Summary

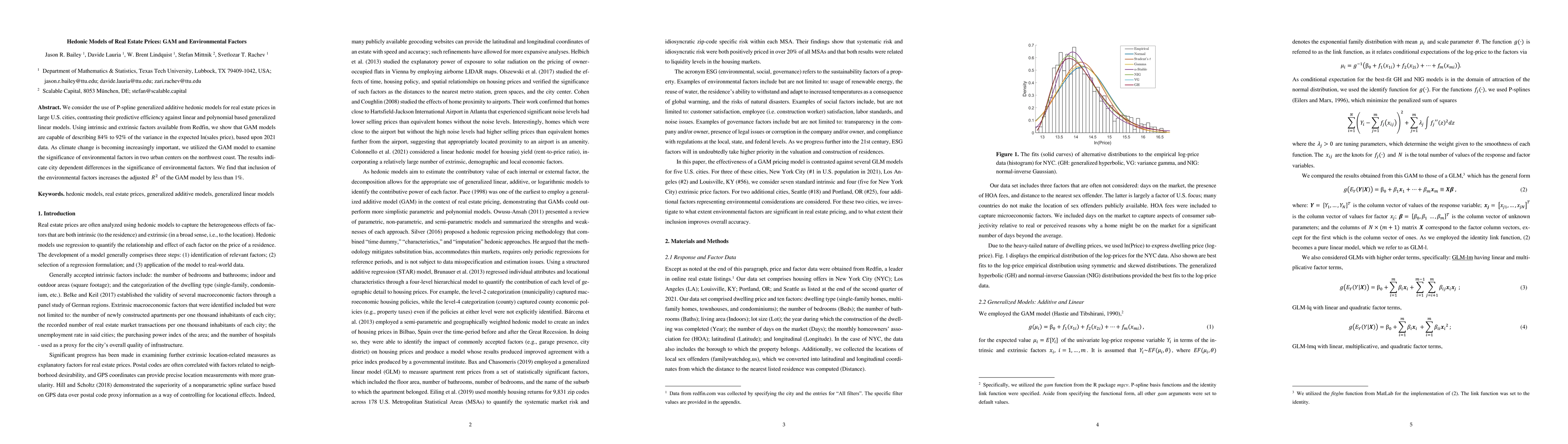

We consider the use of P-spline generalized additive hedonic models for real estate prices in large U.S. cities, contrasting their predictive efficiency against linear and polynomial based generalized linear models. Using intrinsic and extrinsic factors available from Redfin, we show that GAM models are capable of describing 84% to 92% of the variance in the expected ln(sales price), based upon 2021 data. As climate change is becoming increasingly important, we utilized the GAM model to examine the significance of environmental factors in two urban centers on the northwest coast. The results indicate city dependent differences in the significance of environmental factors. We find that inclusion of the environmental factors increases the adjusted R-squared of the GAM model by less than one percent.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersHedonic Models Incorporating ESG Factors for Time Series of Average Annual Home Prices

W. Brent Lindquist, Svetlozar T. Rachev, Jason R. Bailey

No citations found for this paper.

Comments (0)