent neural network (RNN) models are successfully used in many large-scale industrial applications of Deep Learning. Our article combines these two methods in a non-trivial way and proposes a model, which we call the Statistical Recurrent Stochastic Volatility (SR-SV) model, to capture the dynamics of stochastic volatility. The proposed model is able to capture complex volatility effects (e.g., non-linearity and long-memory auto-dependence) overlooked by the conventional SV models, is statistically interpretable and has an impressive out-of-sample forecast performance. These properties are carefully discussed and illustrated through extensive simulation studies and applications to five international stock index datasets: The German stock index DAX30, the Hong Kong stock index HSI50, the France market index CAC40, the US stock market index SP500 and the Canada market index TSX250. An user-friendly software package together with the examples reported in the paper are available at \url{https://github.com/vbayeslab}.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

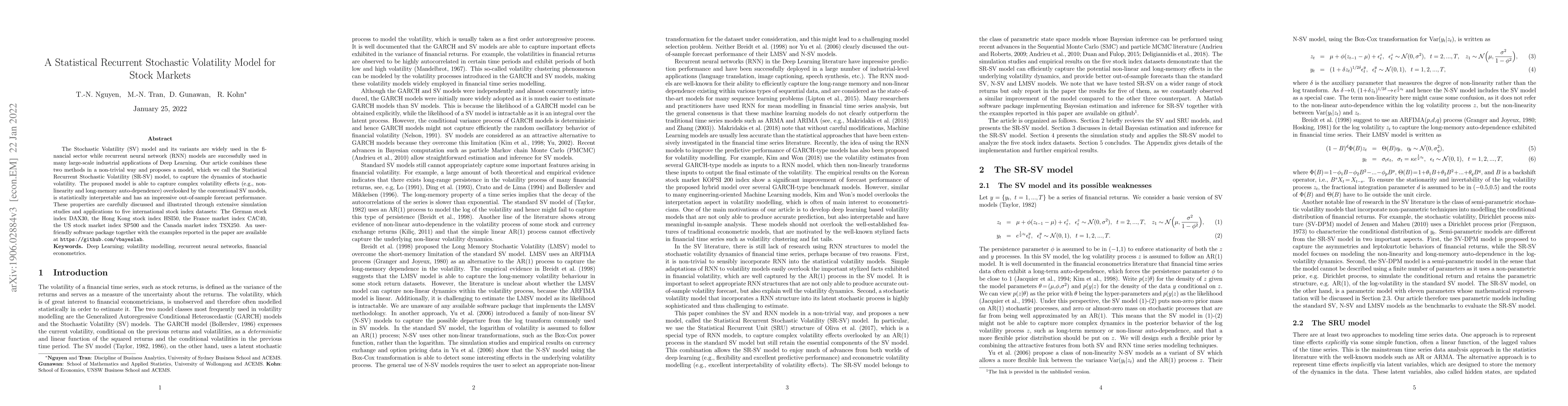

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)