Kjersti Aas

7 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

A Comparative Study of Methods for Estimating Conditional Shapley Values and When to Use Them

Shapley values originated in cooperative game theory but are extensively used today as a model-agnostic explanation framework to explain predictions made by complex machine learning models in the in...

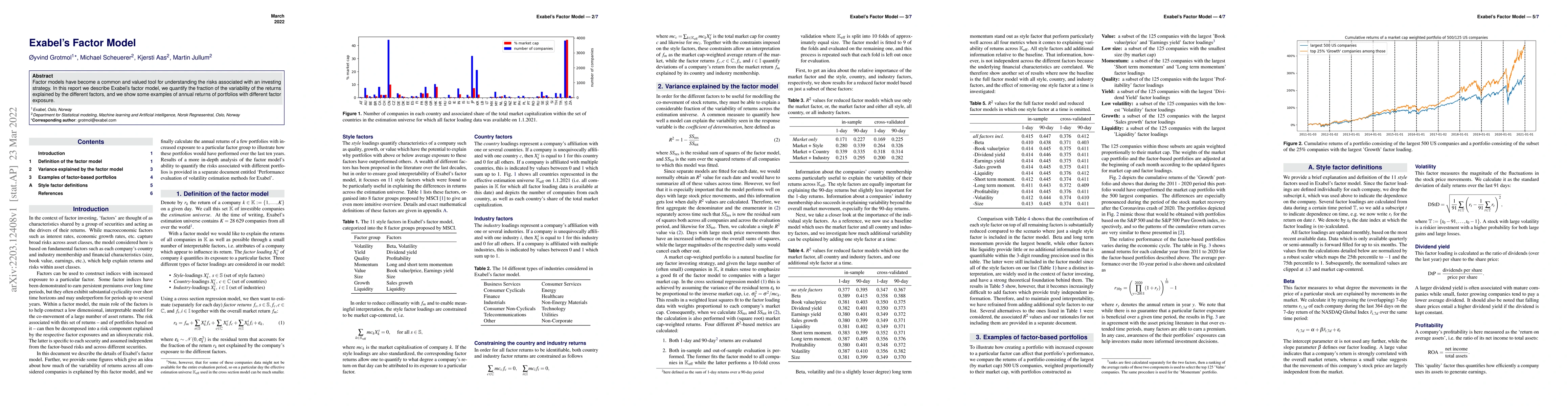

Multimodal Generative Models for Bankruptcy Prediction Using Textual Data

Textual data from financial filings, e.g., the Management's Discussion & Analysis (MDA) section in Form 10-K, has been used to improve the prediction accuracy of bankruptcy models. In practice, howe...

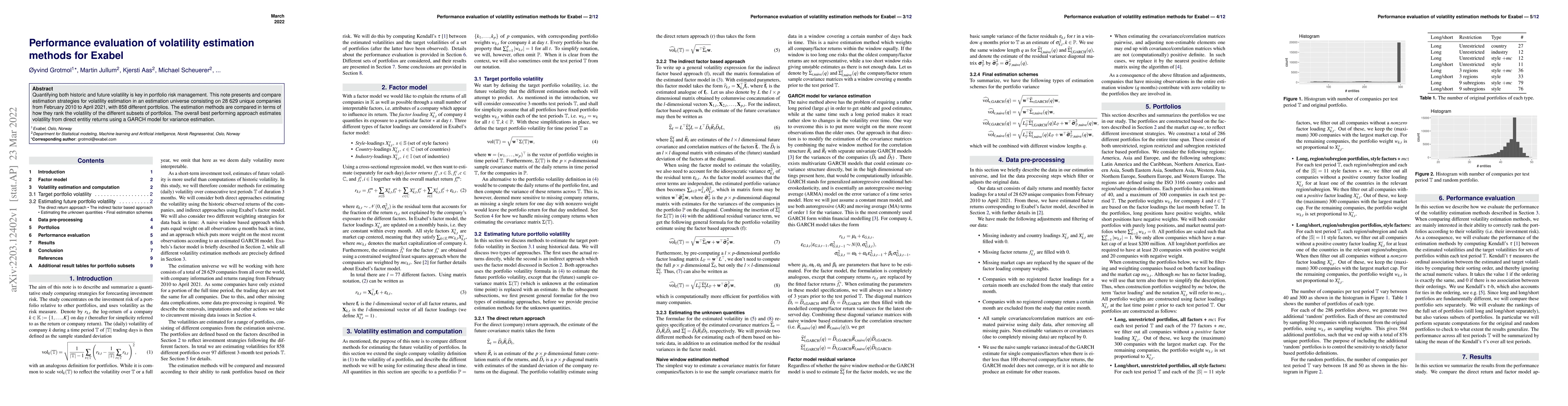

Exabel's Factor Model

Factor models have become a common and valued tool for understanding the risks associated with an investing strategy. In this report we describe Exabel's factor model, we quantify the fraction of th...

Performance evaluation of volatility estimation methods for Exabel

Quantifying both historic and future volatility is key in portfolio risk management. This note presents and compares estimation strategies for volatility estimation in an estimation universe consist...

Using Shapley Values and Variational Autoencoders to Explain Predictive Models with Dependent Mixed Features

Shapley values are today extensively used as a model-agnostic explanation framework to explain complex predictive machine learning models. Shapley values have desirable theoretical properties and a ...

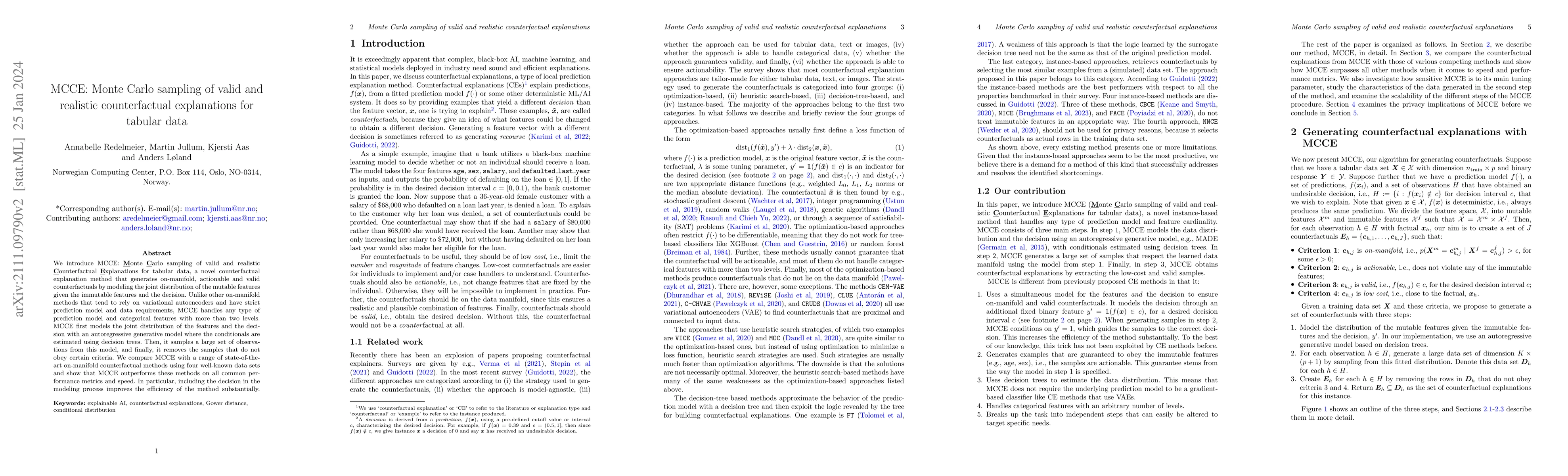

MCCE: Monte Carlo sampling of realistic counterfactual explanations

We introduce MCCE: Monte Carlo sampling of valid and realistic Counterfactual Explanations for tabular data, a novel counterfactual explanation method that generates on-manifold, actionable and vali...

Discriminative Multimodal Learning via Conditional Priors in Generative Models

Deep generative models with latent variables have been used lately to learn joint representations and generative processes from multi-modal data. These two learning mechanisms can, however, conflict...