Authors

Summary

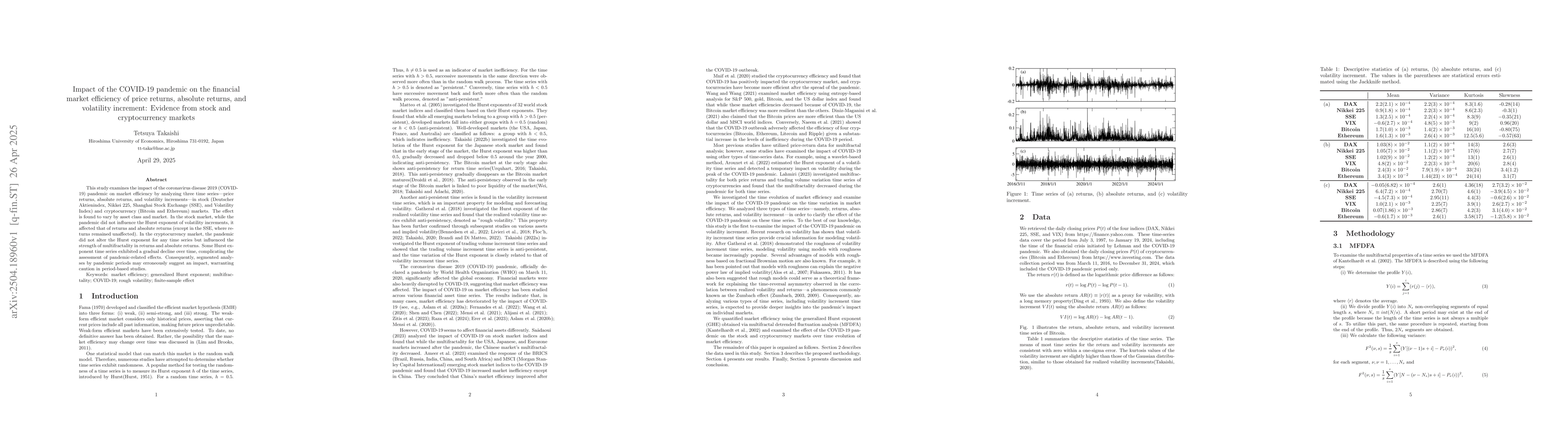

This study examines the impact of the coronavirus disease 2019 (COVID-19) pandemic on market efficiency by analyzing three time series -- price returns, absolute returns, and volatility increments -- in stock (Deutscher Aktienindex, Nikkei 225, Shanghai Stock Exchange (SSE), and Volatility Index) and cryptocurrency (Bitcoin and Ethereum) markets. The effect is found to vary by asset class and market. In the stock market, while the pandemic did not influence the Hurst exponent of volatility increments, it affected that of returns and absolute returns (except in the SSE, where returns remained unaffected). In the cryptocurrency market, the pandemic did not alter the Hurst exponent for any time series but influenced the strength of multifractality in returns and absolute returns. Some Hurst exponent time series exhibited a gradual decline over time, complicating the assessment of pandemic-related effects. Consequently, segmented analyses by pandemic periods may erroneously suggest an impact, warranting caution in period-based studies.

AI Key Findings

Generated Jun 09, 2025

Methodology

The study employs Multifractal Detrended Fluctuation Analysis (MFDFA) to examine the impact of COVID-19 on market efficiency in stock and cryptocurrency markets, focusing on price returns, absolute returns, and volatility increments.

Key Results

- The Hurst exponent (h(2)) for returns and absolute returns in stock markets (DAX, Nikkei 225, SSE, VIX) was affected by the pandemic, except for SSE.

- No impact of the pandemic was observed on the Hurst exponent for volatility increments in stock markets.

- In cryptocurrency markets (Bitcoin, Ethereum), the Hurst exponent for returns and absolute returns did not change significantly due to the pandemic, but multifractal strength fluctuated.

- Some Hurst exponent time series showed a gradual decline over time, complicating the assessment of pandemic-related effects.

- Segmented analyses by pandemic periods may erroneously suggest an impact, warranting caution in period-based studies.

Significance

This research provides insights into how the COVID-19 pandemic influenced market efficiency in various financial markets, which is crucial for traders, investors, and policymakers to understand and develop appropriate strategies.

Technical Contribution

The paper contributes to the literature by applying MFDFA to assess the impact of COVID-19 on market efficiency in both stock and cryptocurrency markets, providing a comprehensive analysis of returns, absolute returns, and volatility increments.

Novelty

This research distinguishes itself by examining the impact of the COVID-19 pandemic on market efficiency across diverse asset classes, including traditional stock markets and cryptocurrencies, using a consistent methodology.

Limitations

- The study relies on MFDFA, which may not capture all nuances of market dynamics.

- The findings are based on historical data and may not fully account for future market behavior or policy changes.

Future Work

- Investigate the impact of the pandemic using alternative methodologies to cross-validate findings.

- Explore the long-term effects of the pandemic on market efficiency beyond the study period.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)