Authors

Summary

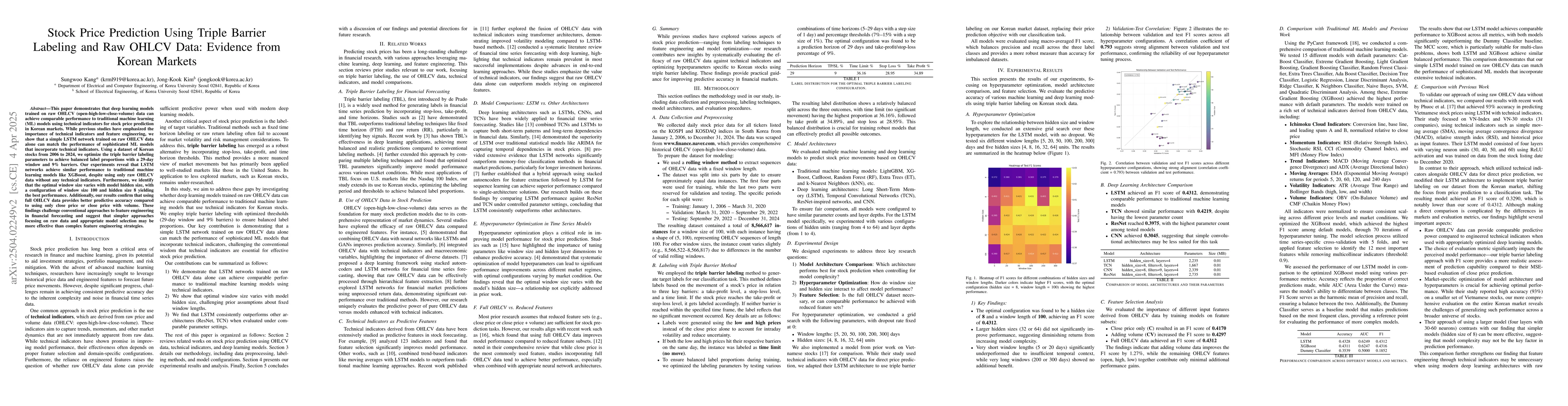

This paper demonstrates that deep learning models trained on raw OHLCV (open-high-low-close-volume) data can achieve comparable performance to traditional machine learning (ML) models using technical indicators for stock price prediction in Korean markets. While previous studies have emphasized the importance of technical indicators and feature engineering, we show that a simple LSTM network trained on raw OHLCV data alone can match the performance of sophisticated ML models that incorporate technical indicators. Using a dataset of Korean stocks from 2006 to 2024, we optimize the triple barrier labeling parameters to achieve balanced label proportions with a 29-day window and 9\% barriers. Our experiments reveal that LSTM networks achieve similar performance to traditional machine learning models like XGBoost, despite using only raw OHLCV data without any technical indicators. Furthermore, we identify that the optimal window size varies with model hidden size, with a configuration of window size 100 and hidden size 8 yielding the best performance. Additionally, our results confirm that using full OHLCV data provides better predictive accuracy compared to using only close price or close price with volume. These findings challenge conventional approaches to feature engineering in financial forecasting and suggest that simpler approaches focusing on raw data and appropriate model selection may be more effective than complex feature engineering strategies.

AI Key Findings

Generated Jun 10, 2025

Methodology

The research employs deep learning models, specifically LSTM networks, trained on raw OHLCV (open-high-low-close-volume) data to predict stock prices in Korean markets. The study optimizes triple barrier labeling parameters with a 29-day window and 9% barriers to achieve balanced label proportions. It compares the performance of LSTM networks to traditional ML models like XGBoost, which use technical indicators.

Key Results

- LSTM networks achieve comparable performance to traditional ML models using technical indicators.

- Using full OHLCV data provides better predictive accuracy than close price or close price with volume.

- Optimal window size varies with model hidden size, with a window size of 100 and hidden size of 8 yielding the best performance.

Significance

This research challenges conventional feature engineering approaches in financial forecasting, suggesting that simpler models focusing on raw data and appropriate selection might be more effective than complex feature engineering strategies.

Technical Contribution

Demonstrates that raw OHLCV data, when fed into LSTM networks, can match the performance of sophisticated ML models using technical indicators for stock price prediction.

Novelty

Contrasts with previous studies emphasizing technical indicators and feature engineering, proposing that simpler models with raw data can be equally effective.

Limitations

- The study is limited to Korean markets, so generalizability to other markets might be questionable.

- No information on how the models handle missing or noisy data in the raw OHLCV dataset.

Future Work

- Explore the applicability of this approach in other stock markets with varying characteristics.

- Investigate the robustness of the models to missing or noisy data in OHLCV datasets.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMamba Meets Financial Markets: A Graph-Mamba Approach for Stock Price Prediction

Xiaohong Chen, Ehsan Hoseinzade, Ali Mehrabian et al.

Multimodal Stock Price Prediction

Furkan Karadaş, Bahaeddin Eravcı, Ahmet Murat Özbayoğlu

No citations found for this paper.

Comments (0)