Authors

Summary

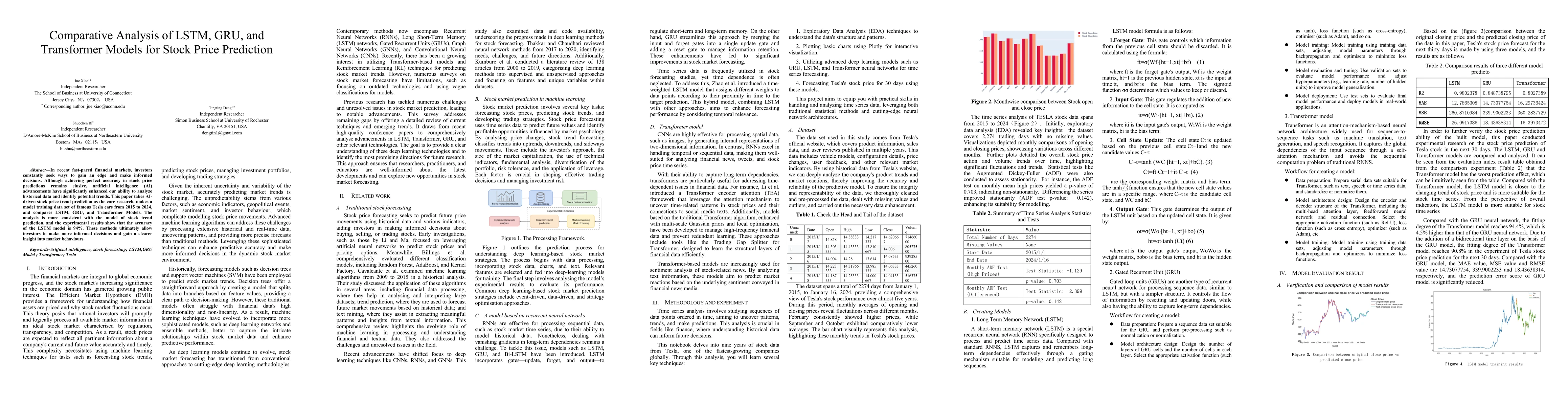

In recent fast-paced financial markets, investors constantly seek ways to gain an edge and make informed decisions. Although achieving perfect accuracy in stock price predictions remains elusive, artificial intelligence (AI) advancements have significantly enhanced our ability to analyze historical data and identify potential trends. This paper takes AI driven stock price trend prediction as the core research, makes a model training data set of famous Tesla cars from 2015 to 2024, and compares LSTM, GRU, and Transformer Models. The analysis is more consistent with the model of stock trend prediction, and the experimental results show that the accuracy of the LSTM model is 94%. These methods ultimately allow investors to make more informed decisions and gain a clearer insight into market behaviors.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAn Advanced Ensemble Deep Learning Framework for Stock Price Prediction Using VAE, Transformer, and LSTM Model

Anindya Sarkar, G. Vadivu

| Title | Authors | Year | Actions |

|---|

Comments (0)