Summary

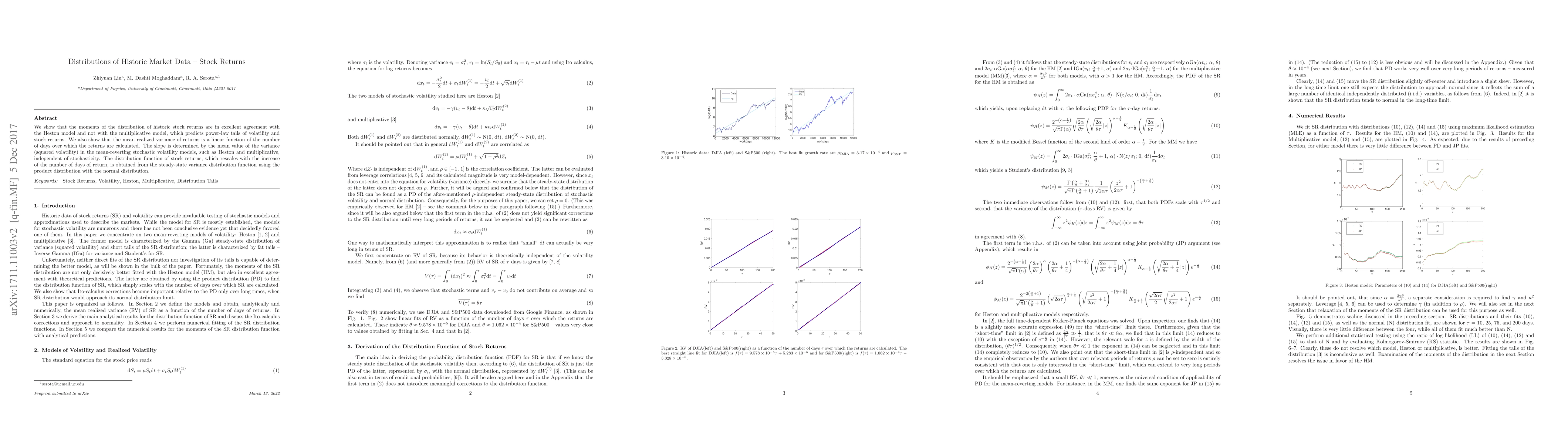

We show that the moments of the distribution of historic stock returns are in excellent agreement with the Heston model and not with the multiplicative model, which predicts power-law tails of volatility and stock returns. We also show that the mean realized variance of returns is a linear function of the number of days over which the returns are calculated. The slope is determined by the mean value of the variance (squared volatility) in the mean-reverting stochastic volatility models, such as Heston and multiplicative, independent of stochasticity. The distribution function of stock returns, which rescales with the increase of the number of days of return, is obtained from the steady-state variance distribution function using the product distribution with the normal distribution.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)