Robert Ślepaczuk

14 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

Improving Realized LGD Approximation: A Novel Framework with XGBoost for Handling Missing Cash-Flow Data

The scope for the accurate calculation of the Loss Given Default (LGD) parameter is comprehensive in terms of financial data. In this research, we aim to explore methods for improving the approximatio...

LSTM-ARIMA as a Hybrid Approach in Algorithmic Investment Strategies

This study focuses on building an algorithmic investment strategy employing a hybrid approach that combines LSTM and ARIMA models referred to as LSTM-ARIMA. This unique algorithm uses LSTM to produc...

Statistical arbitrage in multi-pair trading strategy based on graph clustering algorithms in US equities market

The study seeks to develop an effective strategy based on the novel framework of statistical arbitrage based on graph clustering algorithms. Amalgamation of quantitative and machine learning methods...

Hedging Properties of Algorithmic Investment Strategies using Long Short-Term Memory and Time Series models for Equity Indices

This paper proposes a novel approach to hedging portfolios of risky assets when financial markets are affected by financial turmoils. We introduce a completely novel approach to diversification acti...

Mean Absolute Directional Loss as a New Loss Function for Machine Learning Problems in Algorithmic Investment Strategies

This paper investigates the issue of an adequate loss function in the optimization of machine learning models used in the forecasting of financial time series for the purpose of algorithmic investme...

Systemic risk indicator based on implied and realized volatility

We propose a new measure of systemic risk to analyze the impact of the major financial market turmoils in the stock markets from 2000 to 2023 in the USA, Europe, Brazil, and Japan. Our Implied Volat...

The Hybrid Forecast of S&P 500 Volatility ensembled from VIX, GARCH and LSTM models

Predicting the S&P 500 index volatility is crucial for investors and financial analysts as it helps assess market risk and make informed investment decisions. Volatility represents the level of uncert...

Enhancing literature review with LLM and NLP methods. Algorithmic trading case

This study utilizes machine learning algorithms to analyze and organize knowledge in the field of algorithmic trading. By filtering a dataset of 136 million research papers, we identified 14,342 relev...

Supervised Autoencoders with Fractionally Differentiated Features and Triple Barrier Labelling Enhance Predictions on Noisy Data

This paper investigates the enhancement of financial time series forecasting with the use of neural networks through supervised autoencoders (SAE), to improve investment strategy performance. Using th...

Construction and Hedging of Equity Index Options Portfolios

This research presents a comprehensive evaluation of systematic index option-writing strategies, focusing on S&P500 index options. We compare the performance of hedging strategies using the Black-Scho...

Generalized Mean Absolute Directional Loss as a Solution to Overfitting and High Transaction Costs in Machine Learning Models Used in High-Frequency Algorithmic Investment Strategies

Regardless of the selected asset class and the level of model complexity (Transformer versus LSTM versus Perceptron/RNN), the GMADL loss function produces superior results than standard MSE-type loss ...

Informer in Algorithmic Investment Strategies on High Frequency Bitcoin Data

The article investigates the usage of Informer architecture for building automated trading strategies for high frequency Bitcoin data. Three strategies using Informer model with different loss functio...

Hybrid Models for Financial Forecasting: Combining Econometric, Machine Learning, and Deep Learning Models

This research systematically develops and evaluates various hybrid modeling approaches by combining traditional econometric models (ARIMA and ARFIMA models) with machine learning and deep learning tec...

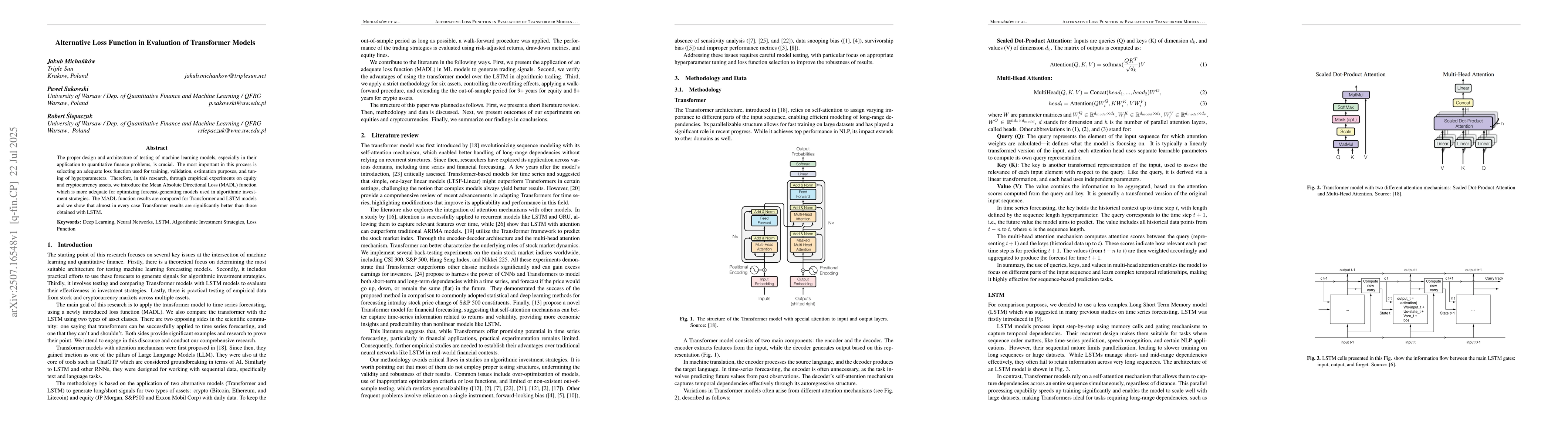

Alternative Loss Function in Evaluation of Transformer Models

The proper design and architecture of testing of machine learning models, especially in their application to quantitative finance problems, is crucial. The most important in this process is selecting ...