Stefan Mittnik

4 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

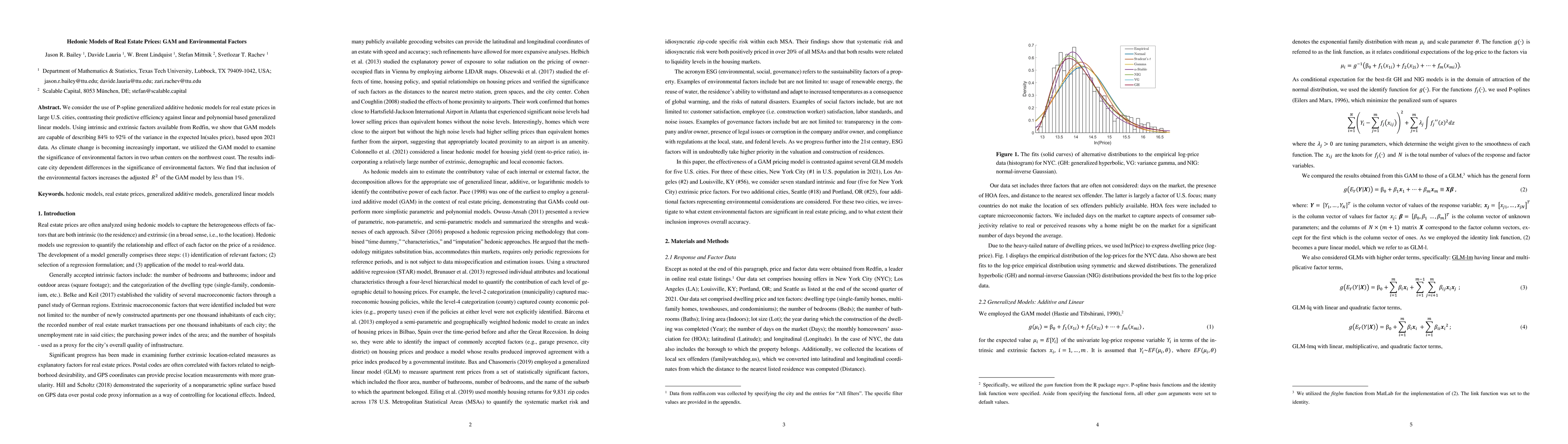

Hedonic Models of Real Estate Prices: GAM and Environmental Factors

We consider the use of P-spline generalized additive hedonic models for real estate prices in large U.S. cities, contrasting their predictive efficiency against linear and polynomial based generaliz...

ESG-Valued Portfolio Optimization and Dynamic Asset Pricing

ESG ratings provide a quantitative measure for socially responsible investment. We present a unified framework for incorporating numeric ESG ratings into dynamic pricing theory. Specifically, we int...

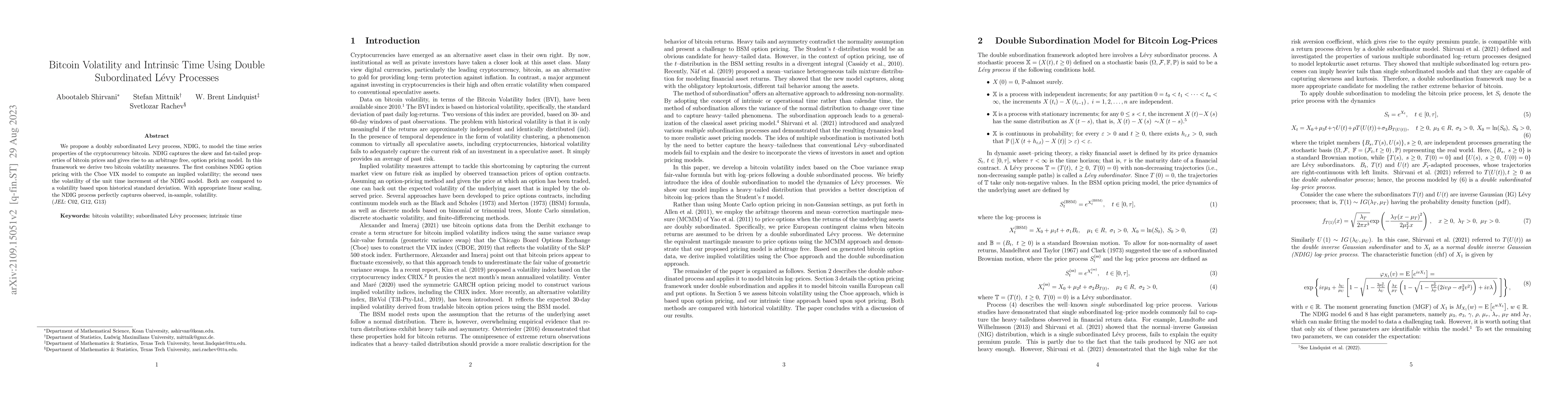

Bitcoin Volatility and Intrinsic Time Using Double Subordinated Levy Processes

We propose a doubly subordinated Levy process, NDIG, to model the time series properties of the cryptocurrency bitcoin. NDIG captures the skew and fat-tailed properties of bitcoin prices and gives r...

Portfolio Optimization on Multivariate Regime Switching GARCH Model with Normal Tempered Stable Innovation

This paper uses simulation-based portfolio optimization to mitigate the left tail risk of the portfolio. The contribution is twofold. (i) We propose the Markov regime-switching GARCH model with mult...