Authors

Summary

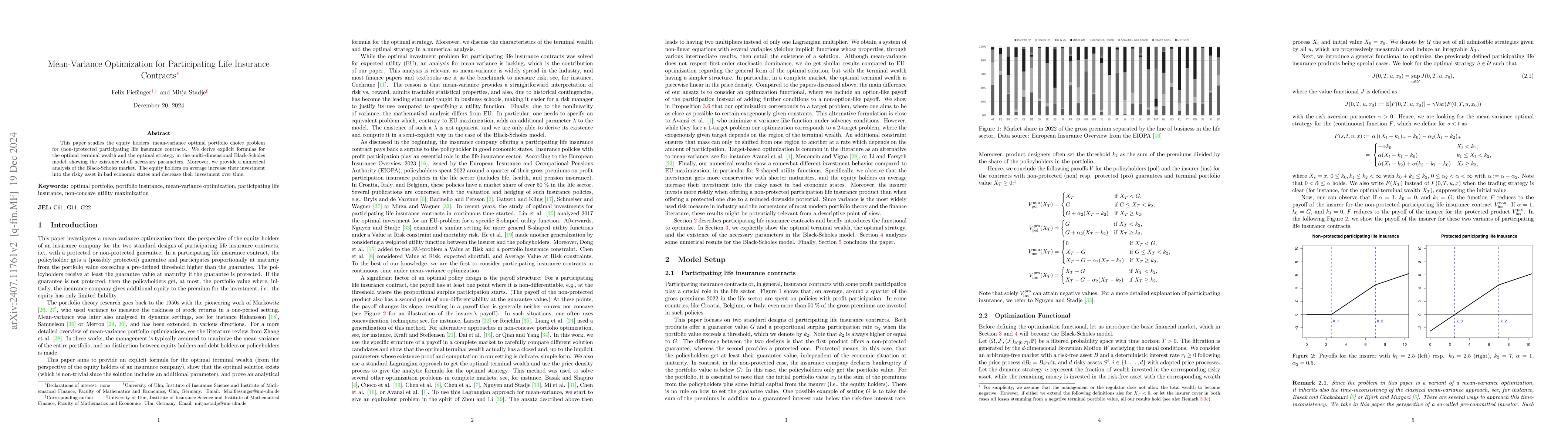

This paper studies the equity holders' mean-variance optimal portfolio choice problem for (non-)protected participating life insurance contracts. We derive explicit formulas for the optimal terminal wealth and the optimal strategy in the multi-dimensional Black-Scholes model, showing the existence of all necessary parameters. In incomplete markets, we state Hamilton-Jacobi-Bellman equations for the value function. Moreover, we provide a numerical analysis of the Black-Scholes market. The equity holders on average increase their investment into the risky asset in bad economic states and decrease their investment over time.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)