Authors

Summary

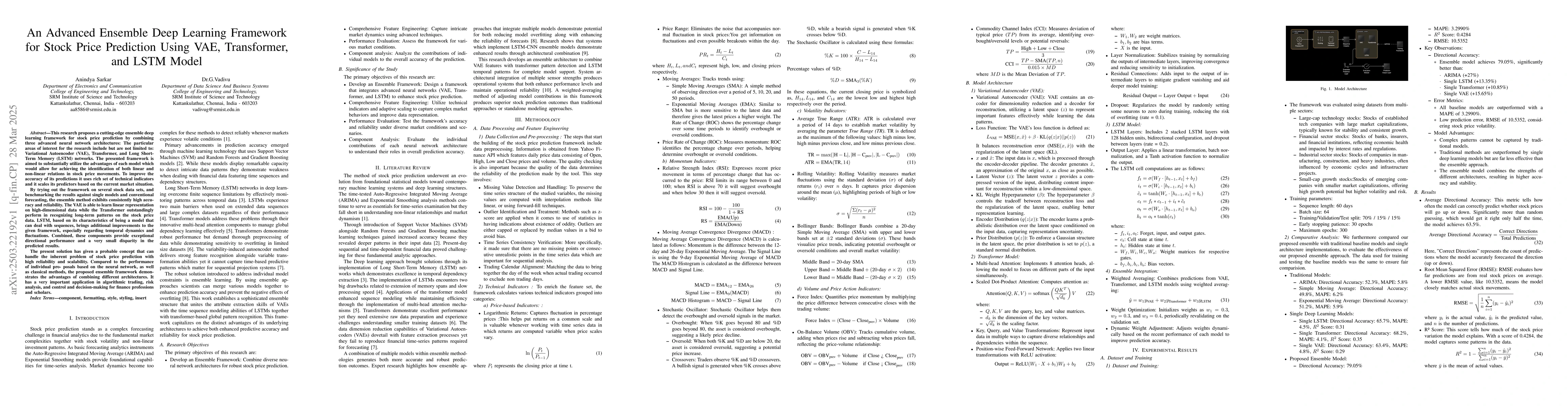

This research proposes a cutting-edge ensemble deep learning framework for stock price prediction by combining three advanced neural network architectures: The particular areas of interest for the research include but are not limited to: Variational Autoencoder (VAE), Transformer, and Long Short-Term Memory (LSTM) networks. The presented framework is aimed to substantially utilize the advantages of each model which would allow for achieving the identification of both linear and non-linear relations in stock price movements. To improve the accuracy of its predictions it uses rich set of technical indicators and it scales its predictors based on the current market situation. By trying out the framework on several stock data sets, and benchmarking the results against single models and conventional forecasting, the ensemble method exhibits consistently high accuracy and reliability. The VAE is able to learn linear representation on high-dimensional data while the Transformer outstandingly perform in recognizing long-term patterns on the stock price data. LSTM, based on its characteristics of being a model that can deal with sequences, brings additional improvements to the given framework, especially regarding temporal dynamics and fluctuations. Combined, these components provide exceptional directional performance and a very small disparity in the predicted results. The present solution has given a probable concept that can handle the inherent problem of stock price prediction with high reliability and scalability. Compared to the performance of individual proposals based on the neural network, as well as classical methods, the proposed ensemble framework demonstrates the advantages of combining different architectures. It has a very important application in algorithmic trading, risk analysis, and control and decision-making for finance professions and scholars.

AI Key Findings

Generated Jun 10, 2025

Methodology

The methodology involves developing an advanced ensemble deep learning framework for stock price prediction, integrating Variational Autoencoder (VAE), Transformer, and Long Short-Term Memory (LSTM) models. It uses comprehensive feature engineering with technical indicators and adaptive scaling to capture complex market behaviors. The framework is evaluated for its accuracy and reliability under diverse market conditions and scenarios.

Key Results

- The proposed ensemble model achieved 79.05% directional accuracy, significantly outperforming traditional models (ARIMA, Simple/Exponential Moving Average) and single deep learning models (LSTM, Transformer, VAE).

- The ensemble model demonstrated a Mean Absolute Percentage Error (MAPE) of 3.2990% and Root Mean Squared Error (RMSE) of 10.5352, indicating very accurate predictions considering stock price volatility.

- The model's R² score of 0.4284 shows its capability to explain stock price variation better than any baseline method.

Significance

This research is significant as it addresses the inherent problems of financial forecasting, such as market volatility, non-linearity, and temporal dependencies, by leveraging the strengths of VAE, Transformer, and LSTM architectures. The proposed ensemble model can characterize both linear and non-linear market dynamics, making it a reliable tool for trading algorithms, risk analysis, and decision-making in finance.

Technical Contribution

The main technical contribution is the development of an advanced ensemble deep learning framework that combines VAE, Transformer, and LSTM models to predict stock prices, effectively addressing the challenges of market volatility, non-linearity, and temporal dependencies.

Novelty

This work stands out by proposing an ensemble approach that leverages the unique advantages of VAE, Transformer, and LSTM architectures, surpassing the performance of traditional methods and single deep learning models in stock price prediction.

Limitations

- The paper does not explicitly mention any limitations of the proposed method.

- Potential limitations could include the reliance on historical data and the assumption that past patterns will persist in the future.

Future Work

- Future work could explore the integration of additional advanced neural network architectures or alternative data sources, such as news sentiment or social media data.

- Investigating the model's performance on various timeframes and different geographical markets could further validate its robustness and applicability.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersHAELT: A Hybrid Attentive Ensemble Learning Transformer Framework for High-Frequency Stock Price Forecasting

Thanh Dan Bui

Comparative Analysis of LSTM, GRU, and Transformer Models for Stock Price Prediction

Jue Xiao, Shuochen Bi, Tingting Deng

No citations found for this paper.

Comments (0)