Summary

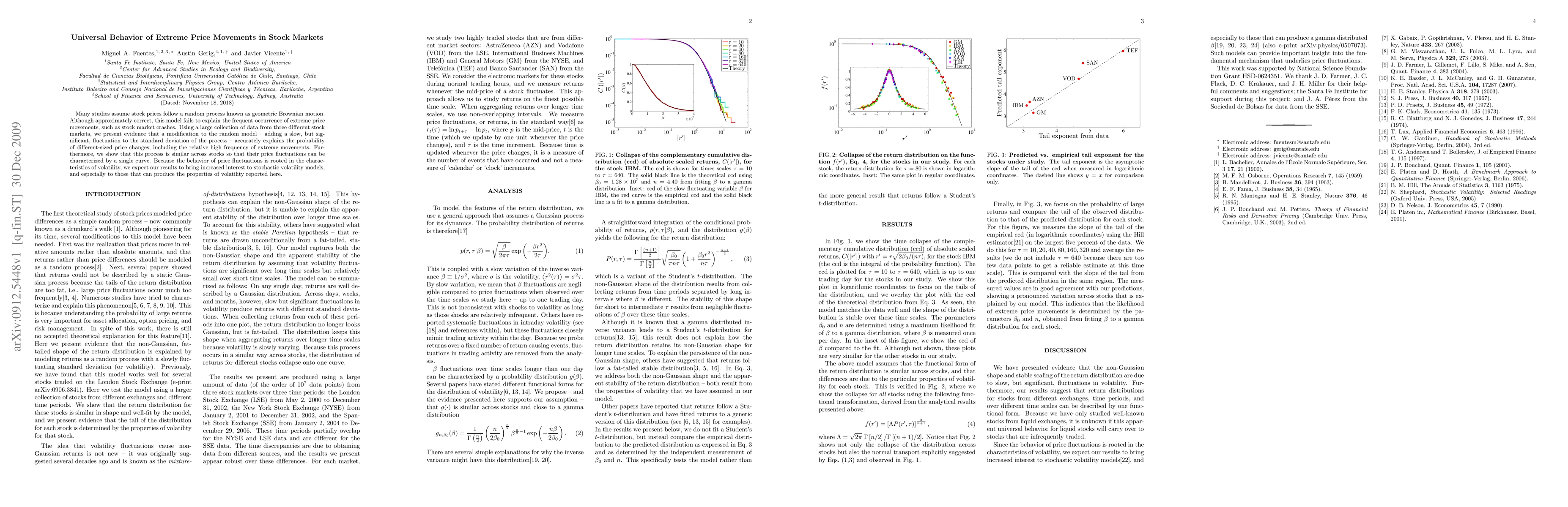

Many studies assume stock prices follow a random process known as geometric Brownian motion. Although approximately correct, this model fails to explain the frequent occurrence of extreme price movements, such as stock market crashes. Using a large collection of data from three different stock markets, we present evidence that a modification to the random model -- adding a slow, but significant, fluctuation to the standard deviation of the process -- accurately explains the probability of different-sized price changes, including the relative high frequency of extreme movements. Furthermore, we show that this process is similar across stocks so that their price fluctuations can be characterized by a single curve. Because the behavior of price fluctuations is rooted in the characteristics of volatility, we expect our results to bring increased interest to stochastic volatility models, and especially to those that can produce the properties of volatility reported here.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAn Exploratory Study of Stock Price Movements from Earnings Calls

Yang Yang, Sourav Medya, Brian Uzzi et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)