Summary

With the global economic integration and the high interconnection of financial markets, financial institutions are facing unprecedented challenges, especially liquidity risk. This paper proposes a liquidity coverage ratio (LCR) prediction model based on the gated recurrent unit (GRU) network to help financial institutions manage their liquidity risk more effectively. By utilizing the GRU network in deep learning technology, the model can automatically learn complex patterns from historical data and accurately predict LCR for a period of time in the future. The experimental results show that compared with traditional methods, the GRU model proposed in this study shows significant advantages in mean absolute error (MAE), proving its higher accuracy and robustness. This not only provides financial institutions with a more reliable liquidity risk management tool but also provides support for regulators to formulate more scientific and reasonable policies, which helps to improve the stability of the entire financial system.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

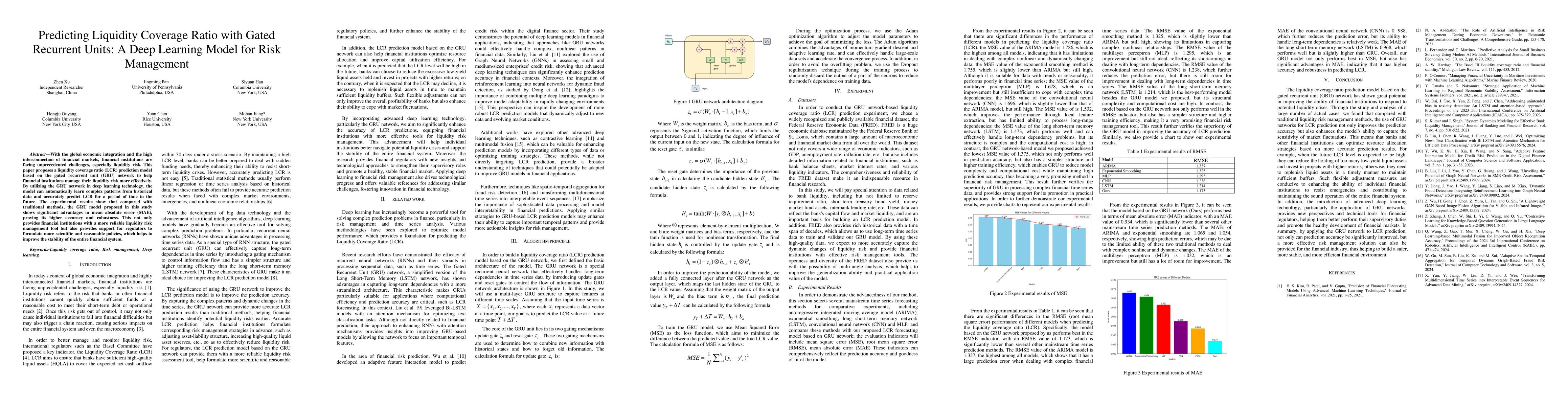

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPredicting the Stay Length of Patients in Hospitals using Convolutional Gated Recurrent Deep Learning Model

Mehdi Neshat, Seyedali Mirjalili, Michael Phipps et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)