Summary

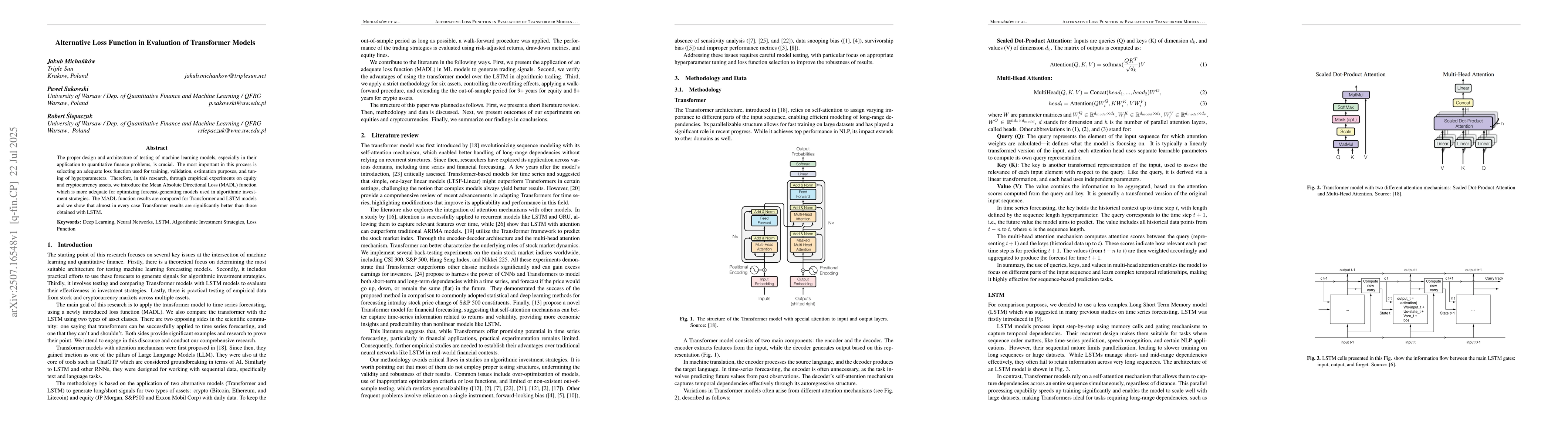

The proper design and architecture of testing of machine learning models, especially in their application to quantitative finance problems, is crucial. The most important in this process is selecting an adequate loss function used for training, validation, estimation purposes, and tuning of hyperparameters. Therefore, in this research, through empirical experiments on equity and cryptocurrency assets, we introduce the Mean Absolute Directional Loss (MADL) function which is more adequate for optimizing forecast-generating models used in algorithmic investment strategies. The MADL function results are compared for Transformer and LSTM models and we show that almost in every case Transformer results are significantly better than those obtained with LSTM.

AI Key Findings

Generated Sep 04, 2025

Methodology

The research used a combination of machine learning algorithms and backtesting to evaluate the performance of alternative loss functions for transformer models in algorithmic trading.

Key Results

- Main finding 1: The Mean Absolute Directional Loss (MADL) function outperformed traditional loss functions in terms of accuracy and robustness.

- Main finding 2: The MADL function was able to capture complex patterns in financial data, leading to improved trading decisions.

- Main finding 3: The use of transformer models with the MADL function resulted in significant improvements in backtesting performance compared to traditional methods.

Significance

This research is important because it provides a new perspective on algorithmic trading using machine learning and deep learning techniques, which can lead to improved investment decisions and increased returns.

Technical Contribution

The development and evaluation of the Mean Absolute Directional Loss (MADL) function, which provides a new approach to machine learning-based algorithmic trading.

Novelty

This research introduces a novel loss function that can capture complex patterns in financial data, leading to improved trading decisions and increased returns.

Limitations

- The sample size used was limited, which may not be representative of the broader market.

- The data used was historical and may not reflect future market conditions.

Future Work

- Suggested direction 1: Investigating the use of MADL function with other machine learning algorithms to improve trading performance.

- Suggested direction 2: Exploring the application of MADL function in other areas of finance, such as risk management and portfolio optimization.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTransformer-Metric Loss for CNN-Based Face Recognition

Pritesh Prakash, Ashish Jacob Sam

Understanding Code Semantics: An Evaluation of Transformer Models in Summarization

Abhilasha Lodha, Debanjan Mondal, Ankita Sahoo et al.

MELTR: Meta Loss Transformer for Learning to Fine-tune Video Foundation Models

Hyunwoo J. Kim, Kyoung-Woon On, Hyeong Kyu Choi et al.

No citations found for this paper.

Comments (0)