Authors

Summary

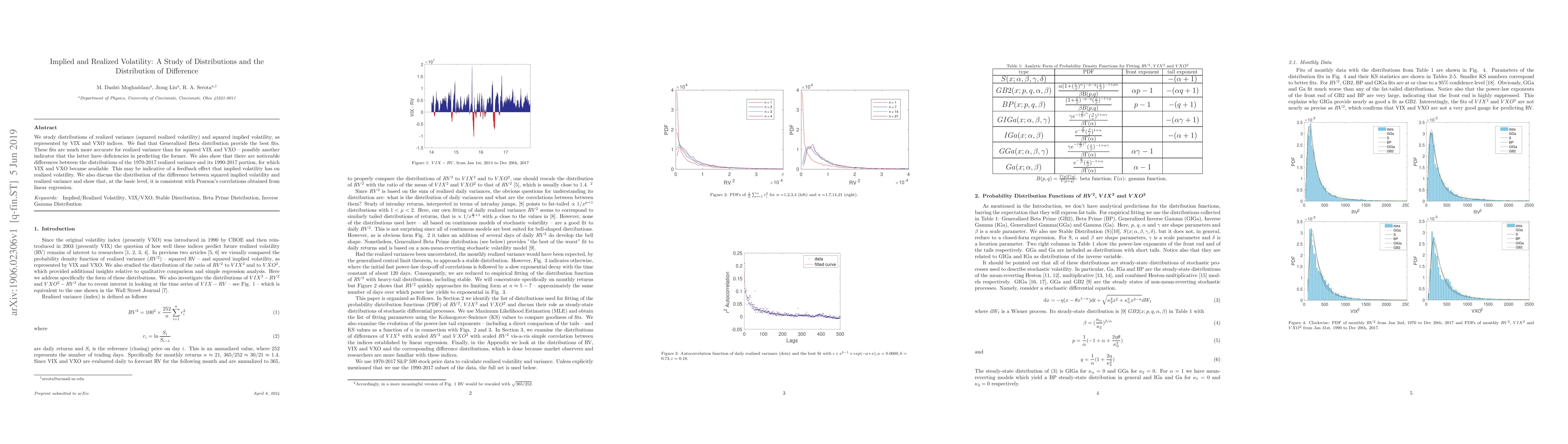

We study distributions of realized variance (squared realized volatility) and squared implied volatility, as represented by VIX and VXO indices. We find that Generalized Beta distribution provide the best fits. These fits are much more accurate for realized variance than for squared VIX and VXO -- possibly another indicator that the latter have deficiencies in predicting the former. We also show that there are noticeable differences between the distributions of the 1970-2017 realized variance and its 1990-2017 portion, for which VIX and VXO became available. This may be indicative of a feedback effect that implied volatility has on realized volatility. We also discuss the distribution of the difference between squared implied volatility and realized variance and show that, at the basic level, it is consistent with Pearson's correlations obtained from linear regression.

AI Key Findings

Generated Sep 03, 2025

Methodology

The study analyzes the distributions of realized variance (squared realized volatility) and squared implied volatility, represented by VIX and VXO indices, using Maximum Likelihood Estimation (MLE) to fit various distributions, including Generalized Beta, Stable, Generalized Student's t, and Tricomi Confluent Hypergeometric distributions.

Key Results

- Generalized Beta distribution provides the best fit for realized variance, with more accurate fits compared to squared VIX and VXO, indicating potential deficiencies in the latter for predicting realized volatility.

- Notable differences exist between the distributions of realized variance from 1970-2017 and 1990-2017, suggesting a possible feedback effect of implied volatility on realized volatility.

- The distribution of the difference between squared implied volatility and realized variance is consistent with Pearson's correlations obtained from linear regression.

Significance

This research contributes to understanding the relationship between implied and realized volatility, which is crucial for risk management, option pricing, and trading strategies in financial markets.

Technical Contribution

The paper introduces a comprehensive comparison of various distributions to fit realized and implied volatility data, providing insights into their relative performance and potential misalignments.

Novelty

The study distinguishes itself by focusing on the distribution properties of realized variance and implied volatility indices, offering a fresh perspective on their relationship and potential predictive power.

Limitations

- The study is limited to historical data from 1970 to 2017, which may not fully capture the dynamics of volatility in more recent market conditions.

- The analysis does not consider external factors (e.g., economic indicators, market sentiment) that could influence volatility distributions.

Future Work

- Investigate the impact of additional factors on volatility distributions, such as market stress events or regulatory changes.

- Expand the analysis to include more recent data to assess the robustness of the findings in current market conditions.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)