Thomas Schmelzer

4 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

Finding Moving-Band Statistical Arbitrages via Convex-Concave Optimization

We propose a new method for finding statistical arbitrages that can contain more assets than just the traditional pair. We formulate the problem as seeking a portfolio with the highest volatility, s...

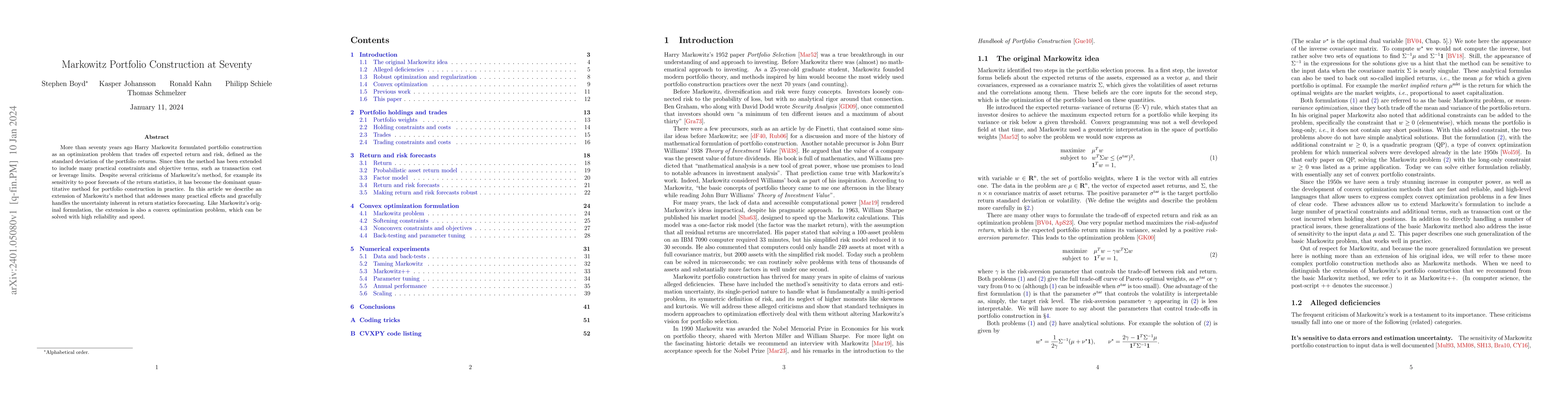

Markowitz Portfolio Construction at Seventy

More than seventy years ago Harry Markowitz formulated portfolio construction as an optimization problem that trades off expected return and risk, defined as the standard deviation of the portfolio ...

A Simple Method for Predicting Covariance Matrices of Financial Returns

We consider the well-studied problem of predicting the time-varying covariance matrix of a vector of financial returns. Popular methods range from simple predictors like rolling window or exponentia...

A Markowitz Approach to Managing a Dynamic Basket of Moving-Band Statistical Arbitrages

We consider the problem of managing a portfolio of moving-band statistical arbitrages (MBSAs), inspired by the Markowitz optimization framework. We show how to manage a dynamic basket of MBSAs, and il...