Summary

This paper studies a Value-at-Risk (VaR)-regulated optimal portfolio problem of the equity holders of a participating life insurance contract. In a setting with unhedgeable mortality risk and complete financial market, the optimal solution is given explicitly for contracts with mortality risk using a martingale approach for constrained non-concave optimization problems. We show that regulatory VaR constraints for participating insurance contracts lead to more prudent investment than in the case of no regulation. This result is contrary to the situation where the insurer maximizes the utility of the total wealth of the company (without distinguishing between contributions of equity holders and policyholders), in which case a VaR constraint may induce the insurer to take excessive risks leading to higher losses than in the case of no regulation. Compared to the unregulated problem, the VaR-constrained strategy leads to a higher expected utility for the policyholders, highlighting the potential usefulness of a VaR-regulation in the context of insurance. The prudent investment behavior is more significant if a VaR-type regulation is replaced by a portfolio insurance (PI)-type regulation. Furthermore, a stricter regulation (a smaller allowed default probability in the VaR problem or a higher minimum guarantee level in the PI problem) enhances the benefit of the policyholder but deteriorates that of the insurer. For both types of regulation, the gains in terms of expected utility are greater for higher participation rates, while being smaller for higher bonus rates. We also extend our analysis to frameworks where dividend and premature death benefit payments are made at an intermediate time date.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

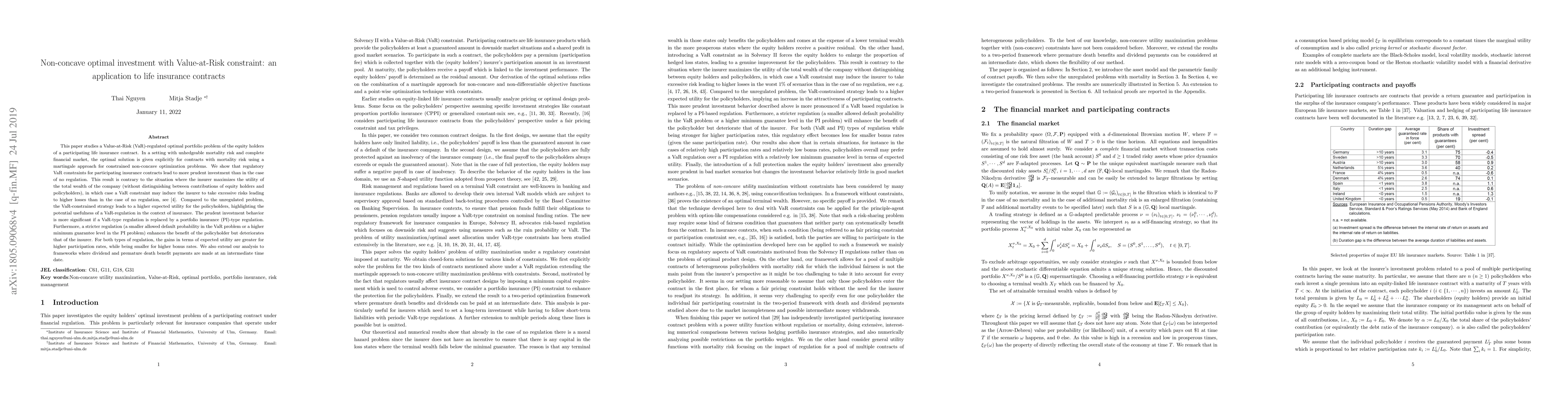

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)