Authors

Summary

We study the long-time behavior of affine processes on positive self-adjoiont Hilbert-Schmidt operators which are of pure-jump type, conservative and have finite second moment. For subcritical processes we prove the existence of a unique limit distribution and construct the corresponding stationary affine process. Moreover, we obtain an explicit convergence rate of the underlying transition kernels to the limit distribution in the Wasserstein distance of order $p\in [1, 2]$ and provide explicit formulas for the first two moments of the limit distribution. We apply our results to the study of infinite-dimensional affine stochastic covariance models in the stationary covariance regime, where the stationary affine process models the instantaneous covariance process. In this context we investigate the behavior of the implied forward volatility smile for large forward dates in a geometric affine forward curve model used for the modeling of forward curve dynamics in fixed income or commodity markets formulated in the Heath-Jarrow-Morton-Musiela framework.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

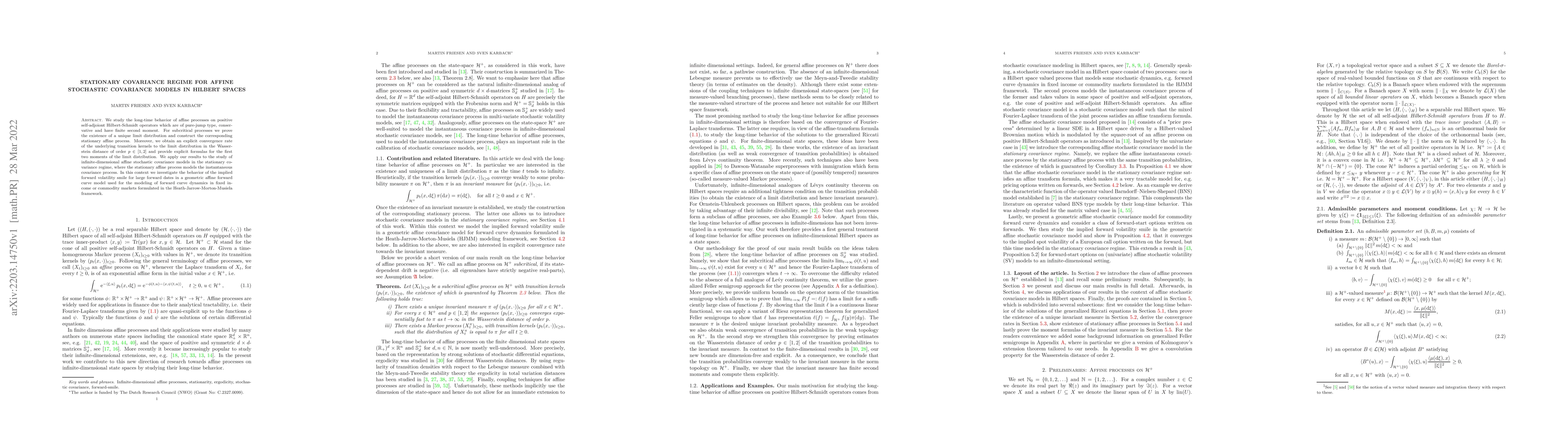

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCoVariance Filters and Neural Networks over Hilbert Spaces

Claudio Battiloro, Elvin Isufi, Andrea Cavallo

| Title | Authors | Year | Actions |

|---|

Comments (0)