Summary

More than seventy years ago Harry Markowitz formulated portfolio construction as an optimization problem that trades off expected return and risk, defined as the standard deviation of the portfolio returns. Since then the method has been extended to include many practical constraints and objective terms, such as transaction cost or leverage limits. Despite several criticisms of Markowitz's method, for example its sensitivity to poor forecasts of the return statistics, it has become the dominant quantitative method for portfolio construction in practice. In this article we describe an extension of Markowitz's method that addresses many practical effects and gracefully handles the uncertainty inherent in return statistics forecasting. Like Markowitz's original formulation, the extension is also a convex optimization problem, which can be solved with high reliability and speed.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

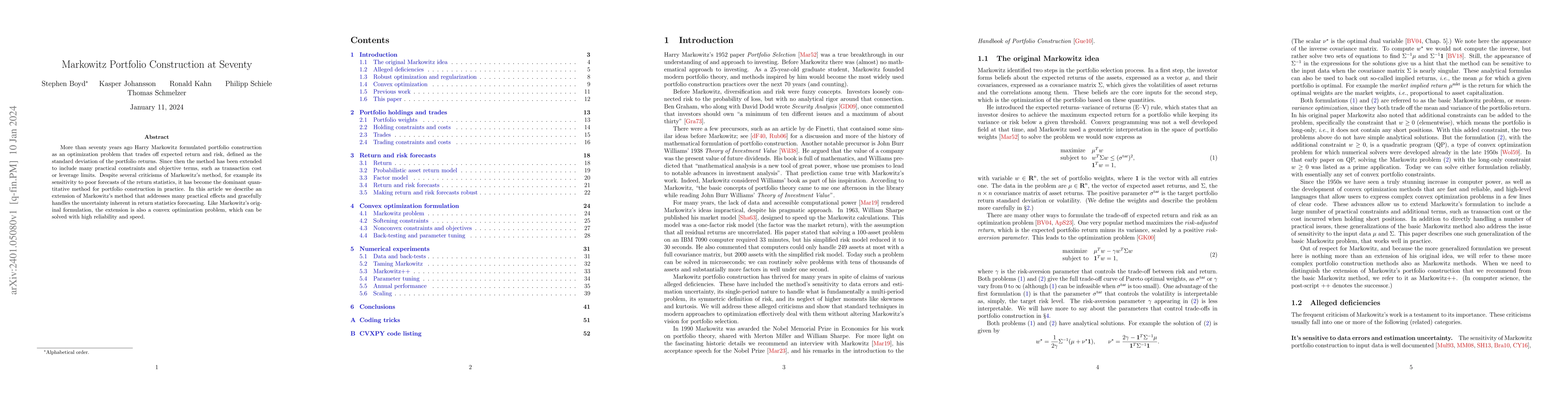

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)