Summary

There has been intensive research regarding machine learning models for predicting bankruptcy in recent years. However, the lack of interpretability limits their growth and practical implementation. This study proposes a data-driven explainable case-based reasoning (CBR) system for bankruptcy prediction. Empirical results from a comparative study show that the proposed approach performs superior to existing, alternative CBR systems and is competitive with state-of-the-art machine learning models. We also demonstrate that the asymmetrical feature similarity comparison mechanism in the proposed CBR system can effectively capture the asymmetrically distributed nature of financial attributes, such as a few companies controlling more cash than the majority, hence improving both the accuracy and explainability of predictions. In addition, we delicately examine the explainability of the CBR system in the decision-making process of bankruptcy prediction. While much research suggests a trade-off between improving prediction accuracy and explainability, our findings show a prospective research avenue in which an explainable model that thoroughly incorporates data attributes by design can reconcile the dilemma.

AI Key Findings

Generated Sep 03, 2025

Methodology

This study proposes a data-driven explainable case-based reasoning (CBR) system for bankruptcy prediction, utilizing an asymmetrical feature similarity comparison mechanism to capture the asymmetric distribution of financial attributes.

Key Results

- The proposed CBR system outperforms existing CBR systems and is competitive with state-of-the-art machine learning models in bankruptcy prediction.

- The asymmetrical similarity function effectively captures the asymmetrically distributed nature of financial attributes, improving both the accuracy and explainability of predictions.

Significance

The research is significant as it presents an explainable model that reconciles the trade-off between prediction accuracy and explainability, which is crucial for stakeholders, decision-makers, and investors in understanding bankruptcy-related decisions.

Technical Contribution

The paper introduces an asymmetrical polynomial local similarity function in CBR systems, which enhances prediction accuracy and better reflects practical economic meanings in comparing similar companies.

Novelty

The research presents a novel approach to bankruptcy prediction by integrating an explainable CBR system that automatically optimizes similarity calculation parameters, distinguishing itself from traditional CBR and black-box machine learning methods.

Limitations

- The paper does not discuss potential limitations or challenges encountered during the research.

- No explicit mention of any assumptions made in the study.

Future Work

- Explore a general way to detect optimal feature weights for the CBR system.

- Investigate the maintenance and effectiveness of the CBR system in supporting bankruptcy-related decisions.

Paper Details

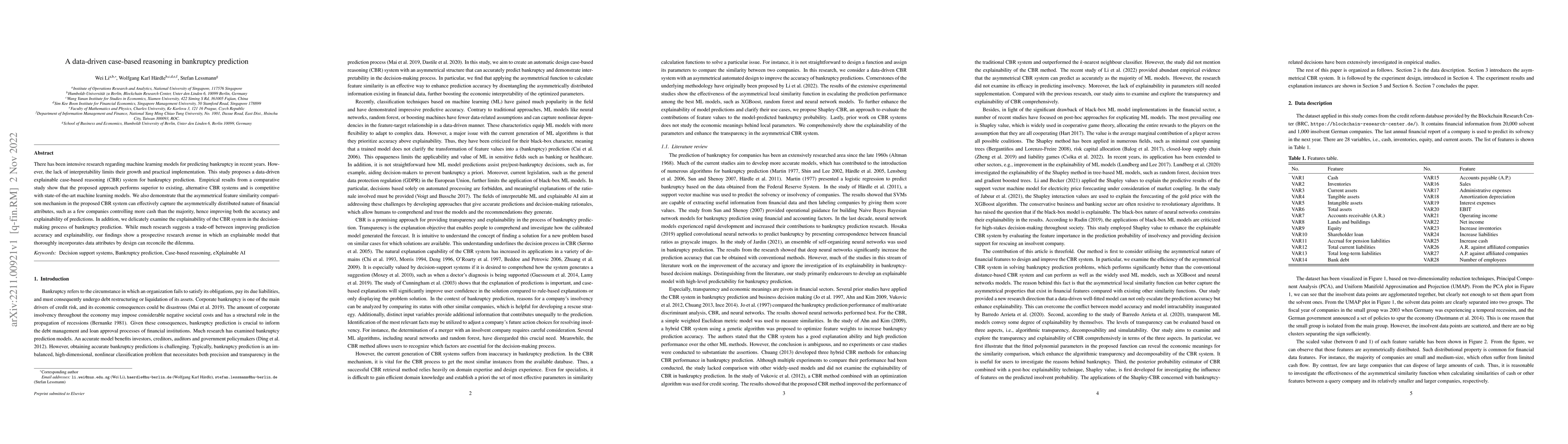

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMissing Data Imputation With Granular Semantics and AI-driven Pipeline for Bankruptcy Prediction

Ravi Ranjan, Debarati Chakraborty

Multimodal Generative Models for Bankruptcy Prediction Using Textual Data

Kjersti Aas, Rogelio A. Mancisidor

Datasets for Advanced Bankruptcy Prediction: A survey and Taxonomy

Xinlin Wang, Mats Brorsson, Zsófia Kräussl

| Title | Authors | Year | Actions |

|---|

Comments (0)