Summary

This paper develops a two-step estimation methodology, which allows us to apply catastrophe theory to stock market returns with time-varying volatility and model stock market crashes. Utilizing high frequency data, we estimate the daily realized volatility from the returns in the first step and use stochastic cusp catastrophe on data normalized by the estimated volatility in the second step to study possible discontinuities in markets. We support our methodology by simulations where we also discuss the importance of stochastic noise and volatility in deterministic cusp catastrophe model. The methodology is empirically tested on almost 27 years of U.S. stock market evolution covering several important recessions and crisis periods. Due to the very long sample period we also develop a rolling estimation approach and we find that while in the first half of the period stock markets showed marks of bifurcations, in the second half catastrophe theory was not able to confirm this behavior. Results suggest that the proposed methodology provides an important shift in application of catastrophe theory to stock markets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

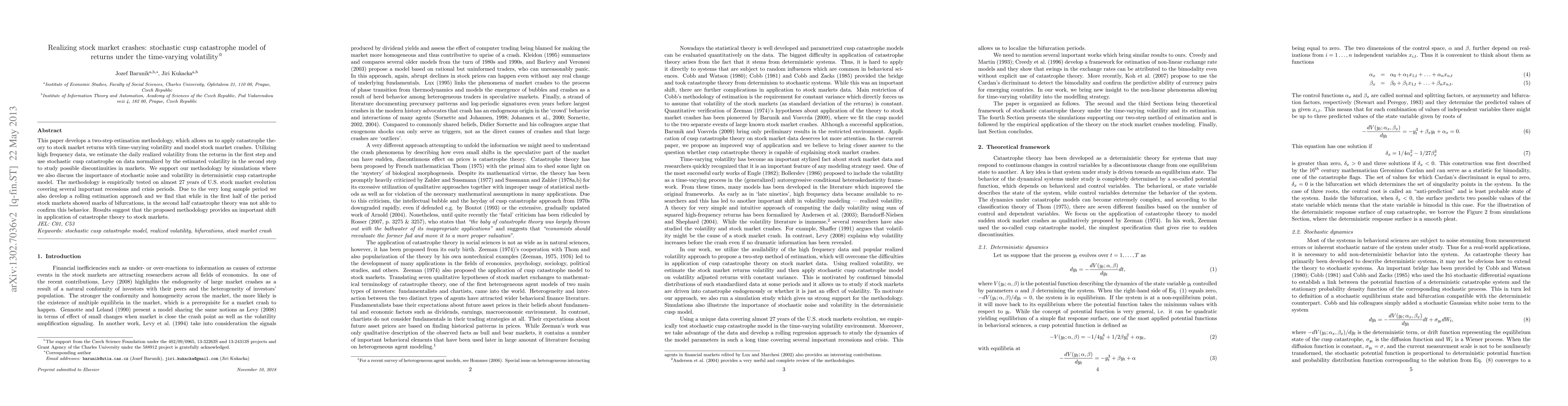

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)