Summary

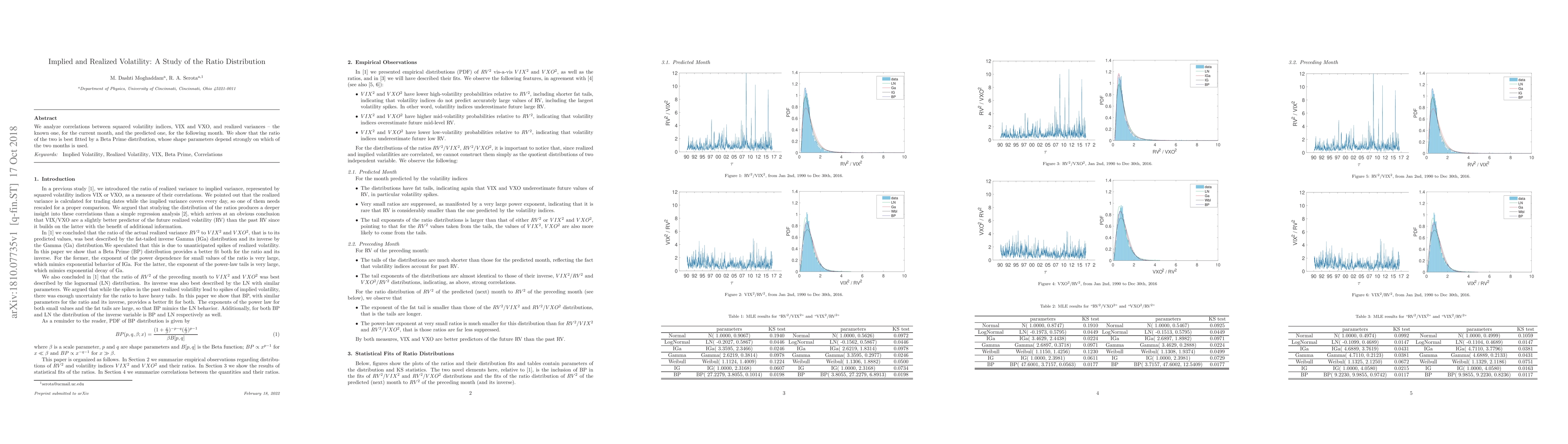

We analyze correlations between squared volatility indices, VIX and VXO, and realized variances -- the known one, for the current month, and the predicted one, for the following month. We show that the ratio of the two is best fitted by a Beta Prime distribution, whose shape parameters depend strongly on which of the two months is used.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersImplied and Realized Volatility: A Study of Distributions and the Distribution of Difference

M. Dashti Moghaddam, Jiong Liu, R. A. Serota

Systemic risk indicator based on implied and realized volatility

Robert Ślepaczuk, Paweł Sakowski, Rafał Sieradzki

| Title | Authors | Year | Actions |

|---|

Comments (0)