Summary

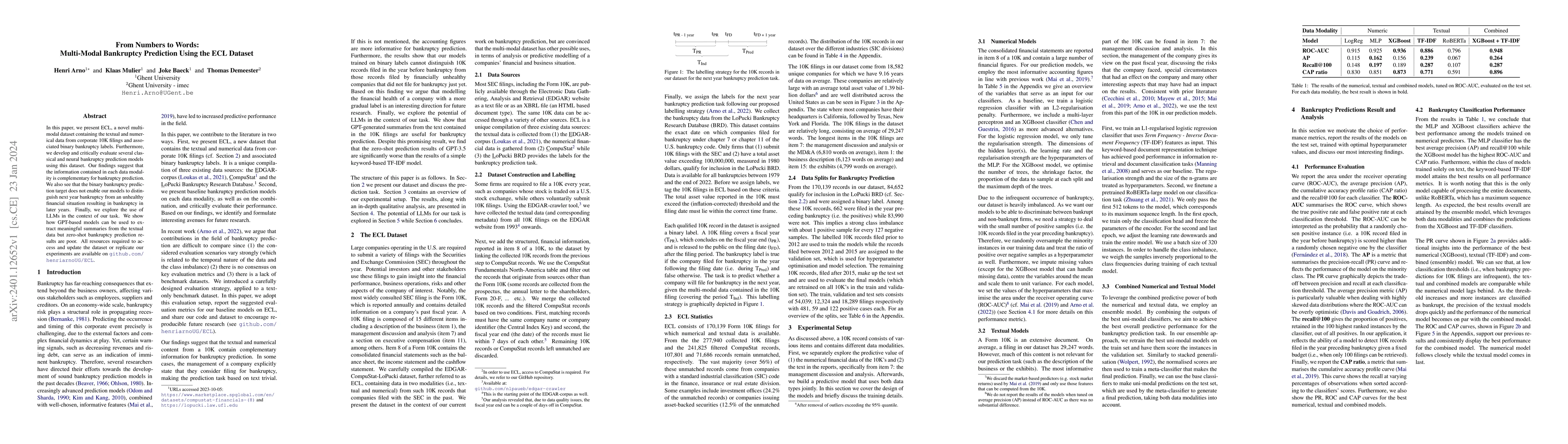

In this paper, we present ECL, a novel multi-modal dataset containing the textual and numerical data from corporate 10K filings and associated binary bankruptcy labels. Furthermore, we develop and critically evaluate several classical and neural bankruptcy prediction models using this dataset. Our findings suggest that the information contained in each data modality is complementary for bankruptcy prediction. We also see that the binary bankruptcy prediction target does not enable our models to distinguish next year bankruptcy from an unhealthy financial situation resulting in bankruptcy in later years. Finally, we explore the use of LLMs in the context of our task. We show how GPT-based models can be used to extract meaningful summaries from the textual data but zero-shot bankruptcy prediction results are poor. All resources required to access and update the dataset or replicate our experiments are available on github.com/henriarnoUG/ECL.

AI Key Findings

Generated Sep 03, 2025

Methodology

The paper presents ECL, a multi-modal dataset combining textual and numerical data from corporate 10K filings with binary bankruptcy labels. It develops and evaluates classical and neural bankruptcy prediction models using this dataset.

Key Results

- The information in each data modality (numerical and textual) is complementary for bankruptcy prediction.

- Models struggle to distinguish between next-year bankruptcy and unhealthy financial situations leading to bankruptcy in later years.

- An ensemble model combining the best unimodal classifiers (XGBoost for numerical data and TF-IDF for textual data) achieves the best overall predictive performance.

- GPT-based models can extract meaningful summaries from textual data, but zero-shot bankruptcy prediction results are poor.

Significance

This research contributes to the field by providing a comprehensive multi-modal dataset and evaluating various bankruptcy prediction models, highlighting the importance of combining different data modalities for improved accuracy in financial health assessments.

Technical Contribution

ECL dataset and the development of an ensemble model combining numerical (XGBoost) and textual (TF-IDF) predictors for bankruptcy prediction.

Novelty

The paper introduces a novel multi-modal dataset (ECL) and demonstrates the complementary value of numerical and textual data in bankruptcy prediction, alongside exploring the potential and limitations of LLMs in financial text summarization and zero-shot prediction.

Limitations

- The dataset is imbalanced, with a small portion of 10K records filed in the year before bankruptcy.

- Models trained on binary bankruptcy labels cannot differentiate between 10K records filed the year before bankruptcy and those filed by financially unhealthy companies close to bankruptcy.

- Zero-shot bankruptcy prediction using LLMs like GPT-3.5 yields poor results.

Future Work

- Investigating more fine-grained prediction targets for modeling financial health.

- Improving LLMs' performance in zero-shot bankruptcy prediction tasks.

- Exploring additional financial text summarization techniques to enhance model accuracy.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMultimodal Generative Models for Bankruptcy Prediction Using Textual Data

Kjersti Aas, Rogelio A. Mancisidor

Augmenting Bankruptcy Prediction using Reported Behavior of Corporate Restructuring

Xinlin Wang, Mats Brorsson

AntM$^{2}$C: A Large Scale Dataset For Multi-Scenario Multi-Modal CTR Prediction

Ang Li, Jun Zhou, Liang Zhang et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)