Sven Karbach

8 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

Finite-rank approximation of affine processes on positive Hilbert-Schmidt operators

In this article, we present a method for approximating affine processes on the cone of positive Hilbert-Schmidt operators using matrix-valued affine processes. By leveraging results from the theory ...

Multivariate continuous-time autoregressive moving-average processes on cones

In this article we study multivariate continuous-time autoregressive moving-average (MCARMA) processes with values in convex cones. More specifically, we introduce matrix-valued MCARMA processes wit...

Stationary Covariance Regime for Affine Stochastic Covariance Models in Hilbert Spaces

We study the long-time behavior of affine processes on positive self-adjoiont Hilbert-Schmidt operators which are of pure-jump type, conservative and have finite second moment. For subcritical proce...

Affine pure-jump processes on positive Hilbert-Schmidt operators

We show the existence of a broad class of affine Markov processes in the cone of positive self-adjoint Hilbert-Schmidt operators. Such processes are well-suited as infinite dimensional stochastic vo...

Heat modulated affine stochastic volatility models for forward curve dynamics

We present a function-valued stochastic volatility model designed to capture the continuous-time evolution of forward curves in fixed-income or commodity markets. The dynamics of the (logarithmic) for...

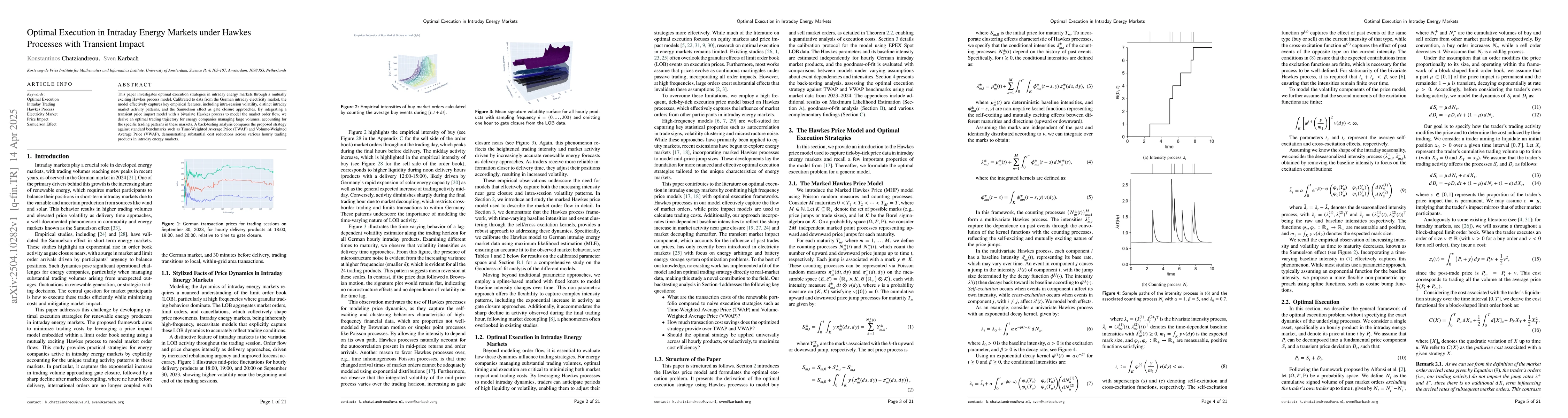

Optimal Execution in Intraday Energy Markets under Hawkes Processes with Transient Impact

This paper investigates optimal execution strategies in intraday energy markets through a mutually exciting Hawkes process model. Calibrated to data from the German intraday electricity market, the mo...

Measure-Valued CARMA Processes

In this paper, we examine continuous-time autoregressive moving-average (CARMA) processes on Banach spaces driven by L\'evy subordinators. We show their existence and cone-invariance, investigate thei...

Pricing Options on Forwards in Function-Valued Affine Stochastic Volatility Models

We study the pricing of European-style options written on forward contracts within function-valued infinite-dimensional affine stochastic volatility models. The dynamics of the underlying forward pric...