Authors

Summary

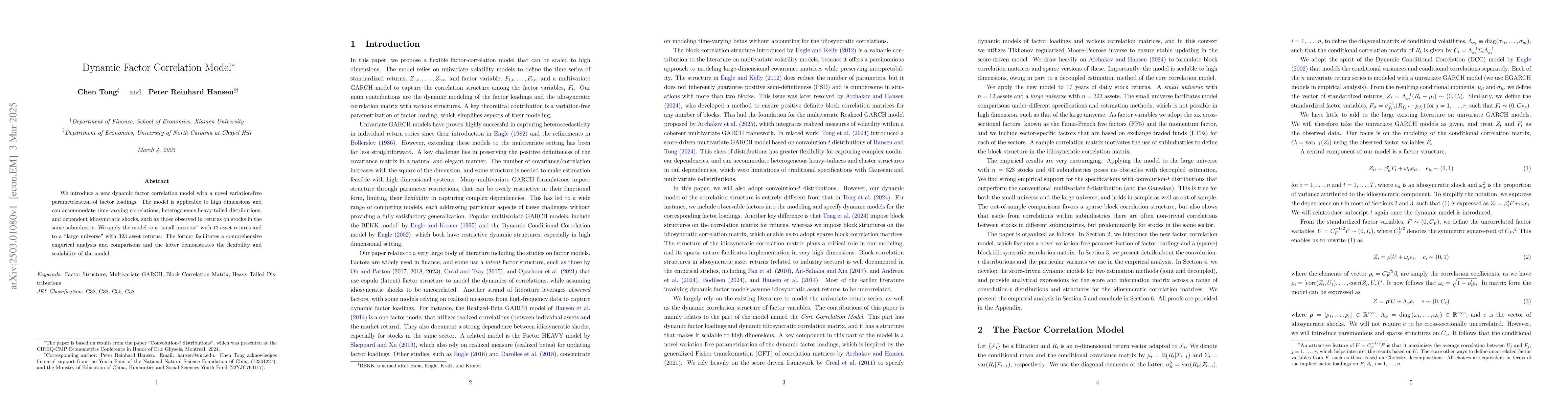

We introduce a new dynamic factor correlation model with a novel variation-free parametrization of factor loadings. The model is applicable to high dimensions and can accommodate time-varying correlations, heterogeneous heavy-tailed distributions, and dependent idiosyncratic shocks, such as those observed in returns on stocks in the same subindustry. We apply the model to a "small universe" with 12 asset returns and to a "large universe" with 323 asset returns. The former facilitates a comprehensive empirical analysis and comparisons and the latter demonstrates the flexibility and scalability of the model.

AI Key Findings

Generated Jun 10, 2025

Methodology

The research introduces a dynamic factor correlation model with a novel variation-free parametrization of factor loadings, applicable to high dimensions, accommodating time-varying correlations, heterogeneous heavy-tailed distributions, and dependent idiosyncratic shocks.

Key Results

- The model demonstrates flexibility and scalability by being applied to both a 'small universe' with 12 asset returns and a 'large universe' with 323 asset returns.

- Empirical analysis shows that the sparse block correlation structure for the idiosyncratic correlation matrix (Ce) tends to have the best out-of-sample performance, followed by the block correlation structure.

- The convolution-t (CT) distribution with a block structure consistently outperforms other distributions in both in-sample and out-of-sample results.

- Strong evidence for time variation in factor loadings is found, explaining dynamic shifts in asset return dependencies.

- Nontrivial correlations between idiosyncratic shocks are primarily found between stocks in the same sector, supporting the sparse block correlation matrix structure.

Significance

This research is significant as it proposes a novel dynamic factor correlation model capable of handling high-dimensional data with time-varying correlations and heavy-tailed distributions, which is crucial for modern financial econometrics.

Technical Contribution

The paper presents a novel dynamic factor correlation model with a variation-free parametrization of factor loadings, allowing for efficient estimation of high-dimensional time-varying correlation structures with dependent idiosyncratic shocks.

Novelty

The model's novelty lies in its ability to handle high-dimensional data, accommodate time-varying correlations, and manage heavy-tailed distributions and dependent idiosyncratic shocks, all within a single framework using a sparse block correlation structure.

Limitations

- The model's performance might be limited in low-dimensional settings when using the multivariate t distribution due to its complexity in estimating non-linear dependencies across sub-industries.

- The empirical application is based on S&P 500 data, which might limit the generalizability to other asset classes or markets.

Future Work

- Exploring the model's applicability to other asset classes beyond equities.

- Investigating the model's performance with different data frequencies, such as intraday or monthly data.

- Expanding the analysis to include more diverse factor specifications and distributions.

Paper Details

PDF Preview

Similar Papers

Found 4 papersCorrelation networks, dynamic factor models and community detection

Dhruv Patel, Shankar Bhamidi, Vladas Pipiras et al.

CP Factor Model for Dynamic Tensors

Yuefeng Han, Dan Yang, Cun-Hui Zhang et al.

No citations found for this paper.

Comments (0)