Stephen Boyd

50 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

Compact Model Parameter Extraction via Derivative-Free Optimization

In this paper, we address the problem of compact model parameter extraction to simultaneously extract tens of parameters via derivative-free optimization. Traditionally, parameter extraction is perfor...

Robust Pareto Design of GaN HEMTs for Millimeter-Wave Applications

This paper introduces a robust Pareto design approach for selecting Gallium Nitride (GaN) High Electron Mobility Transistors (HEMTs), particularly for power amplifier (PA) and low-noise amplifier (L...

Exponentially Weighted Moving Models

An exponentially weighted moving model (EWMM) for a vector time series fits a new data model each time period, based on an exponentially fading loss function on past observed data. The well known an...

Approximate Sequential Optimization for Informative Path Planning

We consider the problem of finding an informative path through a graph, given initial and terminal nodes and a given maximum path length. We assume that a linear noise corrupted measurement is taken...

Finding Moving-Band Statistical Arbitrages via Convex-Concave Optimization

We propose a new method for finding statistical arbitrages that can contain more assets than just the traditional pair. We formulate the problem as seeking a portfolio with the highest volatility, s...

Markowitz Portfolio Construction at Seventy

More than seventy years ago Harry Markowitz formulated portfolio construction as an optimization problem that trades off expected return and risk, defined as the standard deviation of the portfolio ...

Efficient Shapley Performance Attribution for Least-Squares Regression

We consider the performance of a least-squares regression model, as judged by out-of-sample $R^2$. Shapley values give a fair attribution of the performance of a model to its input features, taking ...

Factor Fitting, Rank Allocation, and Partitioning in Multilevel Low Rank Matrices

We consider multilevel low rank (MLR) matrices, defined as a row and column permutation of a sum of matrices, each one a block diagonal refinement of the previous one, with all blocks low rank given...

Polyak Minorant Method for Convex Optimization

In 1963 Boris Polyak suggested a particular step size for gradient descent methods, now known as the Polyak step size, that he later adapted to subgradient methods. The Polyak step size requires kno...

Home Energy Management with Dynamic Tariffs and Tiered Peak Power Charges

We consider a simple home energy system consisting of a (net) load, an energy storage device, and a grid connection. We focus on minimizing the cost for grid power that includes a time-varying usage...

Value-Gradient Iteration with Quadratic Approximate Value Functions

We propose a method for designing policies for convex stochastic control problems characterized by random linear dynamics and convex stage cost. We consider policies that employ quadratic approximat...

Specifying and Solving Robust Empirical Risk Minimization Problems Using CVXPY

We consider robust empirical risk minimization (ERM), where model parameters are chosen to minimize the worst-case empirical loss when each data point varies over a given convex uncertainty set. In ...

A Simple Method for Predicting Covariance Matrices of Financial Returns

We consider the well-studied problem of predicting the time-varying covariance matrix of a vector of financial returns. Popular methods range from simple predictors like rolling window or exponentia...

Joint Graph Learning and Model Fitting in Laplacian Regularized Stratified Models

Laplacian regularized stratified models (LRSM) are models that utilize the explicit or implicit network structure of the sub-problems as defined by the categorical features called strata (e.g., age,...

Fast Path Planning Through Large Collections of Safe Boxes

We present a fast algorithm for the design of smooth paths (or trajectories) that are constrained to lie in a collection of axis-aligned boxes. We consider the case where the number of these safe bo...

Disciplined Saddle Programming

We consider convex-concave saddle point problems, and more generally convex optimization problems we refer to as $\textit{saddle problems}$, which include the partial supremum or infimum of convex-c...

Robust Bond Portfolio Construction via Convex-Concave Saddle Point Optimization

The minimum (worst case) value of a long-only portfolio of bonds, over a convex set of yield curves and spreads, can be estimated by its sensitivities to the points on the yield curve. We show that ...

Tractable Evaluation of Stein's Unbiased Risk Estimate with Convex Regularizers

Stein's unbiased risk estimate (SURE) gives an unbiased estimate of the $\ell_2$ risk of any estimator of the mean of a Gaussian random vector. We focus here on the case when the estimator minimizes...

Implementation of an Oracle-Structured Bundle Method for Distributed Optimization

We consider the problem of minimizing a function that is a sum of convex agent functions plus a convex common public function that couples them. The agent functions can only be accessed via a subgra...

Portfolio Optimization with Cumulative Prospect Theory Utility via Convex Optimization

We consider the problem of choosing a portfolio that maximizes the cumulative prospect theory (CPT) utility on an empirical distribution of asset returns. We show that while CPT utility is not a con...

Strategic Asset Allocation with Illiquid Alternatives

We address the problem of strategic asset allocation (SAA) with portfolios that include illiquid alternative asset classes. The main challenge in portfolio construction with illiquid asset classes i...

Portfolio Construction with Gaussian Mixture Returns and Exponential Utility via Convex Optimization

We consider the problem of choosing an optimal portfolio, assuming the asset returns have a Gaussian mixture (GM) distribution, with the objective of maximizing expected exponential utility. In this...

Bounds on Efficiency Metrics in Photonics

In this paper, we present a method for computing bounds for a variety of efficiency metrics in photonics, such as the focusing efficiency or the mode purity. We focus on the special case where the o...

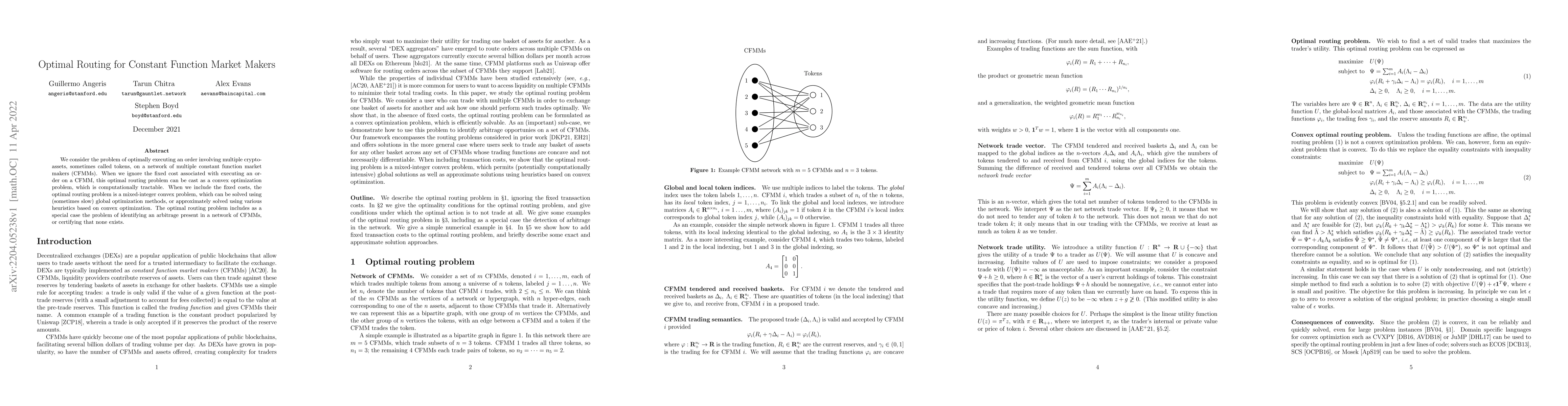

Optimal Routing for Constant Function Market Makers

We consider the problem of optimally executing an order involving multiple crypto-assets, sometimes called tokens, on a network of multiple constant function market makers (CFMMs). When we ignore th...

Embedded Code Generation with CVXPY

We introduce CVXPYgen, a tool for generating custom C code, suitable for embedded applications, that solves a parametrized class of convex optimization problems. CVXPYgen is based on CVXPY, a Python...

A Light-Weight Multi-Objective Asynchronous Hyper-Parameter Optimizer

We describe a light-weight yet performant system for hyper-parameter optimization that approximately minimizes an overall scalar cost function that is obtained by combining multiple performance obje...

Computing Tighter Bounds on the $n$-Queens Constant via Newton's Method

In recent work Simkin shows that bounds on an exponent occurring in the famous $n$-queens problem can be evaluated by solving convex optimization problems, allowing him to find bounds far tighter th...

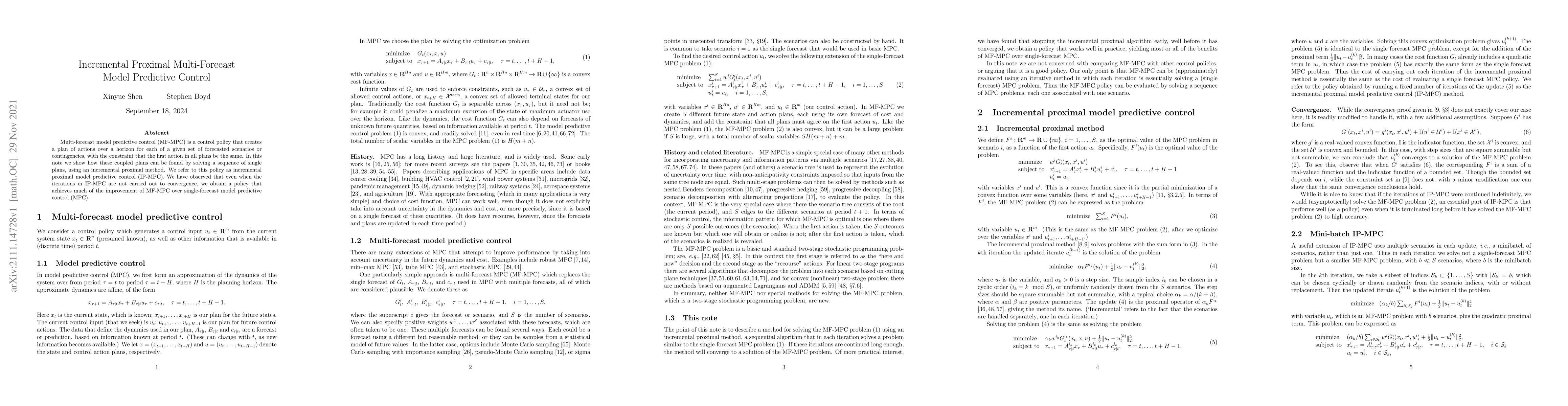

Incremental Proximal Multi-Forecast Model Predictive Control

Multi-forecast model predictive control (MF-MPC) is a control policy that creates a plan of actions over a horizon for each of a given set of forecasted scenarios or contingencies, with the constrai...

Minimizing Oracle-Structured Composite Functions

We consider the problem of minimizing a composite convex function with two different access methods: an oracle, for which we can evaluate the value and gradient, and a structured function, which we ...

Operator Splitting for Adaptive Radiation Therapy with Nonlinear Health Dynamics

We present an optimization-based approach to radiation treatment planning over time. Our approach formulates treatment planning as an optimal control problem with nonlinear patient health dynamics d...

Portfolio Construction as Linearly Constrained Separable Optimization

Mean-variance portfolio optimization problems often involve separable nonconvex terms, including penalties on capital gains, integer share constraints, and minimum position and trade sizes. We propo...

Confidence bands for a log-concave density

We present a new approach for inference about a log-concave distribution: Instead of using the method of maximum likelihood, we propose to incorporate the log-concavity constraint in an appropriate ...

Fitting Multilevel Factor Models

We examine a special case of the multilevel factor model, with covariance given by multilevel low rank (MLR) matrix~\cite{parshakova2023factor}. We develop a novel, fast implementation of the expectat...

Discrete-Time Distribution Steering using Monte Carlo Tree Search

Optimal control problems with state distribution constraints have attracted interest for their expressivity, but solutions rely on linear approximations. We approach the problem of driving the state o...

A Markowitz Approach to Managing a Dynamic Basket of Moving-Band Statistical Arbitrages

We consider the problem of managing a portfolio of moving-band statistical arbitrages (MBSAs), inspired by the Markowitz optimization framework. We show how to manage a dynamic basket of MBSAs, and il...

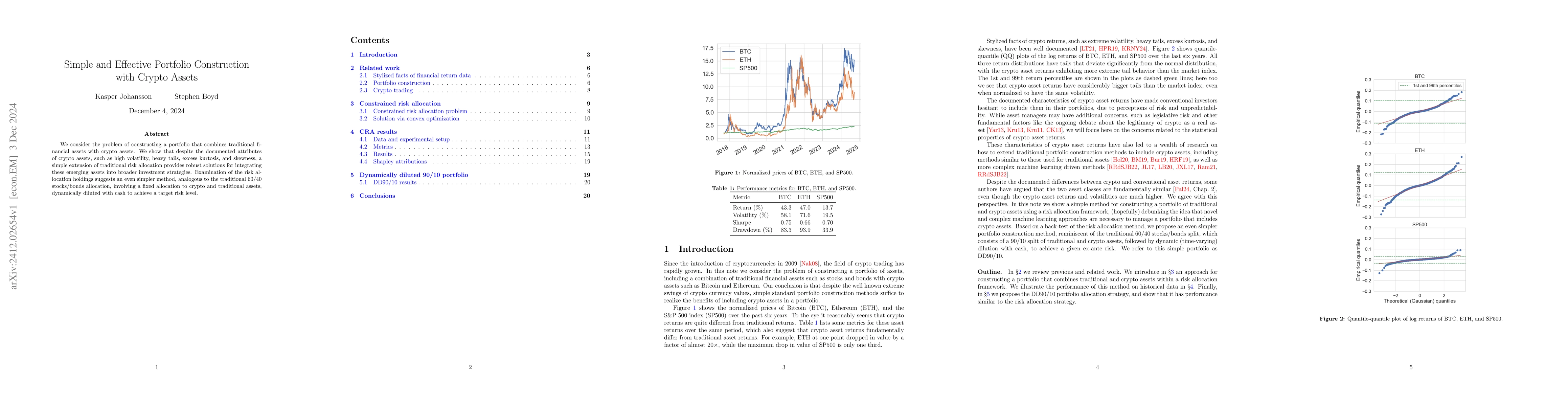

Simple and Effective Portfolio Construction with Crypto Assets

We consider the problem of constructing a portfolio that combines traditional financial assets with crypto assets. We show that despite the documented attributes of crypto assets, such as high volatil...

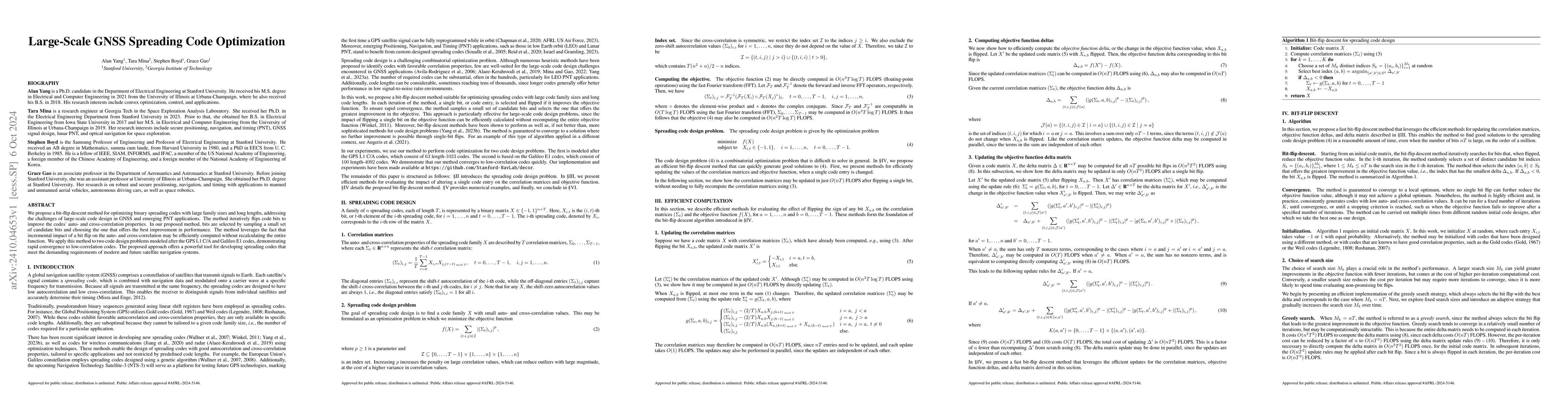

Large-Scale GNSS Spreading Code Optimization

We propose a bit-flip descent method for optimizing binary spreading codes with large family sizes and long lengths, addressing the challenges of large-scale code design in GNSS and emerging PNT appli...

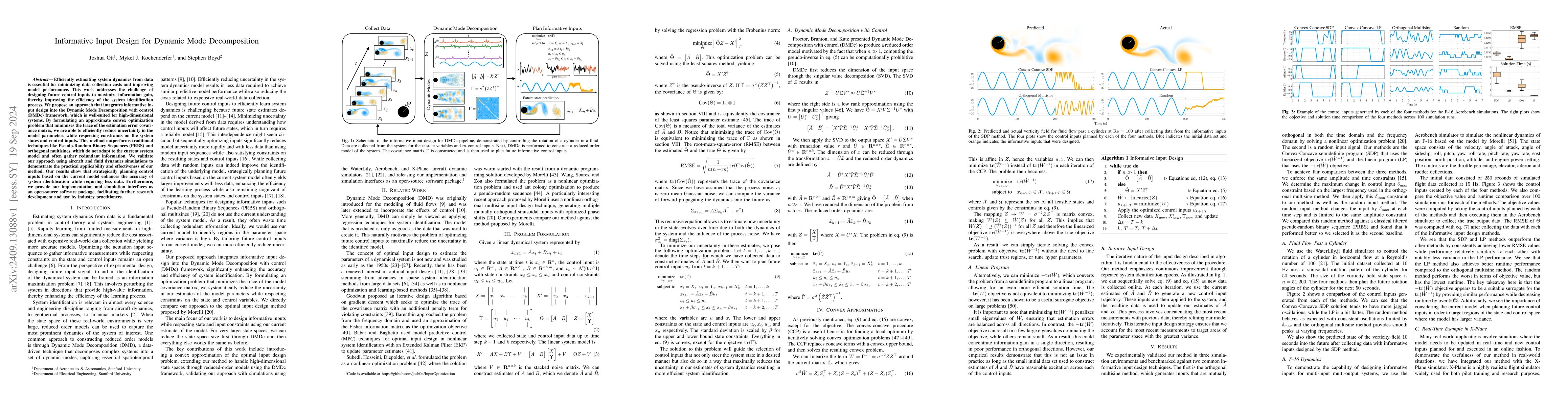

Informative Input Design for Dynamic Mode Decomposition

Efficiently estimating system dynamics from data is essential for minimizing data collection costs and improving model performance. This work addresses the challenge of designing future control inputs...

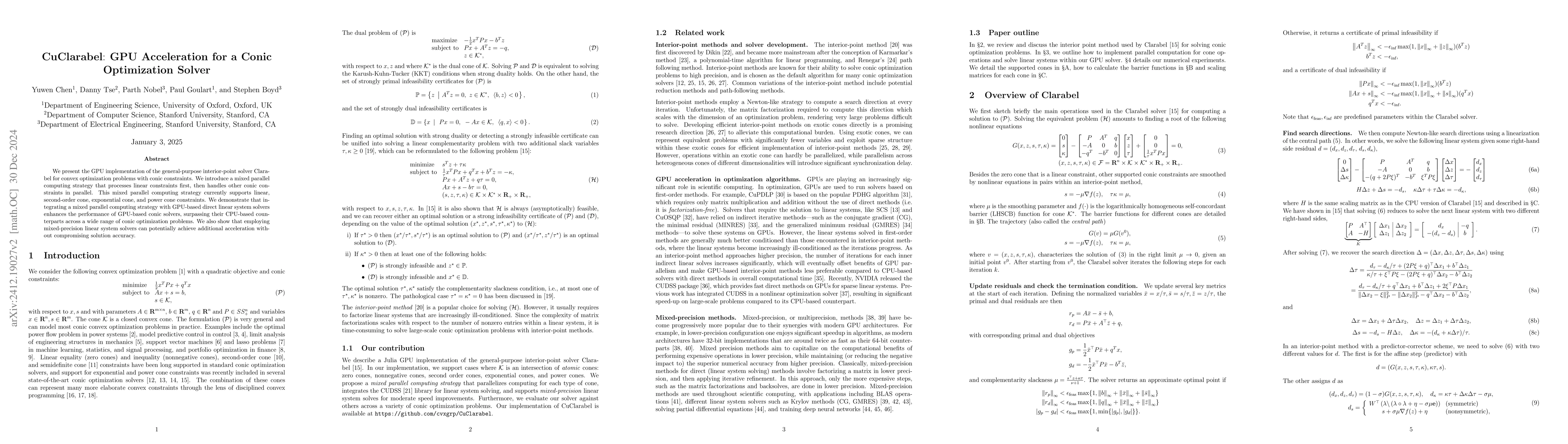

CuClarabel: GPU Acceleration for a Conic Optimization Solver

We present the GPU implementation of the general-purpose interior-point solver Clarabel for convex optimization problems with conic constraints. We introduce a mixed parallel computing strategy that p...

Solving Large Multicommodity Network Flow Problems on GPUs

We consider the all-pairs multicommodity network flow problem on a network with capacitated edges. The usual treatment keeps track of a separate flow for each source-destination pair on each edge; we ...

Multiple-response agents: Fast, feasible, approximate primal recovery for dual optimization methods

We consider the problem of minimizing the sum of agent functions subject to affine coupling constraints. Dual methods are attractive for such problems because they allow the agent-level subproblems to...

An Operator Splitting Method for Large-Scale CVaR-Constrained Quadratic Programs

We introduce a fast and scalable method for solving quadratic programs with conditional value-at-risk (CVaR) constraints. While these problems can be formulated as standard quadratic programs, the num...

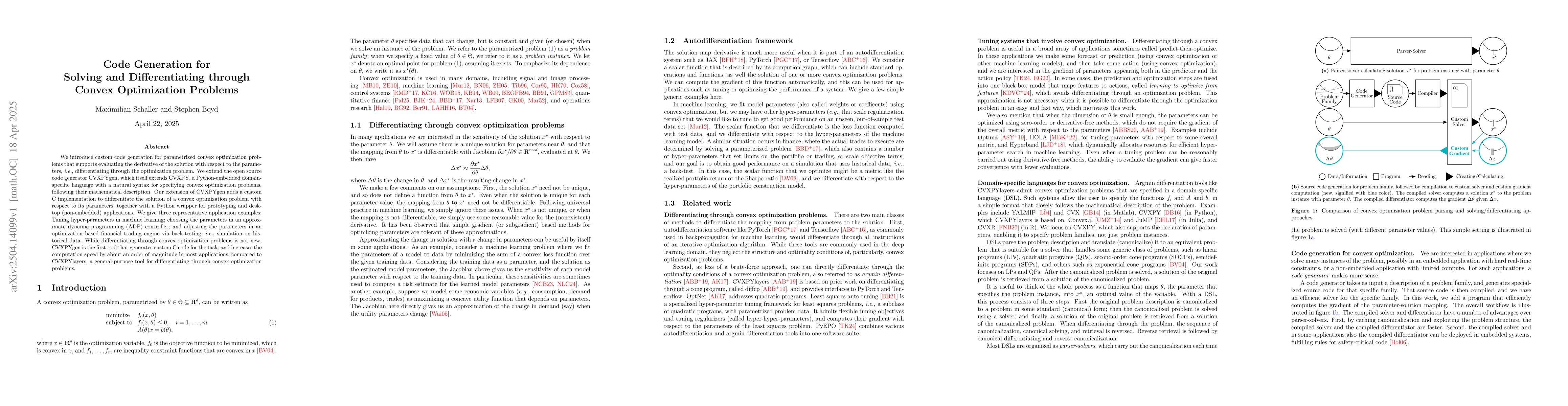

Code generation for solving and differentiating through convex optimization problems

We introduce custom code generation for parametrized convex optimization problems that supports evaluating the derivative of the solution with respect to the parameters, i.e., differentiating through ...

Aging-Aware Battery Control via Convex Optimization

We consider the task of controlling a battery while balancing two competing objectives that evolve over different time scales. The short-term objective, such as arbitrage or load smoothing, improves w...

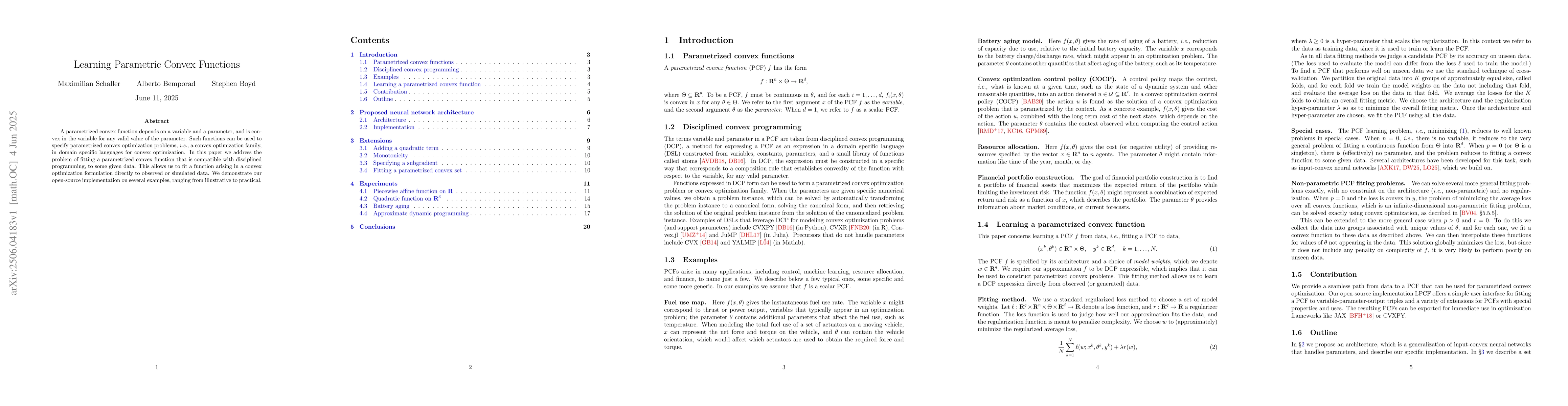

Learning Parametric Convex Functions

A parametrized convex function depends on a variable and a parameter, and is convex in the variable for any valid value of the parameter. Such functions can be used to specify parametrized convex opti...

Automatic Generation of Explicit Quadratic Programming Solvers

We consider a family of convex quadratic programs in which the coefficients of the linear objective term and the righthand side of the constraints are affine functions of a parameter. It is well known...

Iteratively Saturated Kalman Filtering

The Kalman filter (KF) provides optimal recursive state estimates for linear-Gaussian systems and underpins applications in control, signal processing, and others. However, it is vulnerable to outlier...

A Tax-Efficient Model Predictive Control Policy for Retirement Funding

The retirement funding problem addresses the question of how to manage a retiree's savings to provide her with a constant post-tax inflation adjusted consumption throughout her lifetime. This consists...

Adaptive Strategies for Pension Fund Management

This paper proposes a simulation-based framework for assessing and improving the performance of a pension fund management scheme. This framework is modular and allows the definition of customized perf...

Differentiating Through a Quadratic Cone Program

Quadratic cone programs are rapidly becoming the standard canonical form for convex optimization problems. In this paper we address the question of differentiating the solution map for such problems, ...