Summary

We consider a time-consistent mean-variance portfolio selection problem of an insurer and allow for the incorporation of basis (mortality) risk. The optimal solution is identified with a Nash subgame perfect equilibrium. We characterize an optimal strategy as solution of a system of partial integro-differential equations (PIDEs), a so called extended Hamilton-Jacobi-Bellman (HJB) system. We prove that the equilibrium is necessarily a solution of the extended HJB system. Under certain conditions we obtain an explicit solution to the extended HJB system and provide the optimal trading strategies in closed-form. A simulation shows that the previously found strategies yield payoffs whose expectations and variances are robust regarding the distribution of jump sizes of the stock. The same phenomenon is observed when the variance is correctly estimated, but erroneously ascribed to the diffusion components solely. Further, we show that differences in the insurance horizon and the time to maturity of a longevity asset do not add to the variance of the terminal wealth.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

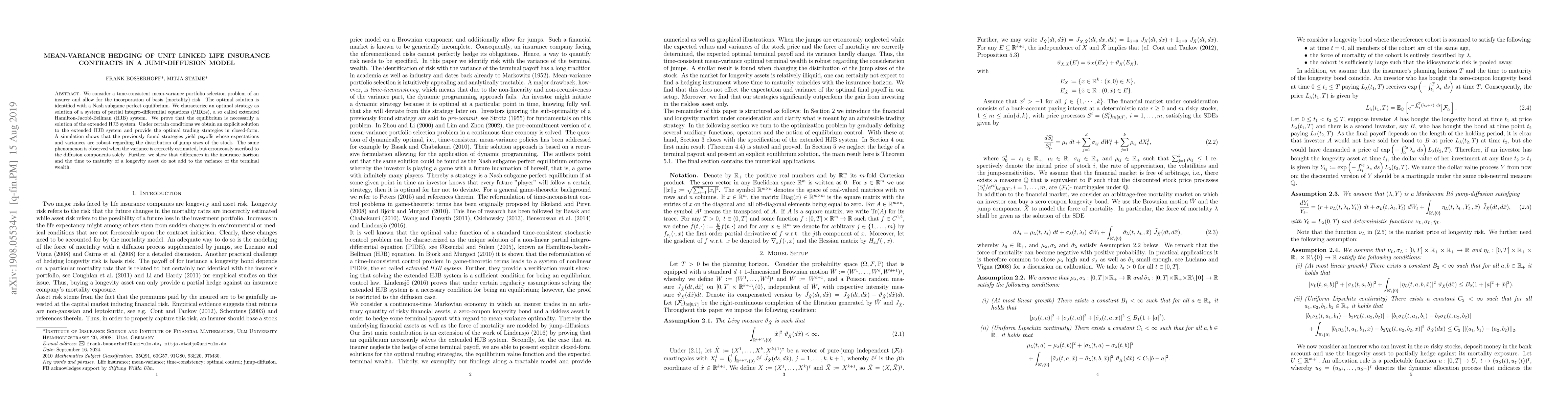

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)