Summary

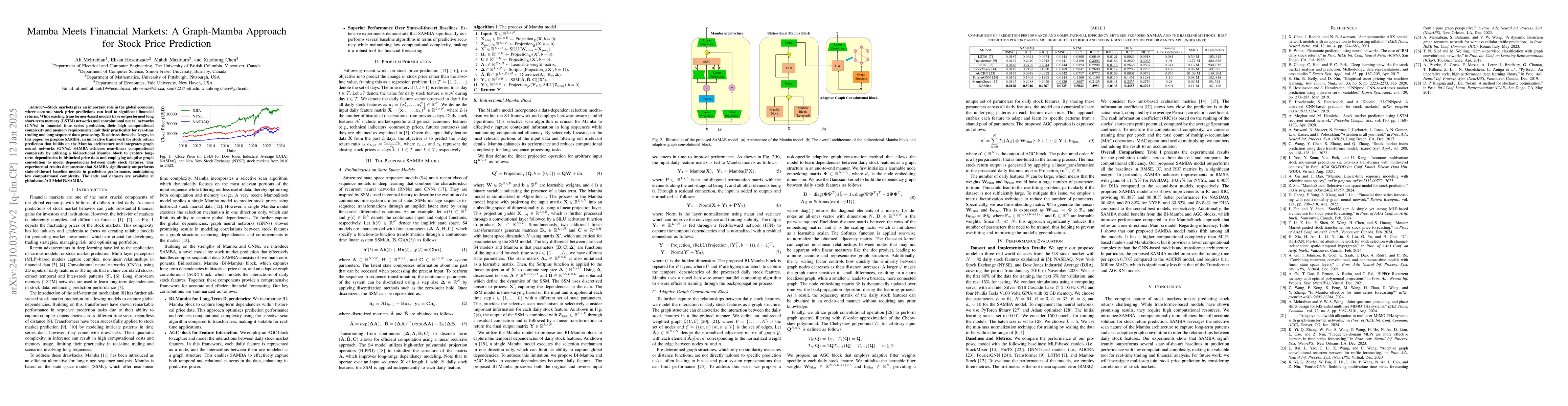

Stock markets play an important role in the global economy, where accurate stock price predictions can lead to significant financial returns. While existing transformer-based models have outperformed long short-term memory networks and convolutional neural networks in financial time series prediction, their high computational complexity and memory requirements limit their practicality for real-time trading and long-sequence data processing. To address these challenges, we propose SAMBA, an innovative framework for stock return prediction that builds on the Mamba architecture and integrates graph neural networks. SAMBA achieves near-linear computational complexity by utilizing a bidirectional Mamba block to capture long-term dependencies in historical price data and employing adaptive graph convolution to model dependencies between daily stock features. Our experimental results demonstrate that SAMBA significantly outperforms state-of-the-art baseline models in prediction accuracy, maintaining low computational complexity. The code and datasets are available at github.com/Ali-Meh619/SAMBA.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersFinMamba: Market-Aware Graph Enhanced Multi-Level Mamba for Stock Movement Prediction

Yifan Hu, Shu-Tao Xia, Tao Dai et al.

No citations found for this paper.

Comments (0)