Mohan Jiang

11 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

Wasserstein Distance-Weighted Adversarial Network for Cross-Domain Credit Risk Assessment

This paper delves into the application of adversarial domain adaptation (ADA) for enhancing credit risk assessment in financial institutions. It addresses two critical challenges: the cold start probl...

Applying Hybrid Graph Neural Networks to Strengthen Credit Risk Analysis

This paper presents a novel approach to credit risk prediction by employing Graph Convolutional Neural Networks (GCNNs) to assess the creditworthiness of borrowers. Leveraging the power of big data an...

Predicting Liquidity Coverage Ratio with Gated Recurrent Units: A Deep Learning Model for Risk Management

With the global economic integration and the high interconnection of financial markets, financial institutions are facing unprecedented challenges, especially liquidity risk. This paper proposes a liq...

Leveraging Generative Adversarial Networks for Addressing Data Imbalance in Financial Market Supervision

This study explores the application of generative adversarial networks in financial market supervision, especially for solving the problem of data imbalance to improve the accuracy of risk prediction....

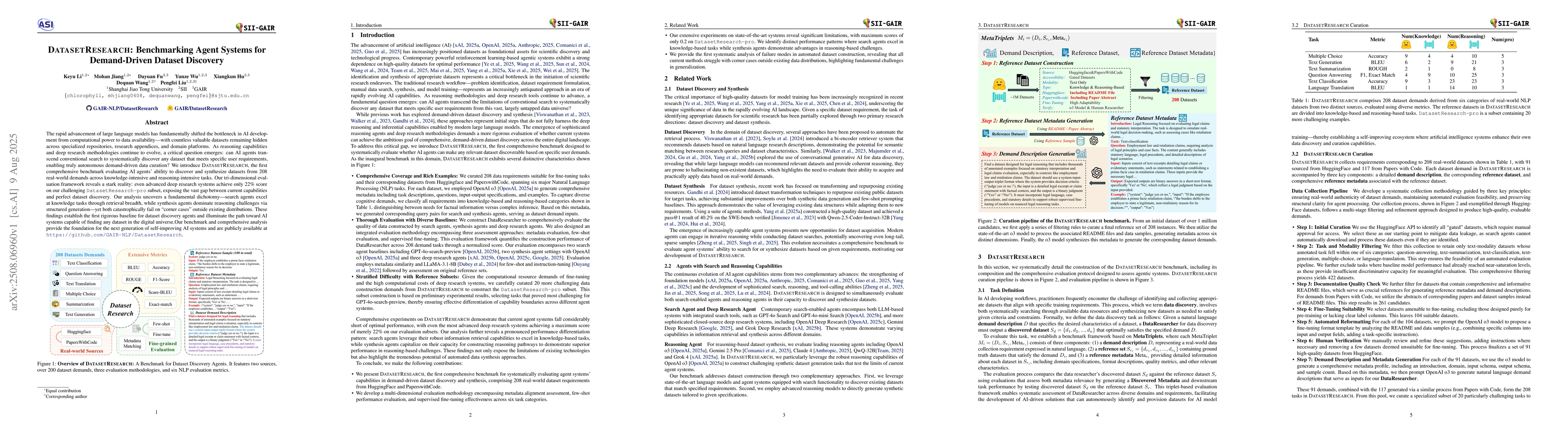

DatasetResearch: Benchmarking Agent Systems for Demand-Driven Dataset Discovery

The rapid advancement of large language models has fundamentally shifted the bottleneck in AI development from computational power to data availability-with countless valuable datasets remaining hidde...

PersonaEval: Are LLM Evaluators Human Enough to Judge Role-Play?

Current role-play studies often rely on unvalidated LLM-as-a-judge paradigms, which may fail to reflect how humans perceive role fidelity. A key prerequisite for human-aligned evaluation is role ident...

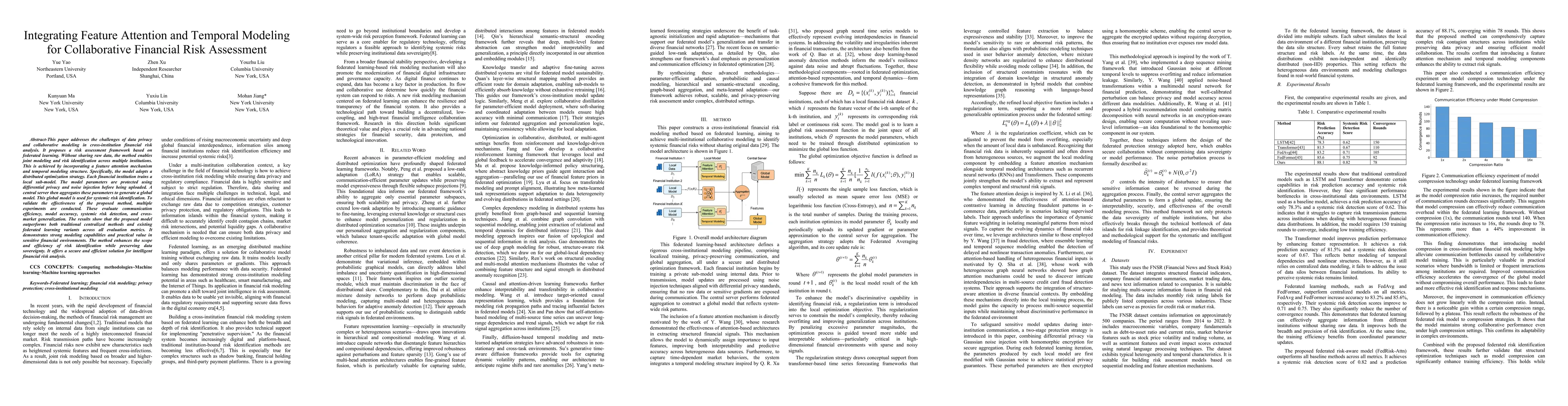

Integrating Feature Attention and Temporal Modeling for Collaborative Financial Risk Assessment

This paper addresses the challenges of data privacy and collaborative modeling in cross-institution financial risk analysis. It proposes a risk assessment framework based on federated learning. Withou...

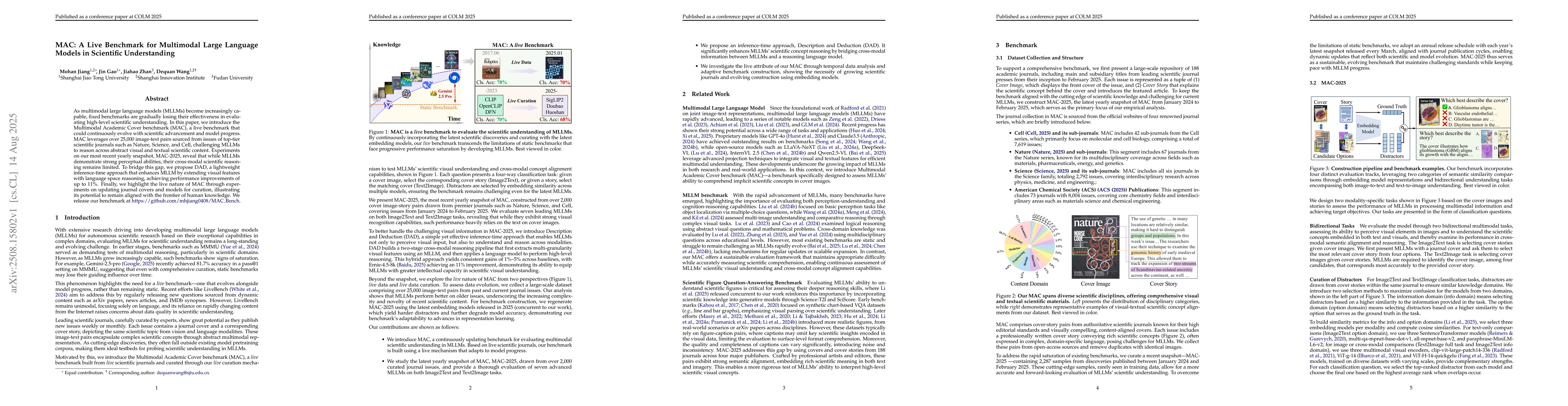

MAC: A Live Benchmark for Multimodal Large Language Models in Scientific Understanding

As multimodal large language models (MLLMs) grow increasingly capable, fixed benchmarks are gradually losing their effectiveness in evaluating high-level scientific understanding. In this paper, we in...

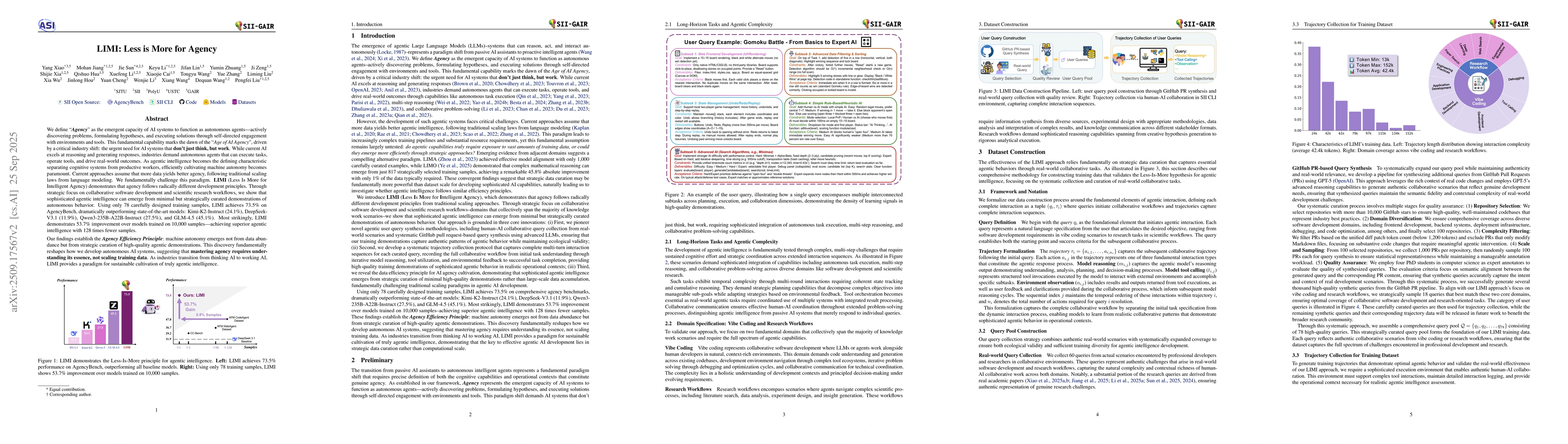

LIMI: Less is More for Agency

We define Agency as the emergent capacity of AI systems to function as autonomous agents actively discovering problems, formulating hypotheses, and executing solutions through self-directed engagement...

Interaction as Intelligence Part II: Asynchronous Human-Agent Rollout for Long-Horizon Task Training

Large Language Model (LLM) agents have recently shown strong potential in domains such as automated coding, deep research, and graphical user interface manipulation. However, training them to succeed ...

InnovatorBench: Evaluating Agents' Ability to Conduct Innovative LLM Research

AI agents could accelerate scientific discovery by automating hypothesis formation, experiment design, coding, execution, and analysis, yet existing benchmarks probe narrow skills in simplified settin...