Authors

Summary

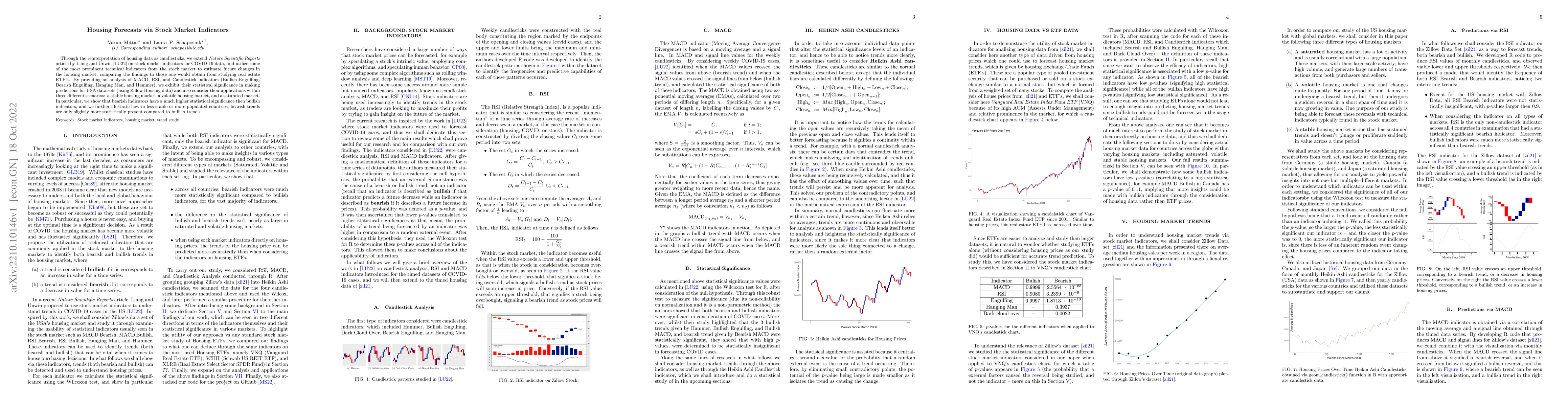

Through the reinterpretation of housing data as candlesticks, we extend Nature Scientific Reports' article by Liang and Unwin [LU22] on stock market indicators for COVID-19 data, and utilize some of the most prominent technical indicators from the stock market to estimate future changes in the housing market, comparing the findings to those one would obtain from studying real estate ETF's. By providing an analysis of MACD, RSI, and Candlestick indicators (Bullish Engulfing, Bearish Engulfing, Hanging Man, and Hammer), we exhibit their statistical significance in making predictions for USA data sets (using Zillow Housing data) and also consider their applications within three different scenarios: a stable housing market, a volatile housing market, and a saturated market. In particular, we show that bearish indicators have a much higher statistical significance then bullish indicators, and we further illustrate how in less stable or more populated countries, bearish trends are only slightly more statistically present compared to bullish trends.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)