Peter Bank

7 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

Rough PDEs for local stochastic volatility models

In this work, we introduce a novel pricing methodology in general, possibly non-Markovian local stochastic volatility (LSV) models. We observe that by conditioning the LSV dynamics on the Brownian m...

Optimal execution and speculation with trade signals

We propose a price impact model where changes in prices are purely driven by the order flow in the market. The stochastic price impact of market orders and the arrival rates of limit and market orde...

Optimal investment with a noisy signal of future stock prices

We consider an investor who is dynamically informed about the future evolution of one of the independent Brownian motions driving a stock's price fluctuations. With linear temporary price impact the...

Merton's optimal investment problem with jump signals

This paper presents a new framework for Merton's optimal investment problem which uses the theory of Meyer $\sigma$-fields to allow for signals that possibly warn the investor about impending jumps....

What if we knew what the future brings? Optimal investment for a frontrunner with price impact

In this paper we study optimal investment when the investor can peek some time units into the future, but cannot fully take advantage of this knowledge because of quadratic transaction costs. In the...

How much should we care about what others know? Jump signals in optimal investment under relative performance concerns

We present a multi-agent and mean-field formulation of a game between investors who receive private signals informing their investment decisions and who interact through relative performance concerns....

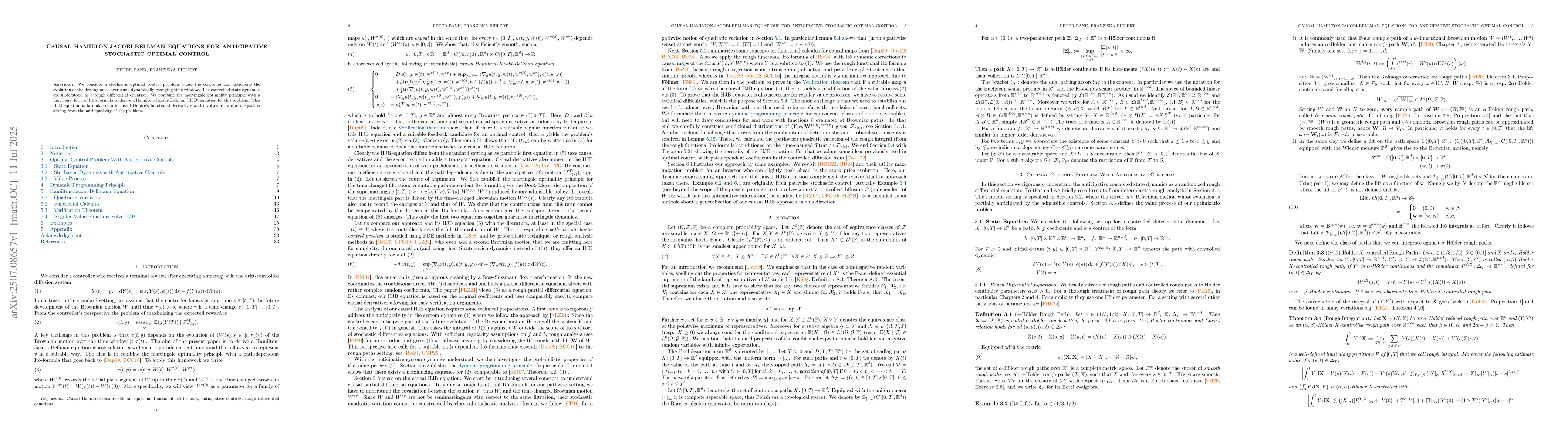

Causal Hamilton-Jacobi-Bellman Equations for Anticipative Stochastic Optimal Control

We consider a stochastic optimal control problem where the controller can anticipate the evolution of the driving noise over some dynamically changing time window. The controlled state dynamics are un...