Authors

Summary

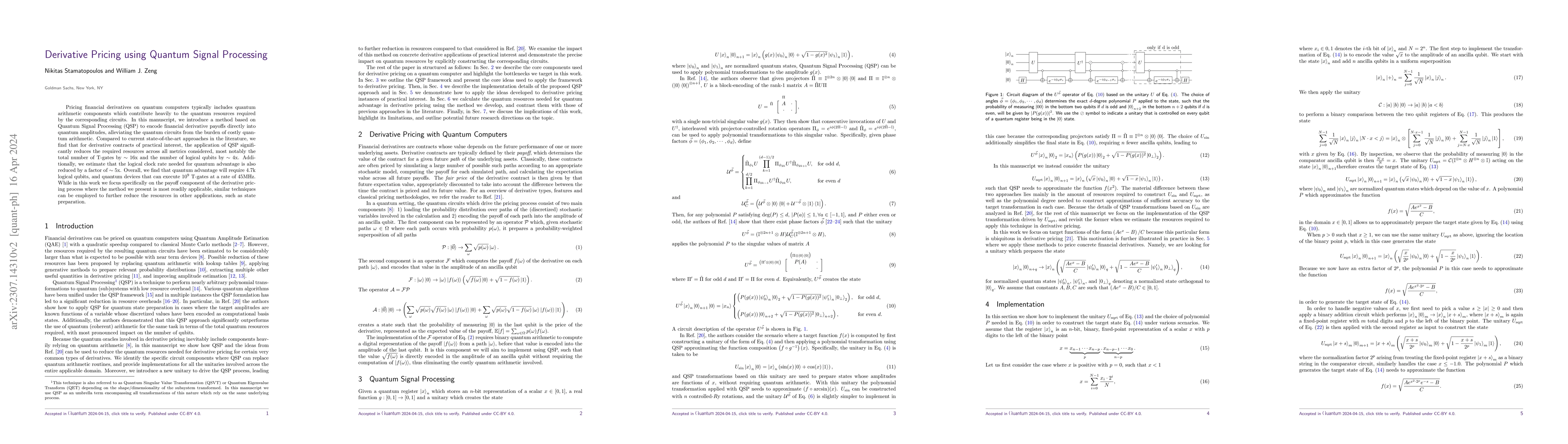

Pricing financial derivatives on quantum computers typically includes quantum arithmetic components which contribute heavily to the quantum resources required by the corresponding circuits. In this manuscript, we introduce a method based on Quantum Signal Processing (QSP) to encode financial derivative payoffs directly into quantum amplitudes, alleviating the quantum circuits from the burden of costly quantum arithmetic. Compared to current state-of-the-art approaches in the literature, we find that for derivative contracts of practical interest, the application of QSP significantly reduces the required resources across all metrics considered, most notably the total number of T-gates by $\sim 16$x and the number of logical qubits by $\sim 4$x. Additionally, we estimate that the logical clock rate needed for quantum advantage is also reduced by a factor of $\sim 5$x. Overall, we find that quantum advantage will require $4.7$k logical qubits, and quantum devices that can execute $10^9$ T-gates at a rate of $45$MHz. While in this work we focus specifically on the payoff component of the derivative pricing process where the method we present is most readily applicable, similar techniques can be employed to further reduce the resources in other applications, such as state preparation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMixed-Signal Quantum Circuit Design for Option Pricing Using Design Compiler

Yeong-Jar Chang, Yu-Ting Kao, Ying-Wei Tseng

Quantum Channel Modelling by Statistical Quantum Signal Processing

Indrakshi Dey, Nicola Marchetti, Mouli Chakraborty et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)