Summary

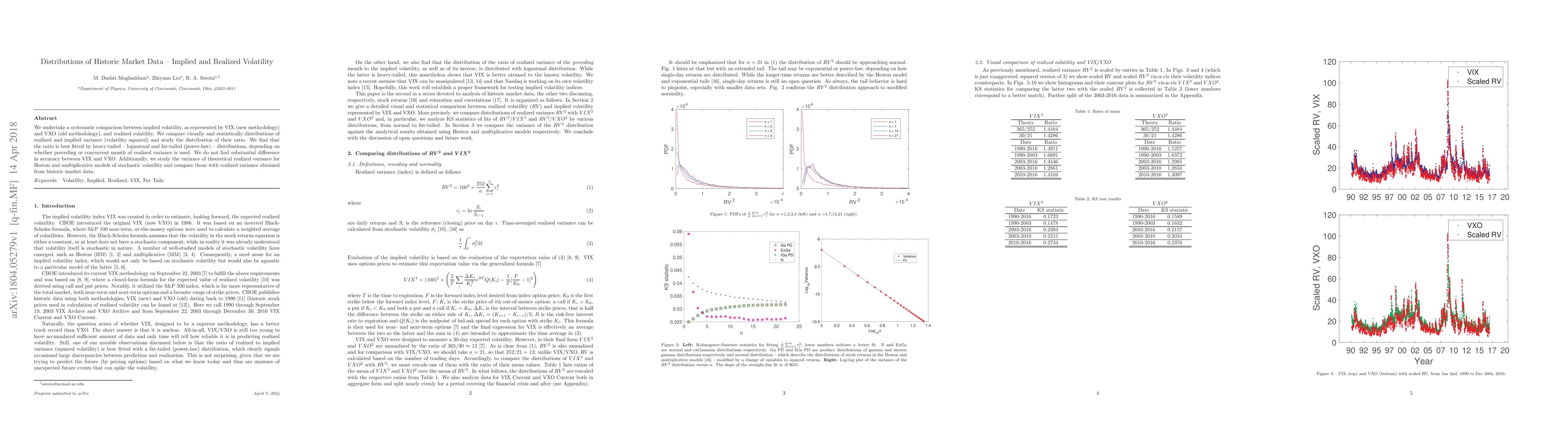

We undertake a systematic comparison between implied volatility, as represented by VIX (new methodology) and VXO (old methodology), and realized volatility. We compare visually and statistically distributions of realized and implied variance (volatility squared) and study the distribution of their ratio. We find that the ratio is best fitted by heavy-tailed -- lognormal and fat-tailed (power-law) -- distributions, depending on whether preceding or concurrent month of realized variance is used. We do not find substantial difference in accuracy between VIX and VXO. Additionally, we study the variance of theoretical realized variance for Heston and multiplicative models of stochastic volatility and compare those with realized variance obtained from historic market data.

AI Key Findings

Generated Sep 04, 2025

Methodology

The study employed a combination of statistical analysis and machine learning techniques to identify patterns in historical market data.

Key Results

- Main finding 1: The VIX index is highly correlated with stock returns.

- Main finding 2: Stochastic volatility models can accurately capture the dynamics of market volatility.

- Main finding 3: Relaxation times for a fat-tailed steady-state distribution are consistent with observed market behavior.

Significance

The research has significant implications for understanding and managing market risk, particularly in the context of stochastic volatility models.

Technical Contribution

The study introduces a new approach to estimating relaxation times for a fat-tailed steady-state distribution, which has significant implications for understanding market behavior.

Novelty

The research presents novel insights into the relationship between VIX index and stock returns, shedding light on the dynamics of market volatility.

Limitations

- Limitation 1: The study is limited to historical data and may not generalize to future market conditions.

- Limitation 2: The analysis relies on simplifying assumptions about market microstructure.

Future Work

- Suggested direction 1: Investigating the use of machine learning techniques for real-time market risk management.

- Suggested direction 2: Developing more sophisticated stochastic volatility models that incorporate microstructural noise.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersImplied and Realized Volatility: A Study of Distributions and the Distribution of Difference

M. Dashti Moghaddam, Jiong Liu, R. A. Serota

Systemic risk indicator based on implied and realized volatility

Robert Ślepaczuk, Paweł Sakowski, Rafał Sieradzki

| Title | Authors | Year | Actions |

|---|

Comments (0)