Robin Fritsch

14 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

SoK: Attacks on DAOs

Decentralized Autonomous Organizations (DAOs) are blockchain-based organizations that facilitate decentralized governance. Today, DAOs not only hold billions of dollars in their treasury but also go...

Measuring Arbitrage Losses and Profitability of AMM Liquidity

This paper presents the results of a comprehensive empirical study of losses to arbitrageurs (following the formalization of loss-versus-rebalancing by [Milionis et al., 2022]) incurred by liquidity...

Liquid Staking Tokens in Automated Market Makers

This paper studies liquid staking tokens (LSTs) on automated market makers (AMMs), both theoretically and empirically. LSTs are tokenized representations of staked assets on proof-of-stake blockchai...

Arbitrageurs' profits, LVR, and sandwich attacks: batch trading as an AMM design response

We study a novel automated market maker design: the function maximizing AMM (FM-AMM). Our central assumption is that trades are batched before execution. Because of competition between arbitrageurs,...

The Hidden Shortcomings of (D)AOs -- An Empirical Study of On-Chain Governance

Decentralized autonomous organizations (DAOs) are a recent innovation in organizational structures, which are already widely used in the blockchain ecosystem. We empirically study the on-chain gover...

The Economics of Automated Market Makers

This paper studies the question whether automated market maker protocols such as Uniswap can sustainably retain a portion of their trading fees for the protocol. We approach the problem by modelling...

Understanding the Relationship Between Core Constraints and Core-Selecting Payment Rules in Combinatorial Auctions

Combinatorial auctions (CAs) allow bidders to express complex preferences for bundles of goods being auctioned. However, the behavior of bidders under different payment rules is often unclear. In th...

Analyzing Voting Power in Decentralized Governance: Who controls DAOs?

We empirically study the state of three prominent DAO governance systems on the Ethereum blockchain: Compound, Uniswap and ENS. In particular, we examine how the voting power is distributed in these...

An Empirical Study of Market Inefficiencies in Uniswap and SushiSwap

Decentralized exchanges are revolutionizing finance. With their ever-growing increase in popularity, a natural question that begs to be asked is: how efficient are these new markets? We find that ...

The Price of Majority Support

We consider the problem of finding a compromise between the opinions of a group of individuals on a number of mutually independent, binary topics. In this paper, we quantify the loss in representati...

Concentrated Liquidity in Automated Market Makers

We examine how the introduction of concentrated liquidity has changed the liquidity provision market in automated market makers such as Uniswap. To this end, we compare average liquidity provider re...

A Note on Optimal Fees for Constant Function Market Makers

We suggest a framework to determine optimal trading fees for constant function market makers (CFMMs) in order to maximize liquidity provider returns. In a setting of multiple competing liquidity poo...

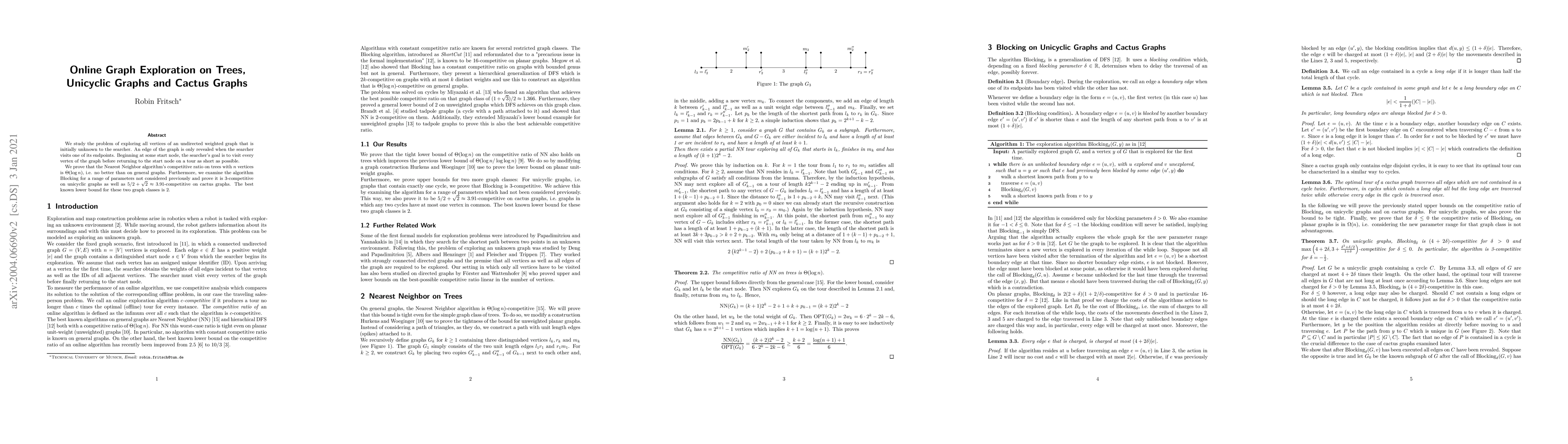

Online Graph Exploration on Trees, Unicyclic Graphs and Cactus Graphs

We study the problem of exploring all vertices of an undirected weighted graph that is initially unknown to the searcher. An edge of the graph is only revealed when the searcher visits one of its en...

MEV Capture Through Time-Advantaged Arbitrage

As blockchains begin processing significant economic activity, the ability to include and order transactions inevitably becomes highly valuable, a concept known as Maximal Extractable Value (MEV). Thi...