Nikitas Stamatopoulos

7 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

Quantum amplitude estimation from classical signal processing

We demonstrate that the problem of amplitude estimation, a core subroutine used in many quantum algorithms, can be mapped directly to a problem in signal processing called direction of arrival (DOA)...

Quantum Risk Analysis of Financial Derivatives

We introduce two quantum algorithms to compute the Value at Risk (VaR) and Conditional Value at Risk (CVaR) of financial derivatives using quantum computers: the first by applying existing ideas fro...

Derivative Pricing using Quantum Signal Processing

Pricing financial derivatives on quantum computers typically includes quantum arithmetic components which contribute heavily to the quantum resources required by the corresponding circuits. In this ...

End-to-end resource analysis for quantum interior point methods and portfolio optimization

We study quantum interior point methods (QIPMs) for second-order cone programming (SOCP), guided by the example use case of portfolio optimization (PO). We provide a complete quantum circuit-level d...

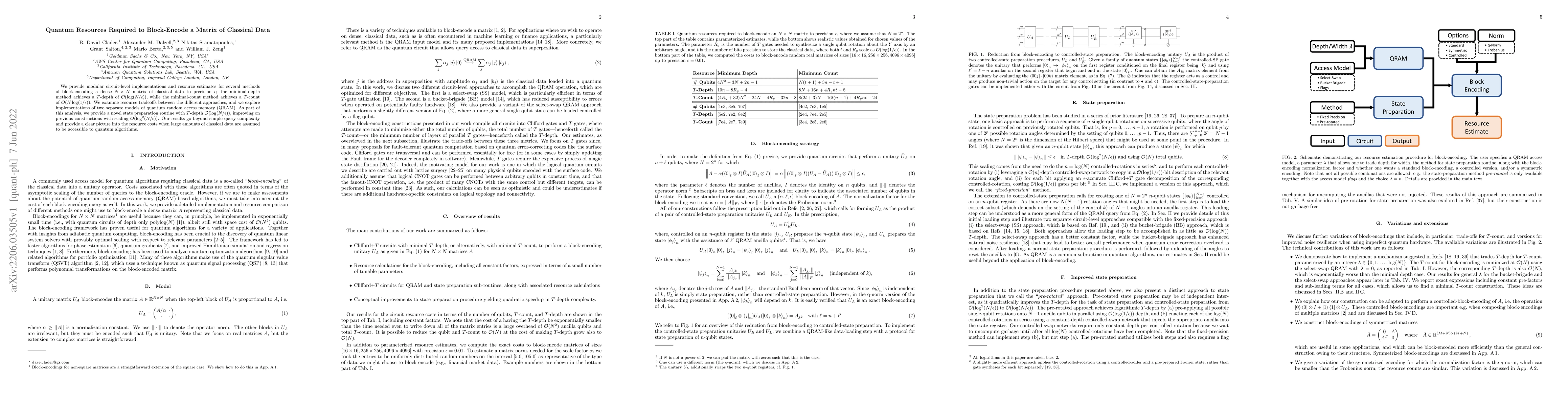

Quantum Resources Required to Block-Encode a Matrix of Classical Data

We provide modular circuit-level implementations and resource estimates for several methods of block-encoding a dense $N\times N$ matrix of classical data to precision $\epsilon$; the minimal-depth ...

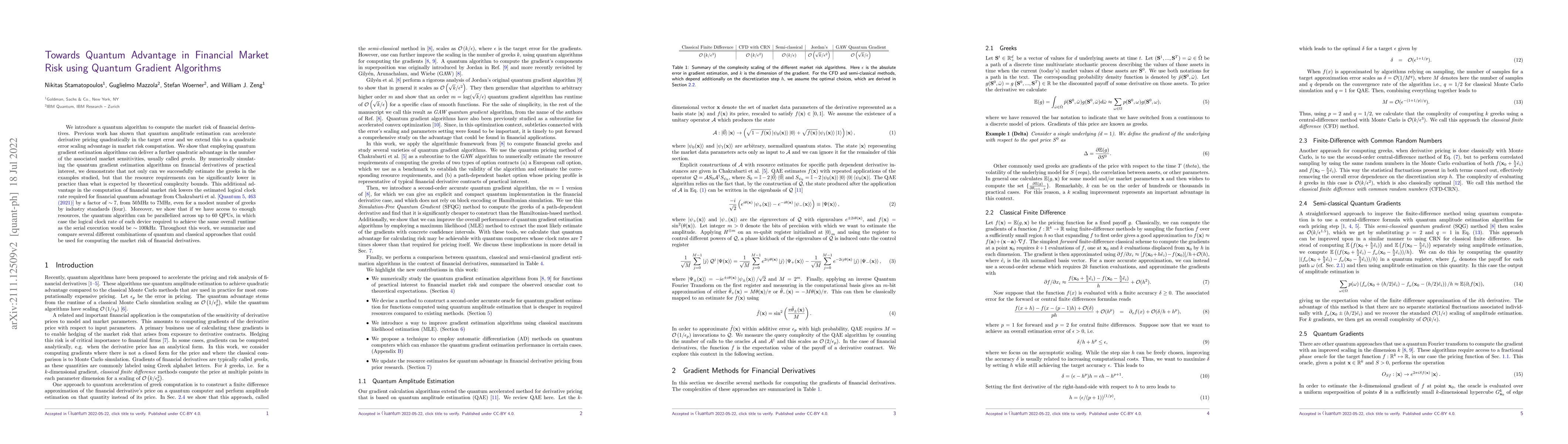

Towards Quantum Advantage in Financial Market Risk using Quantum Gradient Algorithms

We introduce a quantum algorithm to compute the market risk of financial derivatives. Previous work has shown that quantum amplitude estimation can accelerate derivative pricing quadratically in the...

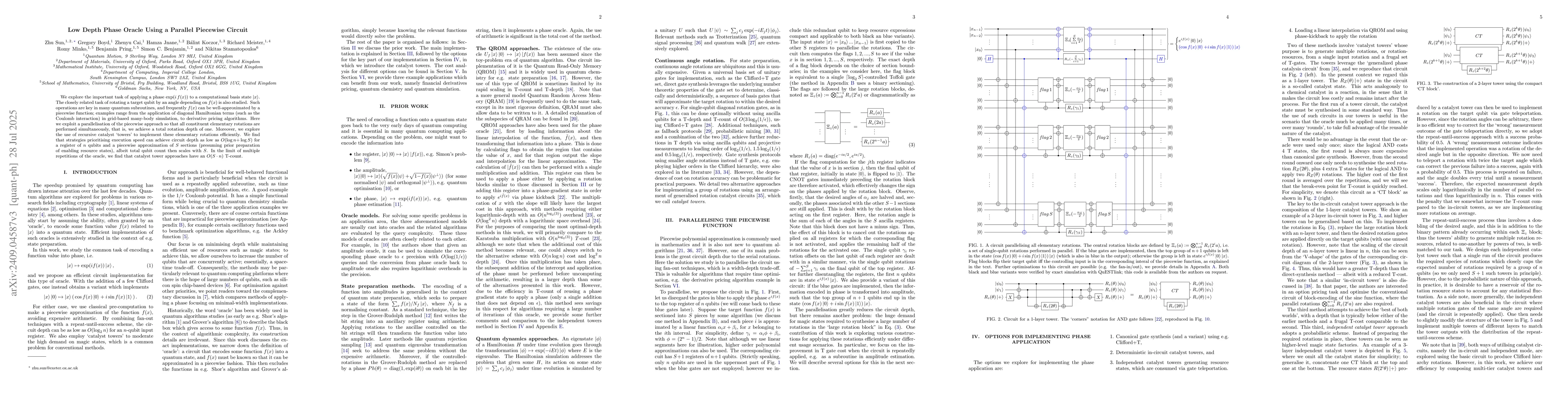

Low Depth Phase Oracle Using a Parallel Piecewise Circuit

We explore the important task of applying a phase $\exp(i\,f(x))$ to a computational basis state $\left| x \right>$. The closely related task of rotating a target qubit by an angle depending on $f(x)$...