Summary

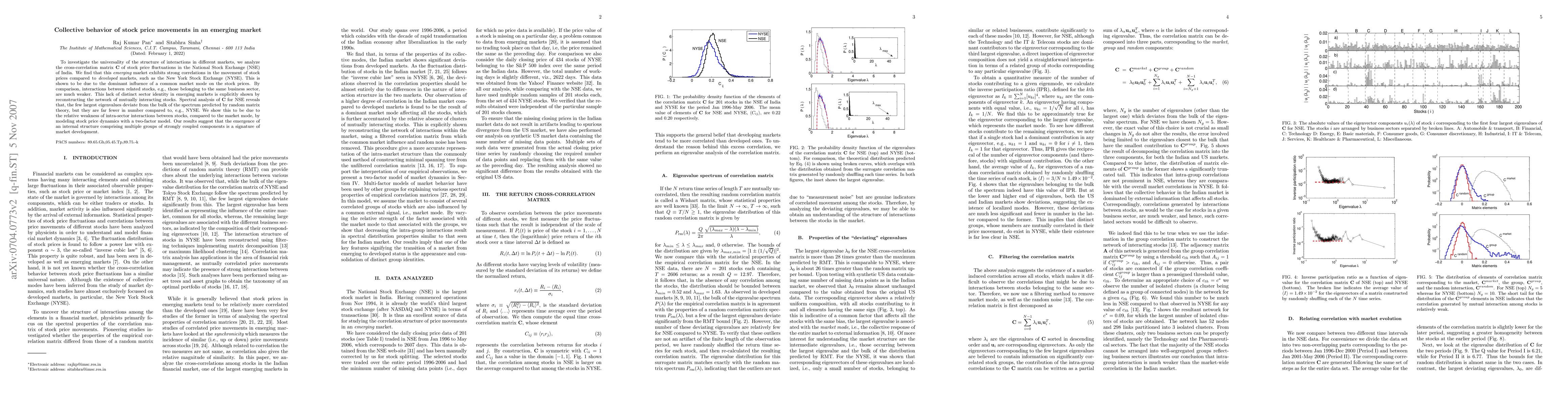

To investigate the universality of the structure of interactions in different markets, we analyze the cross-correlation matrix C of stock price fluctuations in the National Stock Exchange (NSE) of India. We find that this emerging market exhibits strong correlations in the movement of stock prices compared to developed markets, such as the New York Stock Exchange (NYSE). This is shown to be due to the dominant influence of a common market mode on the stock prices. By comparison, interactions between related stocks, e.g., those belonging to the same business sector, are much weaker. This lack of distinct sector identity in emerging markets is explicitly shown by reconstructing the network of mutually interacting stocks. Spectral analysis of C for NSE reveals that, the few largest eigenvalues deviate from the bulk of the spectrum predicted by random matrix theory, but they are far fewer in number compared to, e.g., NYSE. We show this to be due to the relative weakness of intra-sector interactions between stocks, compared to the market mode, by modeling stock price dynamics with a two-factor model. Our results suggest that the emergence of an internal structure comprising multiple groups of strongly coupled components is a signature of market development.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAn Exploratory Study of Stock Price Movements from Earnings Calls

Yang Yang, Sourav Medya, Brian Uzzi et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)