Summary

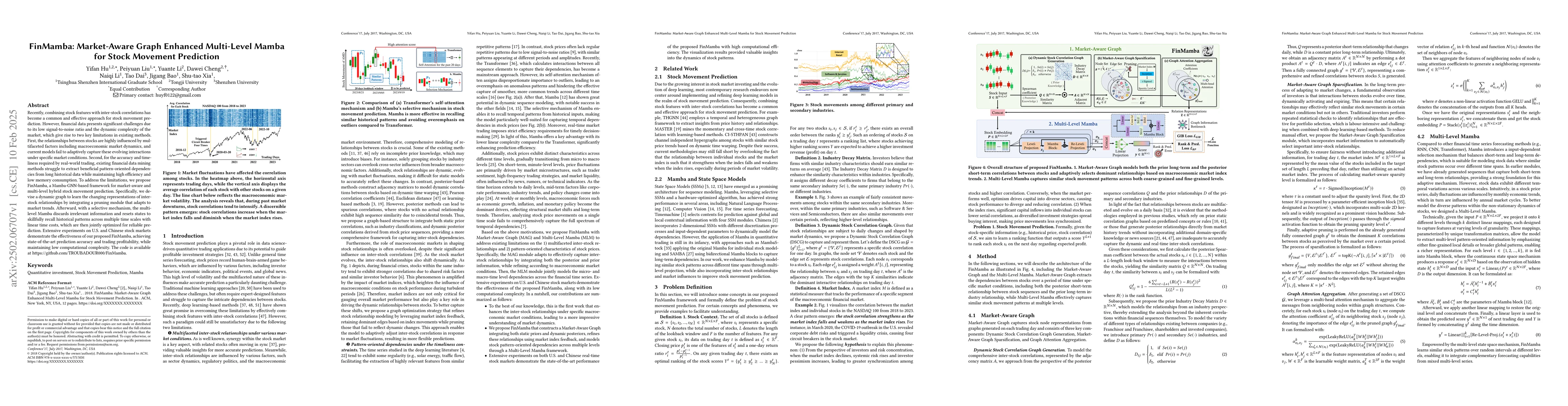

Recently, combining stock features with inter-stock correlations has become a common and effective approach for stock movement prediction. However, financial data presents significant challenges due to its low signal-to-noise ratio and the dynamic complexity of the market, which give rise to two key limitations in existing methods. First, the relationships between stocks are highly influenced by multifaceted factors including macroeconomic market dynamics, and current models fail to adaptively capture these evolving interactions under specific market conditions. Second, for the accuracy and timeliness required by real-world trading, existing financial data mining methods struggle to extract beneficial pattern-oriented dependencies from long historical data while maintaining high efficiency and low memory consumption. To address the limitations, we propose FinMamba, a Mamba-GNN-based framework for market-aware and multi-level hybrid stock movement prediction. Specifically, we devise a dynamic graph to learn the changing representations of inter-stock relationships by integrating a pruning module that adapts to market trends. Afterward, with a selective mechanism, the multi-level Mamba discards irrelevant information and resets states to skillfully recall historical patterns across multiple time scales with linear time costs, which are then jointly optimized for reliable prediction. Extensive experiments on U.S. and Chinese stock markets demonstrate the effectiveness of our proposed FinMamba, achieving state-of-the-art prediction accuracy and trading profitability, while maintaining low computational complexity. The code is available at https://github.com/TROUBADOUR000/FinMamba.

AI Key Findings

Generated Jun 11, 2025

Methodology

The research proposes FinMamba, a Mamba-GNN-based framework for stock movement prediction, which integrates a dynamic graph to learn changing inter-stock relationships and a multi-level Mamba to recall historical patterns across multiple time scales efficiently.

Key Results

- FinMamba achieves state-of-the-art prediction accuracy and trading profitability.

- The framework effectively captures both prior long-term industry relationships and posterior short-term stock sequence relationships.

- FinMamba maintains low computational complexity with linear time costs for state resetting.

- Extensive experiments on U.S. and Chinese stock markets validate its effectiveness.

- The model outperforms other methods on most evaluation metrics (ARR, ASR, CR, IR) across diverse datasets (CSI300, CSI500, S&P500, NASDAQ100).

Significance

This research is significant as it addresses the challenges of low signal-to-noise ratio and dynamic market complexity in financial data, providing a more adaptive and efficient approach to stock movement prediction, which is crucial for real-world trading strategies.

Technical Contribution

FinMamba introduces a market-aware graph sparsification module and a multi-level Mamba to efficiently capture and recall stock movement patterns across various time scales, integrating market trends and maintaining low computational complexity.

Novelty

The proposed FinMamba framework distinguishes itself by combining a dynamic graph for adaptive inter-stock relationship learning with a multi-level Mamba for efficient pattern recall, addressing the limitations of existing methods in handling dynamic market conditions and long-term dependencies in financial time series data.

Limitations

- The paper does not discuss the generalizability of FinMamba to other asset classes or markets beyond stocks.

- No information is provided on how the model handles missing or incomplete data, which is common in financial time series.

Future Work

- Investigate the applicability of FinMamba to other financial instruments like bonds, commodities, or cryptocurrencies.

- Explore techniques to handle missing data and assess the robustness of FinMamba under such conditions.

Paper Details

PDF Preview

Similar Papers

Found 4 papersMamba Meets Financial Markets: A Graph-Mamba Approach for Stock Price Prediction

Xiaohong Chen, Ehsan Hoseinzade, Ali Mehrabian et al.

Stock Movement Prediction Based on Bi-typed Hybrid-relational Market Knowledge Graph via Dual Attention Networks

Qing Li, Ji Liu, Yu Zhao et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)