Authors

Summary

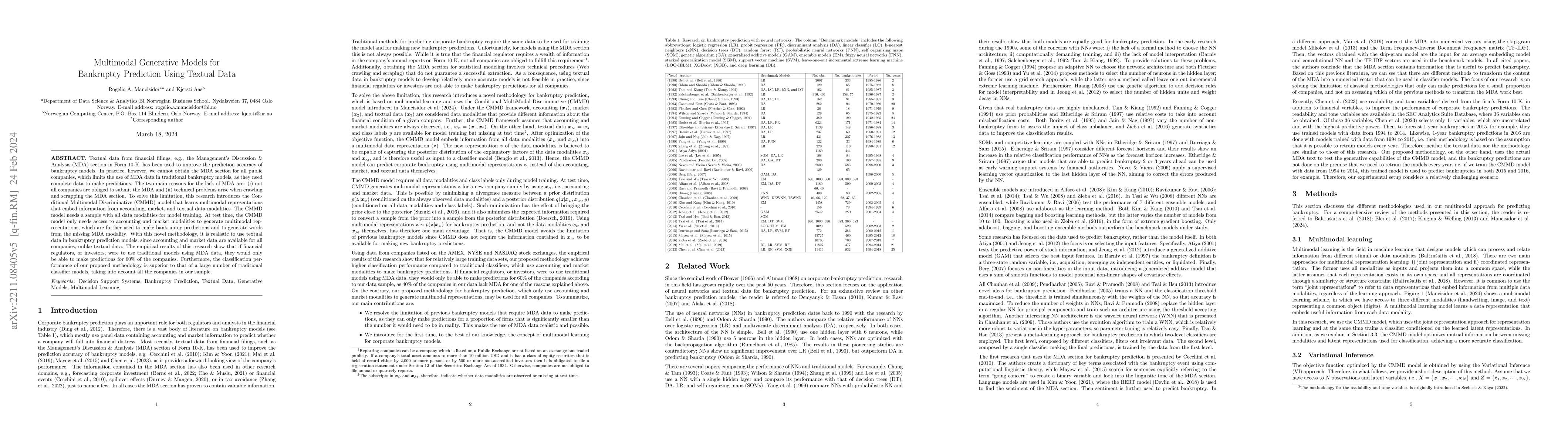

Textual data from financial filings, e.g., the Management's Discussion & Analysis (MDA) section in Form 10-K, has been used to improve the prediction accuracy of bankruptcy models. In practice, however, we cannot obtain the MDA section for all public companies, which limits the use of MDA data in traditional bankruptcy models, as they need complete data to make predictions. The two main reasons for the lack of MDA are: (i) not all companies are obliged to submit the MDA and (ii) technical problems arise when crawling and scrapping the MDA section. To solve this limitation, this research introduces the Conditional Multimodal Discriminative (CMMD) model that learns multimodal representations that embed information from accounting, market, and textual data modalities. The CMMD model needs a sample with all data modalities for model training. At test time, the CMMD model only needs access to accounting and market modalities to generate multimodal representations, which are further used to make bankruptcy predictions and to generate words from the missing MDA modality. With this novel methodology, it is realistic to use textual data in bankruptcy prediction models, since accounting and market data are available for all companies, unlike textual data. The empirical results of this research show that if financial regulators, or investors, were to use traditional models using MDA data, they would only be able to make predictions for 60% of the companies. Furthermore, the classification performance of our proposed methodology is superior to that of a large number of traditional classifier models, taking into account all the companies in our sample.

AI Key Findings

Generated Sep 03, 2025

Methodology

This research introduces the Conditional Multimodal Discriminative (CMMD) model, which learns multimodal representations that embed information from accounting, market, and textual data modalities. The CMMD model requires complete data for training but can make predictions using only accounting and market data at test time, generating the missing textual data.

Key Results

- The CMMD model outperforms a large number of traditional classifier models in bankruptcy prediction, considering all companies in the sample.

- Traditional models using MDA data can only make predictions for 60% of companies, as many lack the MDA section.

- The CMMD model can generate words from the missing MDA data that belong to financial tone dictionaries used in previous literature.

- SHAP values allow for interpreting bankruptcy predictions made by the CMMD model.

Significance

This research is significant as it addresses the limitation of traditional bankruptcy models that rely on complete MDA data, which is unavailable for 40% of companies in the sample. The CMMD model's ability to generate textual data from accounting and market data makes it a more comprehensive and practical solution for bankruptcy prediction.

Technical Contribution

The Conditional Multimodal Discriminative (CMMD) model, which combines accounting, market, and textual data for bankruptcy prediction, is the main technical contribution of this research.

Novelty

This research introduces multimodal learning to bankruptcy prediction models for the first time, combining accounting, market, and textual data to improve prediction accuracy and address the limitation of missing MDA data.

Limitations

- The study's findings are based on a specific dataset of publicly traded firms in NYSE, NASDAQ, and AMEX stock exchanges from 1994 to 2020.

- The model's performance might vary when applied to different datasets or industries.

Future Work

- Investigating the model's performance on datasets from different geographical regions or industries.

- Exploring the application of the CMMD model for other financial forecasting tasks.

- Enhancing the model to handle more diverse textual data sources.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNext-Year Bankruptcy Prediction from Textual Data: Benchmark and Baselines

Thomas Demeester, Henri Arno, Klaas Mulier et al.

From Numbers to Words: Multi-Modal Bankruptcy Prediction Using the ECL Dataset

Thomas Demeester, Henri Arno, Klaas Mulier et al.

No citations found for this paper.

Comments (0)