Authors

Summary

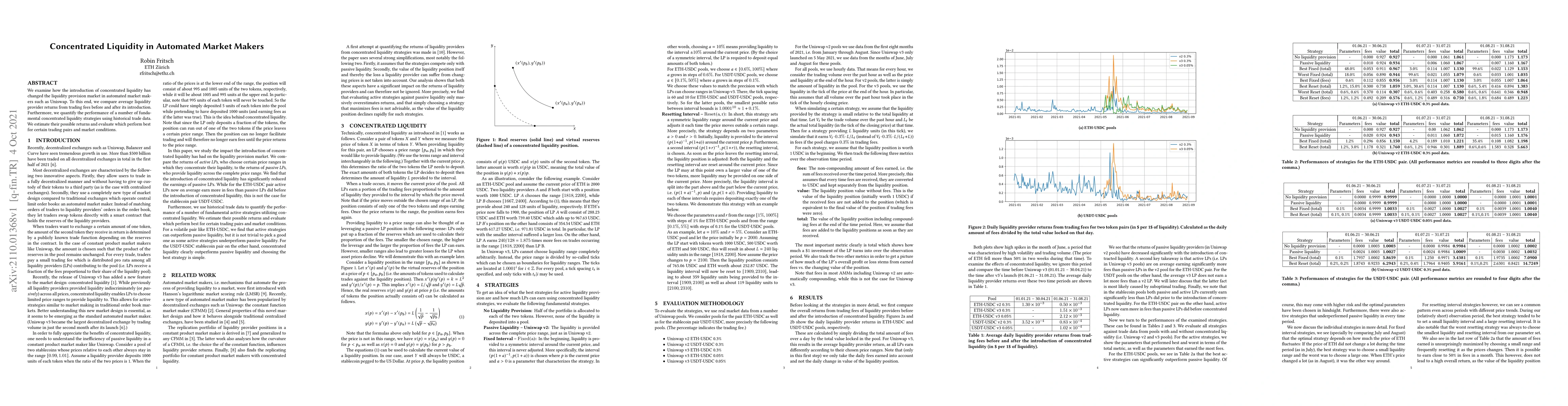

We examine how the introduction of concentrated liquidity has changed the liquidity provision market in automated market makers such as Uniswap. To this end, we compare average liquidity provider returns from trading fees before and after its introduction. Furthermore, we quantify the performance of a number of fundamental concentrated liquidity strategies using historical trade data. We estimate their possible returns and evaluate which perform best for certain trading pairs and market conditions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDelta Hedging Liquidity Positions on Automated Market Makers

Xi Chen, Adam Khakhar

Game Theoretic Liquidity Provisioning in Concentrated Liquidity Market Makers

Giulia Fanti, Weizhao Tang, Rachid El-Azouzi et al.

Liquidity Pool Design on Automated Market Makers

Chen Yang, Xue Dong He, Yutian Zhou

Backtesting Framework for Concentrated Liquidity Market Makers on Uniswap V3 Decentralized Exchange

Andrey Urusov, Rostislav Berezovskiy, Yury Yanovich

| Title | Authors | Year | Actions |

|---|

Comments (0)