Summary

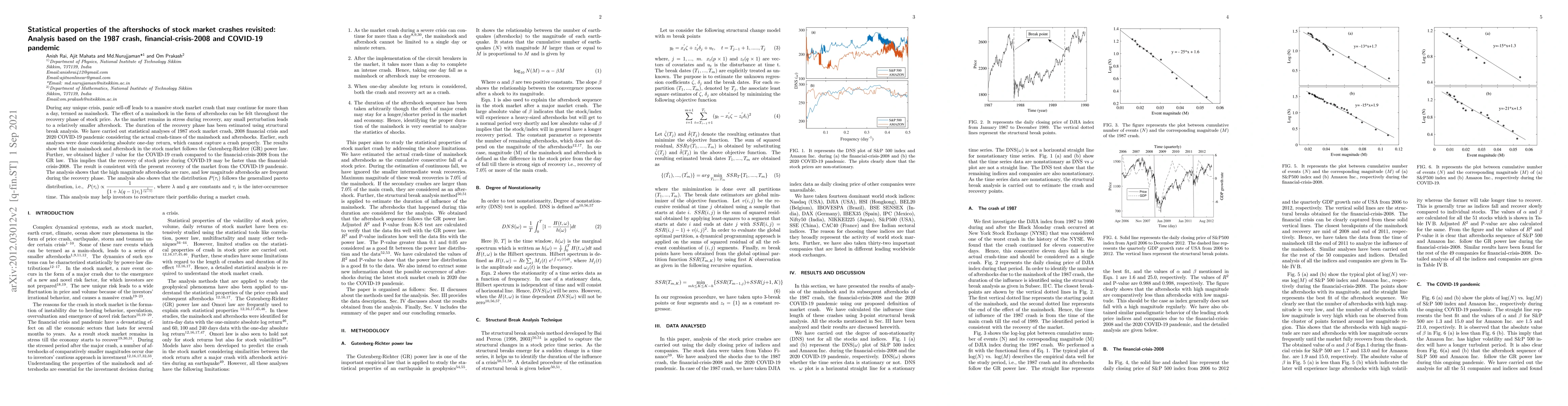

During any unique crisis, panic sell-off leads to a massive stock market crash that may continue for more than a day, termed as mainshock. The effect of a mainshock in the form of aftershocks can be felt throughout the recovery phase of stock price. As the market remains in stress during recovery, any small perturbation leads to a relatively smaller aftershock. The duration of the recovery phase has been estimated using structural break analysis. We have carried out statistical analyses of the 1987 stock market crash, 2008 financial crisis and 2020 COVID-19 pandemic considering the actual crash-times of the mainshock and aftershocks. Earlier, such analyses were done considering an absolute one-day return, which cannot capture a crash properly. The results show that the mainshock and aftershock in the stock market follow the Gutenberg-Richter (GR) power law. Further, we obtained a higher $\beta$ value for the COVID-19 crash compared to the financial-crisis-2008 from the GR law. This implies that the recovery of stock price during COVID-19 may be faster than the financial-crisis-2008. The result is consistent with the present recovery of the market from the COVID-19 pandemic. The analysis shows that the high magnitude aftershocks are rare, and low magnitude aftershocks are frequent during the recovery phase. The analysis also shows that the distribution $P(\tau_i)$ follows the generalized Pareto distribution, i.e., $\displaystyle~P(\tau_i)\propto\frac{1}{\{1+\lambda(q-1)\tau_i\}^{\frac{1}{(q-1)}}}$, where $\lambda$ and $q$ are constants and $\tau_i$ is the inter-occurrence time. This analysis may help investors to restructure their portfolios during a market crash.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)