Summary

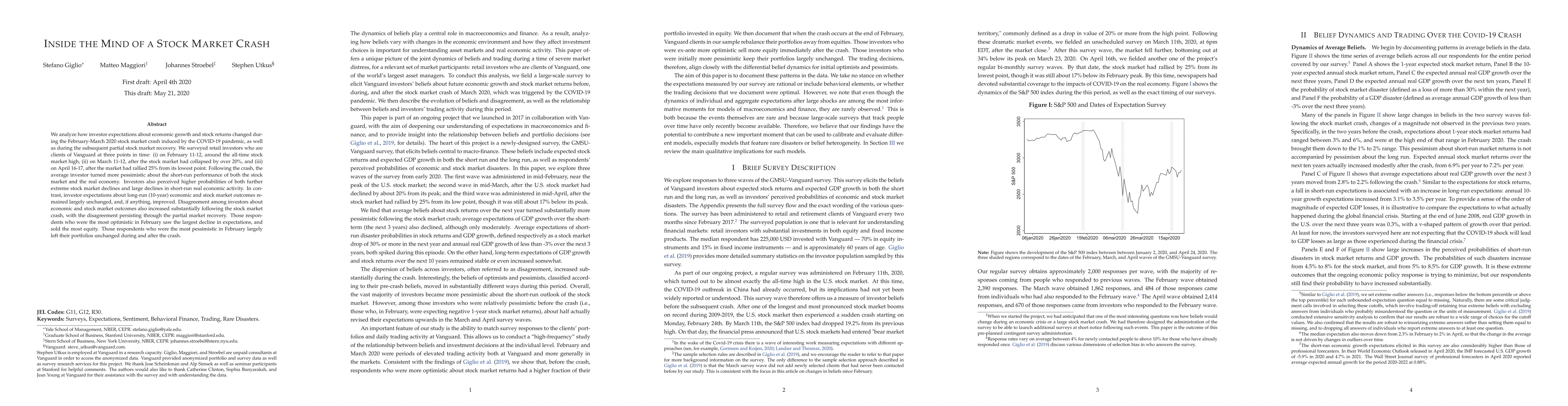

We analyze how investor expectations about economic growth and stock returns changed during the February-March 2020 stock market crash induced by the COVID-19 pandemic, as well as during the subsequent partial stock market recovery. We surveyed retail investors who are clients of Vanguard at three points in time: (i) on February 11-12, around the all-time stock market high, (ii) on March 11-12, after the stock market had collapsed by over 20\%, and (iii) on April 16-17, after the market had rallied 25\% from its lowest point. Following the crash, the average investor turned more pessimistic about the short-run performance of both the stock market and the real economy. Investors also perceived higher probabilities of both further extreme stock market declines and large declines in short-run real economic activity. In contrast, investor expectations about long-run (10-year) economic and stock market outcomes remained largely unchanged, and, if anything, improved. Disagreement among investors about economic and stock market outcomes also increased substantially following the stock market crash, with the disagreement persisting through the partial market recovery. Those respondents who were the most optimistic in February saw the largest decline in expectations, and sold the most equity. Those respondents who were the most pessimistic in February largely left their portfolios unchanged during and after the crash.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)