Stefan Lessmann

20 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

Leveraging Zero-Shot Prompting for Efficient Language Model Distillation

This paper introduces a novel approach for efficiently distilling LLMs into smaller, application-specific models, significantly reducing operational costs and manual labor. Addressing the challenge ...

Heteroscedasticity-aware stratified sampling to improve uplift modeling

In many business applications, including online marketing and customer churn prevention, randomized controlled trials (RCT's) are conducted to investigate on the effect of specific treatment (coupon...

The impact of heteroskedasticity on uplift modeling

There are various applications, where companies need to decide to which individuals they should best allocate treatment. To support such decisions, uplift models are applied to predict treatment eff...

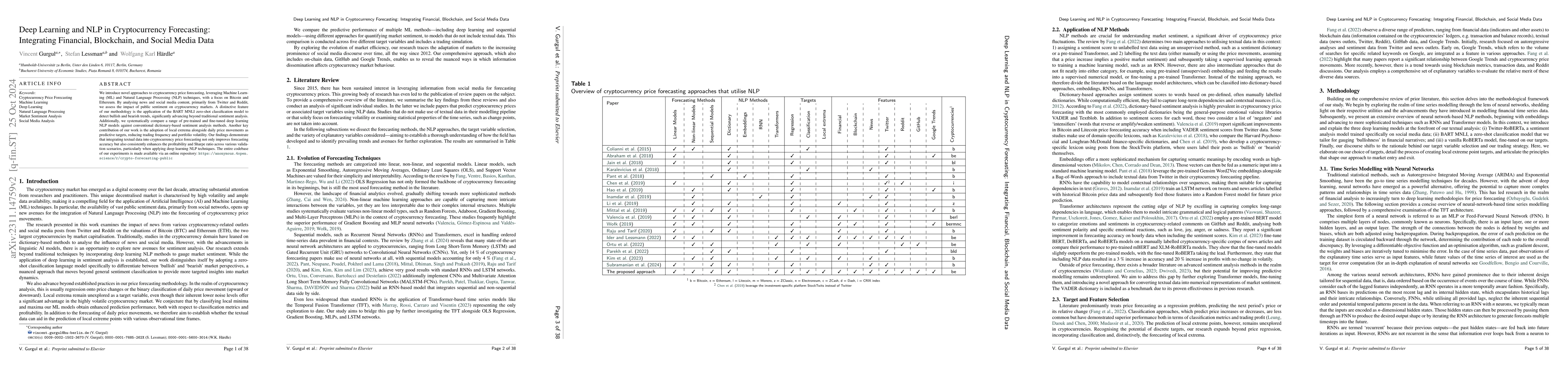

Forecasting Cryptocurrency Prices Using Deep Learning: Integrating Financial, Blockchain, and Text Data

This paper explores the application of Machine Learning (ML) and Natural Language Processing (NLP) techniques in cryptocurrency price forecasting, specifically Bitcoin (BTC) and Ethereum (ETH). Focu...

Fair Models in Credit: Intersectional Discrimination and the Amplification of Inequity

The increasing usage of new data sources and machine learning (ML) technology in credit modeling raises concerns with regards to potentially unfair decision-making that rely on protected characteris...

Multimodal Document Analytics for Banking Process Automation

Traditional banks face increasing competition from FinTechs in the rapidly evolving financial ecosystem. Raising operational efficiency is vital to address this challenge. Our study aims to improve ...

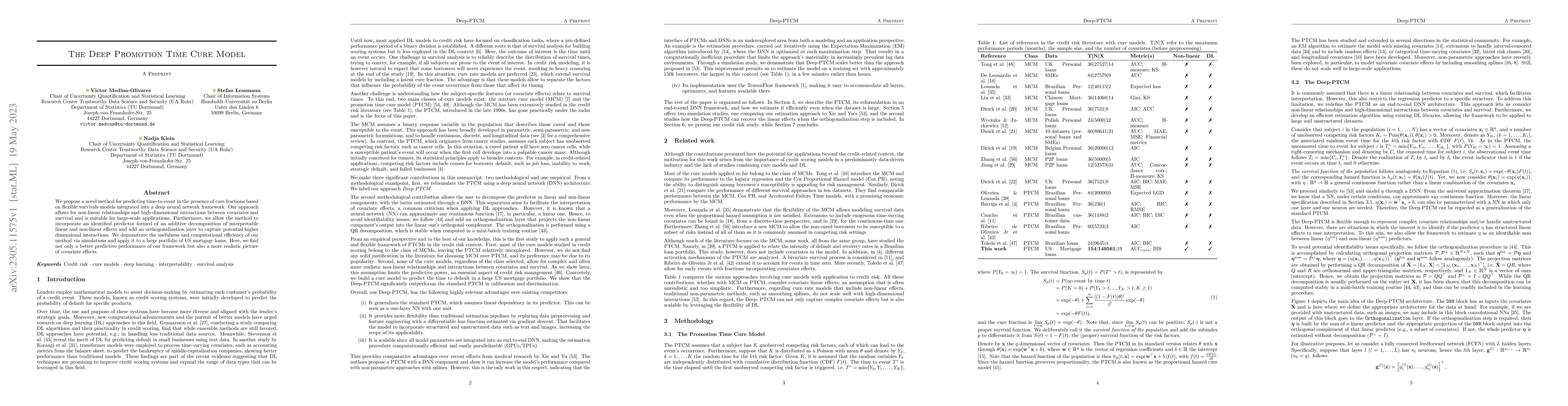

The Deep Promotion Time Cure Model

We propose a novel method for predicting time-to-event in the presence of cure fractions based on flexible survivals models integrated into a deep neural network framework. Our approach allows for n...

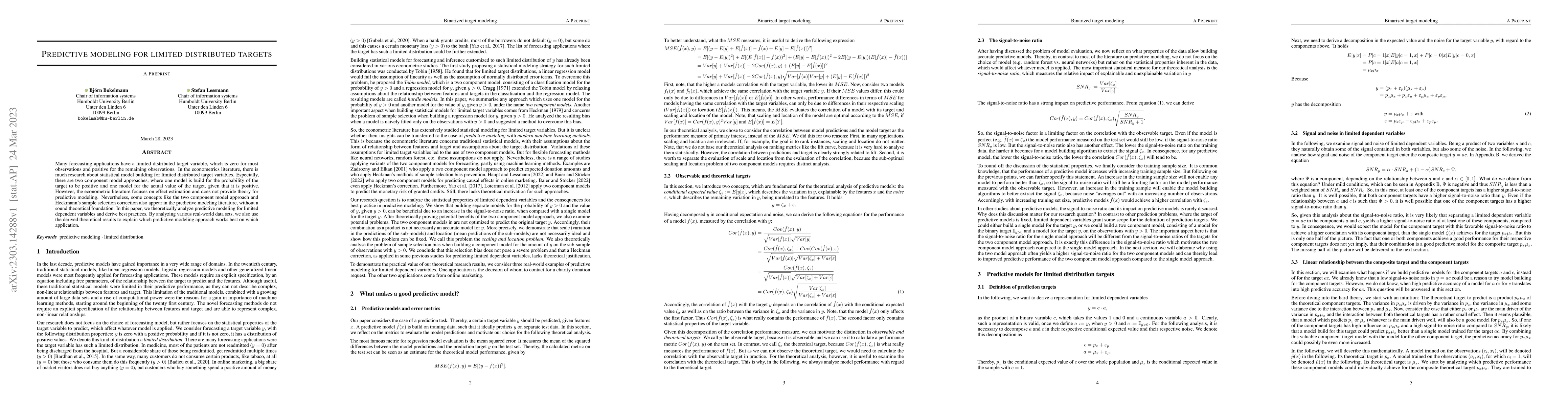

Predictive modeling for limited distributed targets

Many forecasting applications have a limited distributed target variable, which is zero for most observations and positive for the remaining observations. In the econometrics literature, there is mu...

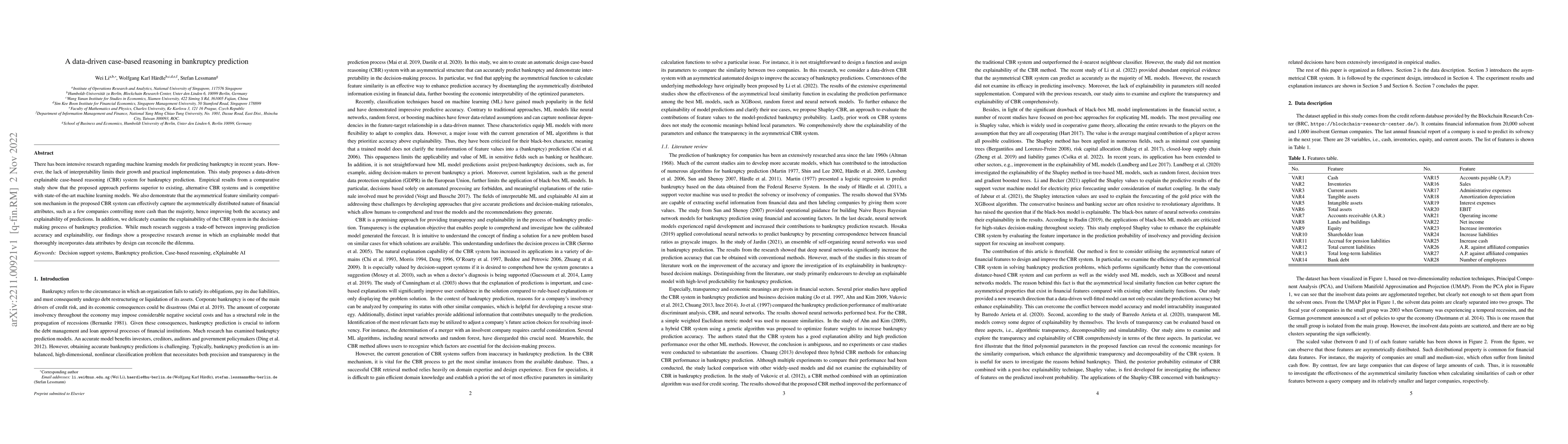

A Data-driven Case-based Reasoning in Bankruptcy Prediction

There has been intensive research regarding machine learning models for predicting bankruptcy in recent years. However, the lack of interpretability limits their growth and practical implementation....

Improving uplift model evaluation on RCT data

Estimating treatment effects is one of the most challenging and important tasks of data analysts. In many applications, like online marketing and personalized medicine, treatment needs to be allocat...

Forecasting Cryptocurrency Returns from Sentiment Signals: An Analysis of BERT Classifiers and Weak Supervision

Anticipating price developments in financial markets is a topic of continued interest in forecasting. Funneled by advancements in deep learning and natural language processing (NLP) together with th...

Leveraging Image-based Generative Adversarial Networks for Time Series Generation

Generative models for images have gained significant attention in computer vision and natural language processing due to their ability to generate realistic samples from complex data distributions. ...

Modeling Irregular Time Series with Continuous Recurrent Units

Recurrent neural networks (RNNs) are a popular choice for modeling sequential data. Modern RNN architectures assume constant time-intervals between observations. However, in many datasets (e.g. medi...

Fairness in Credit Scoring: Assessment, Implementation and Profit Implications

The rise of algorithmic decision-making has spawned much research on fair machine learning (ML). Financial institutions use ML for building risk scorecards that support a range of credit-related dec...

Fighting Sampling Bias: A Framework for Training and Evaluating Credit Scoring Models

Scoring models support decision-making in financial institutions. Their estimation and evaluation are based on the data of previously accepted applicants with known repayment behavior. This creates sa...

How much do we really know about Structure Learning from i.i.d. Data? Interpretable, multi-dimensional Performance Indicator for Causal Discovery

Nonlinear causal discovery from observational data imposes strict identifiability assumptions on the formulation of structural equations utilized in the data generating process. The evaluation of stru...

Energy Price Modelling: A Comparative Evaluation of four Generations of Forecasting Methods

Energy is a critical driver of modern economic systems. Accurate energy price forecasting plays an important role in supporting decision-making at various levels, from operational purchasing decisions...

Leveraging AI and NLP for Bank Marketing: A Systematic Review and Gap Analysis

This paper explores the growing impact of AI and NLP in bank marketing, highlighting their evolving roles in enhancing marketing strategies, improving customer engagement, and creating value within th...

Uplift modeling with continuous treatments: A predict-then-optimize approach

The goal of uplift modeling is to recommend actions that optimize specific outcomes by determining which entities should receive treatment. One common approach involves two steps: first, an inference ...

Causality analysis of electricity market liberalization on electricity price using novel Machine Learning methods

Relationships between the energy and the finance markets are increasingly important. Understanding these relationships is vital for policymakers and other stakeholders as the world faces challenges su...