Authors

Summary

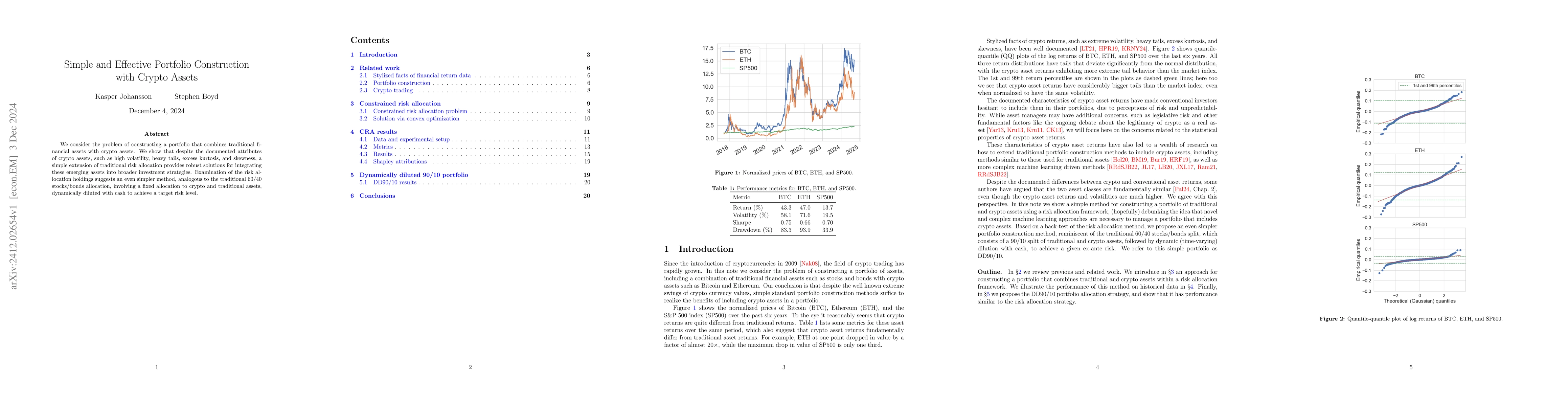

We consider the problem of constructing a portfolio that combines traditional financial assets with crypto assets. We show that despite the documented attributes of crypto assets, such as high volatility, heavy tails, excess kurtosis, and skewness, a simple extension of traditional risk allocation provides robust solutions for integrating these emerging assets into broader investment strategies. Examination of the risk allocation holdings suggests an even simpler method, analogous to the traditional 60/40 stocks/bonds allocation, involving a fixed allocation to crypto and traditional assets, dynamically diluted with cash to achieve a target risk level.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEnvironmental-Social-Governance Preferences and Investments in Crypto-Assets

d'Artis Kancs, Pavel Ciaian, Andrej Cupak et al.

Liquidity Jump, Liquidity Diffusion, and Portfolio of Assets with Extreme Liquidity

Qi Deng, Zhong-guo Zhou

No citations found for this paper.

Comments (0)