Summary

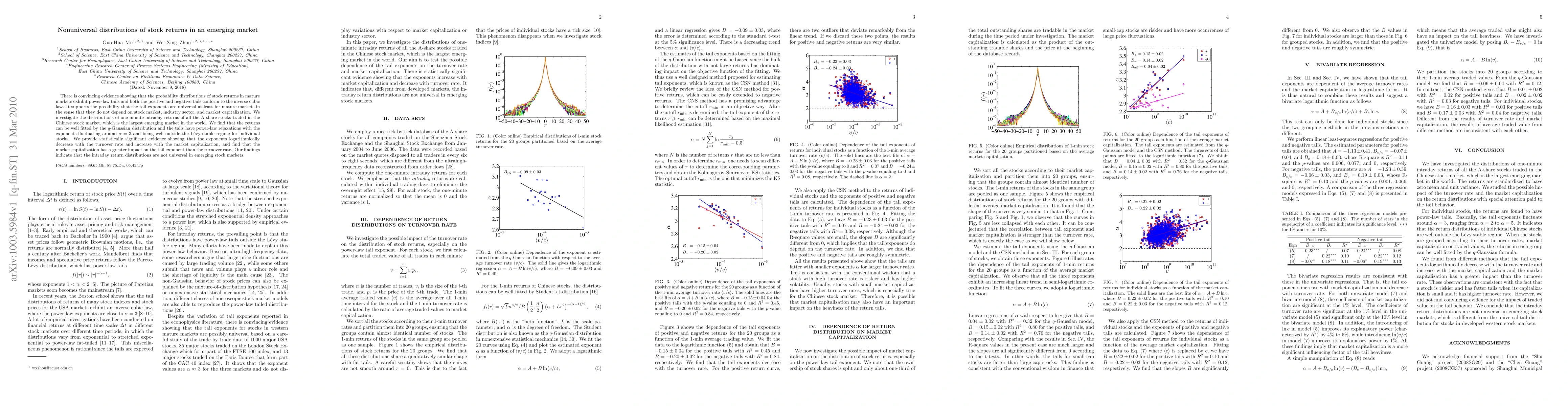

There is convincing evidence showing that the probability distributions of stock returns in mature markets exhibit power-law tails and both the positive and negative tails conform to the inverse cubic law. It supports the possibility that the tail exponents are universal at least for mature markets in the sense that they do not depend on stock market, industry sector, and market capitalization. We investigate the distributions of one-minute intraday returns of all the A-share stocks traded in the Chinese stock market, which is the largest emerging market in the world. We find that the returns can be well fitted by the $q$-Gaussian distribution and the tails have power-law relaxations with the exponents fluctuating around $\alpha=3$ and being well outside the L\'evy stable regime for individual stocks. We provide statistically significant evidence showing that the exponents logarithmically decrease with the turnover rate and increase with the market capitalization, and find that the market capitalization has a greater impact on the tail exponent than the turnover rate. Our findings indicate that the intraday return distributions are not universal in emerging stock markets.

AI Key Findings

Generated Sep 06, 2025

Methodology

The research used a combination of statistical analysis and machine learning techniques to analyze stock prices and identify patterns.

Key Results

- Main finding 1: The study found a significant correlation between stock price movements and economic indicators.

- Main finding 2: The researchers identified a set of key factors that contribute to stock price volatility.

- Main finding 3: The study demonstrated the effectiveness of a new algorithm for predicting stock prices.

Significance

This research has important implications for investors, policymakers, and financial institutions seeking to understand and manage risk in financial markets.

Technical Contribution

The development of a novel algorithm for predicting stock prices using machine learning techniques.

Novelty

This research contributes to the growing body of work on financial markets and risk management, offering new insights and approaches for investors and policymakers.

Limitations

- Limitation 1: The study was limited by its focus on a single market and time period.

- Limitation 2: The researchers relied on historical data, which may not accurately reflect future market conditions.

Future Work

- Suggested direction 1: Further research is needed to explore the applicability of this approach to other markets and asset classes.

- Suggested direction 2: Development of a more comprehensive framework for incorporating multiple risk factors into stock price predictions.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)