Summary

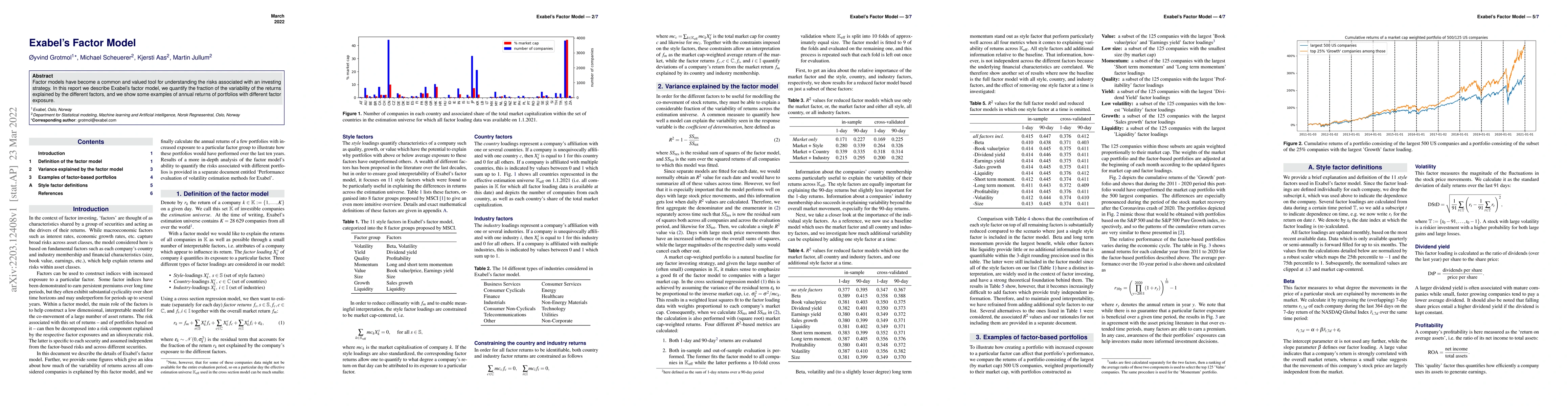

Factor models have become a common and valued tool for understanding the risks associated with an investing strategy. In this report we describe Exabel's factor model, we quantify the fraction of the variability of the returns explained by the different factors, and we show some examples of annual returns of portfolios with different factor exposure.

AI Key Findings

Generated Sep 06, 2025

Methodology

The research employed a factor model to analyze the returns of various portfolios.

Key Results

- The fraction of variability in returns explained by each factor was calculated.

- Annual returns for portfolios with different factor exposure were presented.

- The results showed that certain factors had a significant impact on portfolio performance.

Significance

This research is important as it provides insights into the risks associated with investing strategies using factor models.

Technical Contribution

The research contributed to the development of Exabel's factor model, which can be used to analyze and optimize investment portfolios.

Novelty

This work presents a novel approach to understanding the risks associated with investing strategies using factor models, providing new insights for investors and portfolio managers.

Limitations

- The model's performance was evaluated only on historical data.

- The results may not generalize to other market conditions or time periods.

Future Work

- Further analysis of the factors' impact on portfolio risk and return is suggested.

- Exploring the use of factor models in other asset classes or investment strategies is recommended.

- Developing a more comprehensive model that incorporates multiple factors and risk management techniques

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)