Mitja Stadje

7 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

A Rank-Dependent Theory for Decision under Risk and Ambiguity

This paper axiomatizes, in a two-stage setup, a new theory for decision under risk and ambiguity. The axiomatized preference relation $\succeq$ on the space $\tilde{V}$ of random variables induces a...

Utility maximization under endogenous pricing

We study the expected utility maximization problem of a large investor who is allowed to make transactions on tradable assets in an incomplete financial market with endogenous permanent market impac...

On the equivalence between Value-at-Risk- and Expected Shortfall-based risk measures in non-concave optimization

We study a non-concave optimization problem in which a financial company maximizes the expected utility of the surplus under a risk-based regulatory constraint. For this problem, we consider four di...

Robustness of Delta Hedging in a Jump-Diffusion Model

Suppose an investor aims at Delta hedging a European contingent claim $h(S(T))$ in a jump-diffusion model, but incorrectly specifies the stock price's volatility and jump sensitivity, so that any he...

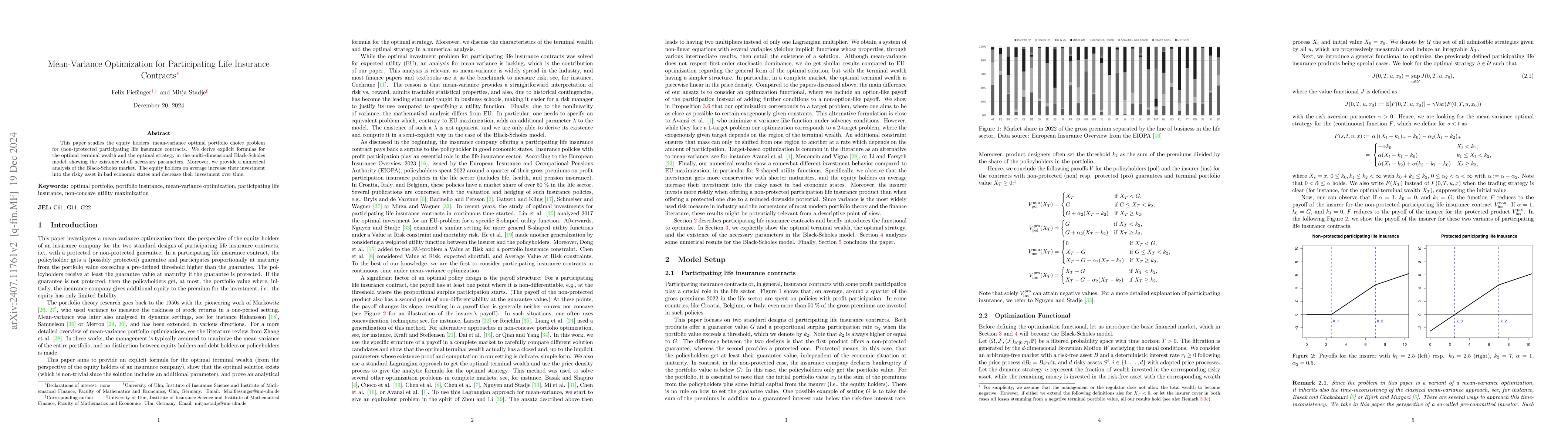

Mean-Variance Optimization for Participating Life Insurance Contracts

This paper studies the equity holders' mean-variance optimal portfolio choice problem for (non-)protected participating life insurance contracts. We derive explicit formulas for the optimal terminal w...

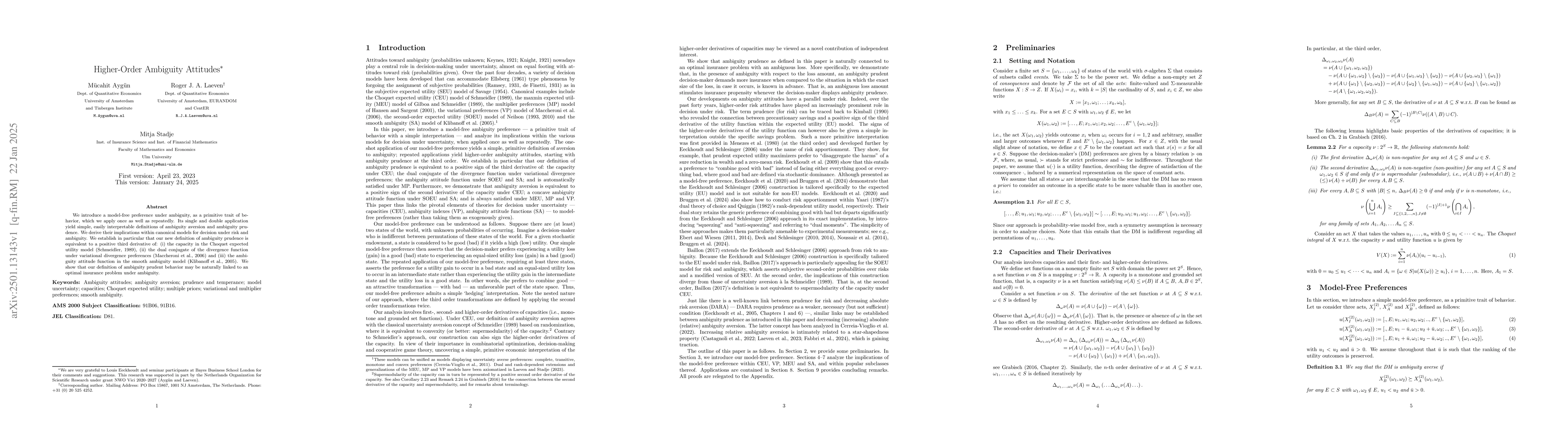

Higher-Order Ambiguity Attitudes

We introduce a model-free preference under ambiguity, as a primitive trait of behavior, which we apply once as well as repeatedly. Its single and double application yield simple, easily interpretable ...

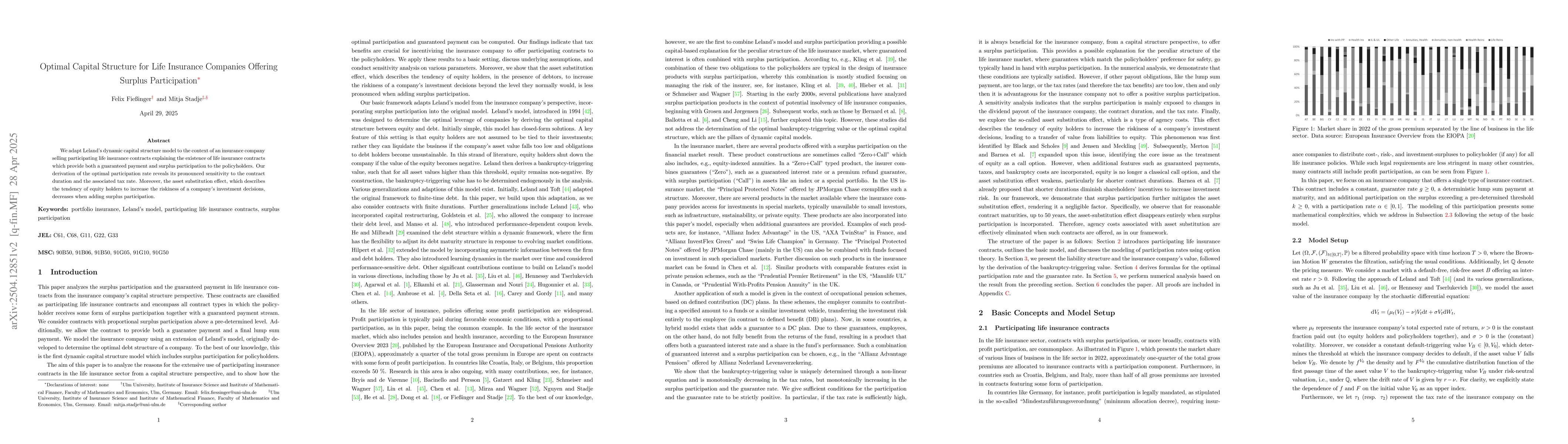

Optimal Capital Structure for Life Insurance Companies Offering Surplus Participation

We adapt Leland's dynamic capital structure model to the context of an insurance company selling participating life insurance contracts explaining the existence of life insurance contracts which provi...