Summary

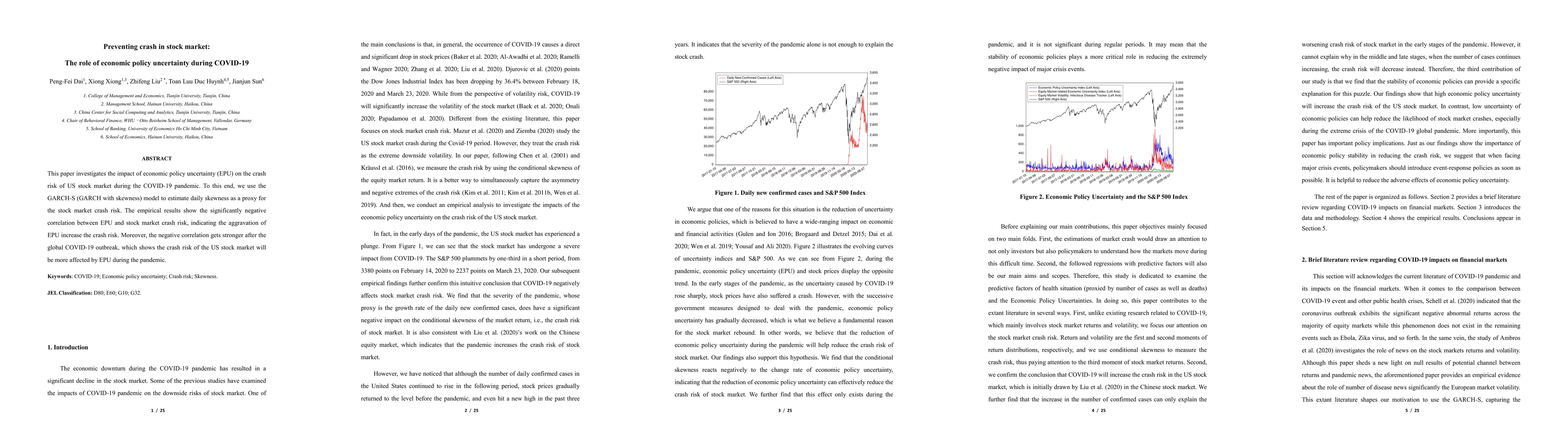

This paper investigates the impact of economic policy uncertainty (EPU) on the crash risk of US stock market during the COVID-19 pandemic. To this end, we use the GARCH-S (GARCH with skewness) model to estimate daily skewness as a proxy for the stock market crash risk. The empirical results show the significantly negative correlation between EPU and stock market crash risk, indicating the aggravation of EPU increase the crash risk. Moreover, the negative correlation gets stronger after the global COVID-19 outbreak, which shows the crash risk of the US stock market will be more affected by EPU during the pandemic.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)