Authors

Summary

We propose a price impact model where changes in prices are purely driven by the order flow in the market. The stochastic price impact of market orders and the arrival rates of limit and market orders are functions of the market liquidity process which reflects the balance of the demand and supply of liquidity. Limit and market orders mutually excite each other so that liquidity is mean reverting. We use the theory of Meyer-$\sigma$-fields to introduce a short-term signal process from which a trader learns about imminent changes in order flow. In this setting, we examine an optimal execution problem and derive the Hamilton--Jacobi--Bellman (HJB) equation for the value function. The HJB equation is solved numerically and we illustrate how the trader uses the signal to enhance the performance of execution problems and to execute speculative strategies.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

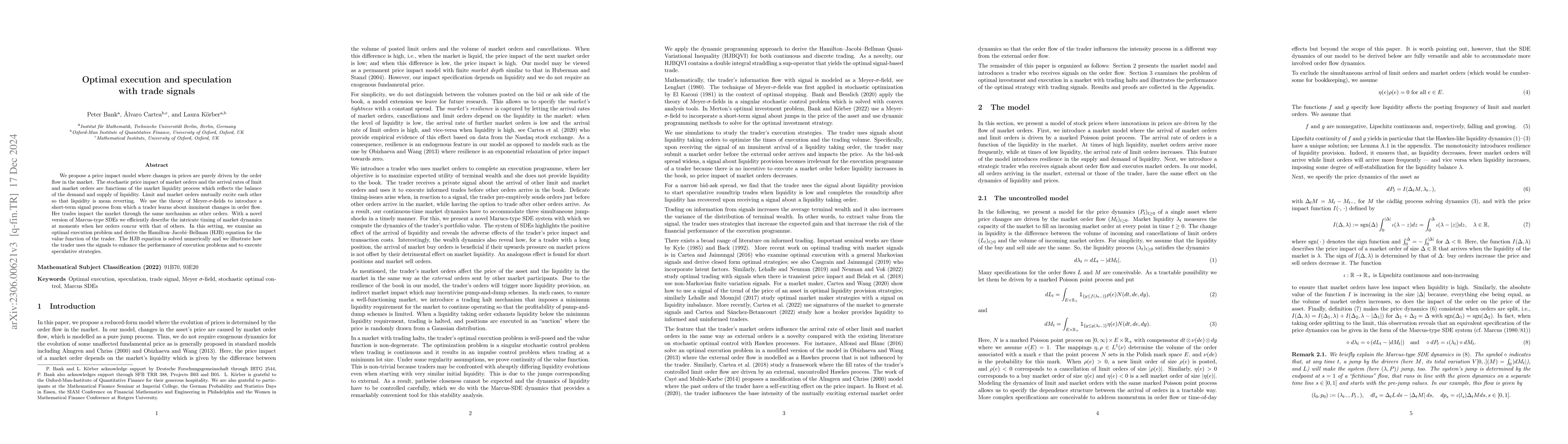

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimal Trade Execution with Uncertain Volume Target

Raphael Hauser, Julien Vaes

| Title | Authors | Year | Actions |

|---|

Comments (0)