Authors

Summary

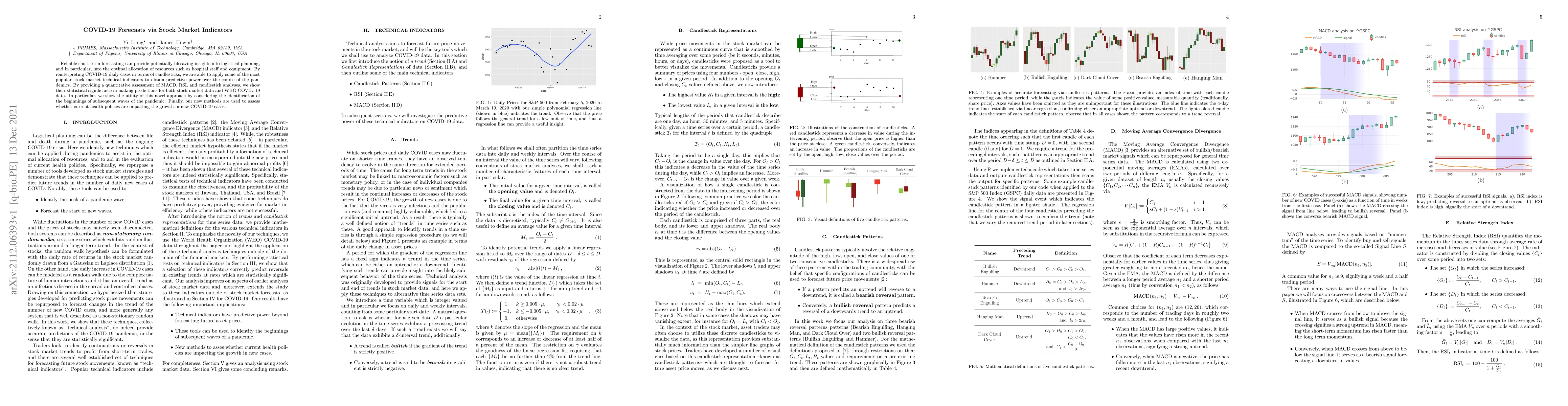

Reliable short term forecasting can provide potentially lifesaving insights into logistical planning, and in particular, into the optimal allocation of resources such as hospital staff and equipment. By reinterpreting COVID-19 daily cases in terms of candlesticks, we are able to apply some of the most popular stock market technical indicators to obtain predictive power over the course of the pandemics. By providing a quantitative assessment of MACD, RSI, and candlestick analyses, we show their statistical significance in making predictions for both stock market data and WHO COVID-19 data. In particular, we show the utility of this novel approach by considering the identification of the beginnings of subsequent waves of the pandemic. Finally, our new methods are used to assess whether current health policies are impacting the growth in new COVID-19 cases.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersHousing Forecasts via Stock Market Indicators

Laura P. Schaposnik, Varun Mittal

Forecasting the Performance of US Stock Market Indices During COVID-19: RF vs LSTM

Ali Lashgari, Reza Nematirad, Amin Ahmadisharaf

| Title | Authors | Year | Actions |

|---|

Comments (0)