Summary

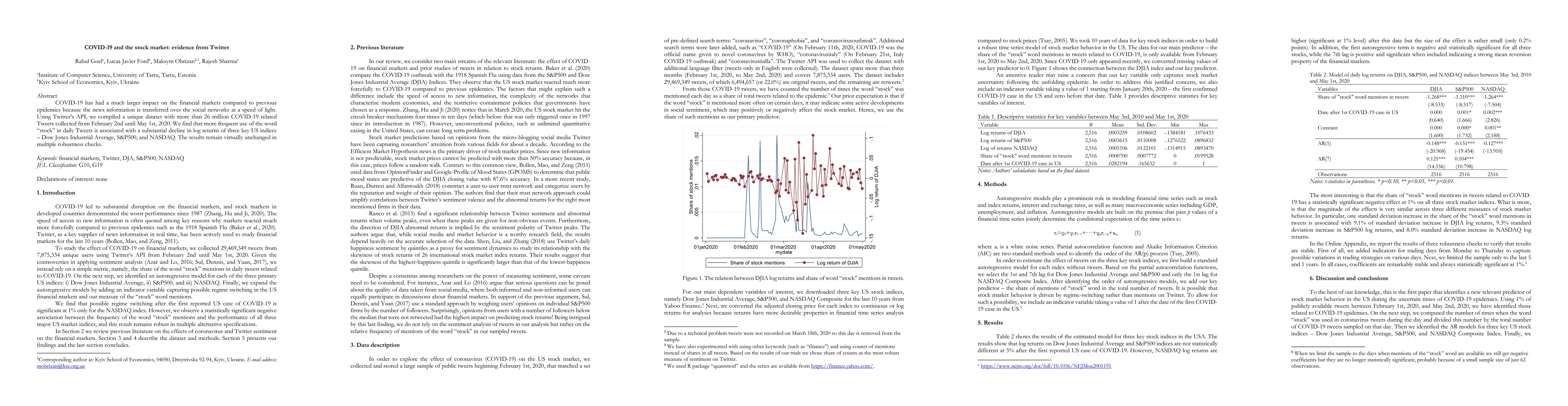

COVID-19 has had a much larger impact on the financial markets compared to previous epidemics because the news information is transferred over the social networks at a speed of light. Using Twitter's API, we compiled a unique dataset with more than 26 million COVID-19 related Tweets collected from February 2nd until May 1st, 2020. We find that more frequent use of the word "stock" in daily Tweets is associated with a substantial decline in log returns of three key US indices - Dow Jones Industrial Average, S&P500, and NASDAQ. The results remain virtually unchanged in multiple robustness checks.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMining the Relationship Between COVID-19 Sentiment and Market Performance

Ziyuan Xia, Jeffery Chen, Anchen Sun

| Title | Authors | Year | Actions |

|---|

Comments (0)